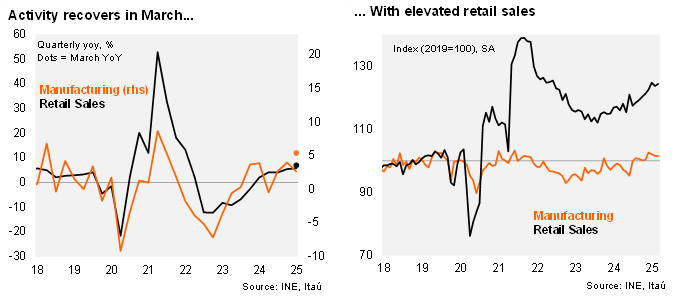

Retail sales and mining activity rose sequentially in March, while manufacturing dynamics at the margin remained soft. Mining production rose a strong 3.6% MoM/SA, leading to annual growth of 5.4% YoY (-6.6% in February), favored by improved ore-grade and base effects. Manufacturing fell 0.1% sequentially, the third consecutive drop, leading to a 5.4% YoY increase (Itaú: 7%; Bloomberg: 5.6%; -1.2% in February). Food processing continued to advance favorably (9% YoY; 3pp contribution). After the February disruption to retail operations following the electricity blackout, retail sales increased 0.5% MoM/SA, leading to annual growth of 6.9% YoY (Itaú: 9%; Bloomberg consensus: 6.5%; 2.6% in February). The continued influx of consumer tourism and a rising real wage bill will likely support upbeat retail sales dynamics ahead.

Retail counters broader activity slowdown in 1Q25. Retail sales remained a key activity driver in 1Q25 increasing by 5.8% YoY (5.4% in 4Q), with durable retail sales rising 7.3% YoY and non-durable goods increasing 4.9%. Separately, total industrial production rose 1.0% in the quarter (4.4% in 4Q). Manufacturing growth came in at 2.6% (3.9% in 4Q), while mining contracted 0.1% (+6.2% in 4Q). In seasonally adjusted terms, retail sales increased 10% QoQ/saar (10.6% in 4Q24; 0.8% in 3Q24), while industrial production fell 2.3% QoQ/saar (+2.9% in 4Q24).

Our Take: We expect March’s IMACEC, to be published by the BCCH tomorrow, to rise by 3% YoY (-0.1% in February), amid better mining dynamics, resulting in growth of 1.8% in 1Q25 (implicit IPoM estimate: 1.6%). The INE will publish April sectoral data on May 30. We expect GDP growth of 2.2% this year, as the external pull that was prevalent last year moderates. While the activity recovery and disinflation process have unfolded broadly in line with expectations, the Central Bank has opted for a cautious approach, preferring to accumulate more information before embarking on lowering rates further.