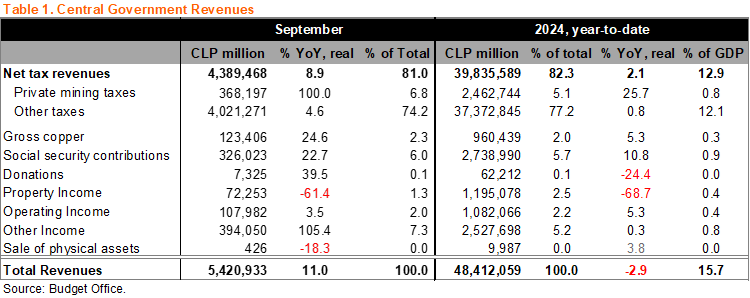

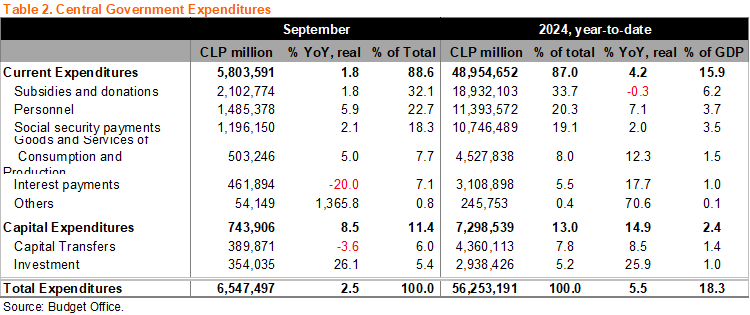

Gradual moderation in spending continues, as revenues improve. Even though real revenues rose by 11% YoY in September, a real expenditure increase of 2.5% led to a monthly fiscal balance of -0.4% of GDP, the fifth consecutive monthly deficit. On revenues, the annual rise in September was mainly driven by the delayed, yet ongoing recovery of cyclically related revenues (+4.6% YoY), and the improvement in mining related payments (see Table 1 below). Rents from lithium remain very weak, reflecting the normalization of lithium prices. Cumulative revenue growth in the year improved at the margin to -2.9% YoY (-4.4% in August), still well below the MoF’s annual revenue growth forecast (+5.3%). On the spending side, current expenditure growth slowed again in September to 1.8% YoY, mainly driven by a 20% annual decline in interest payments, while capital expenditures increased by 8.5% YoY (see Table 2 below). Cumulative expenditure growth in the year reached 5.5% (5.9% through August), implying a material spending constraint would have to be implemented through year-end to comply with the MoF’s spending growth forecast of 3.5%.

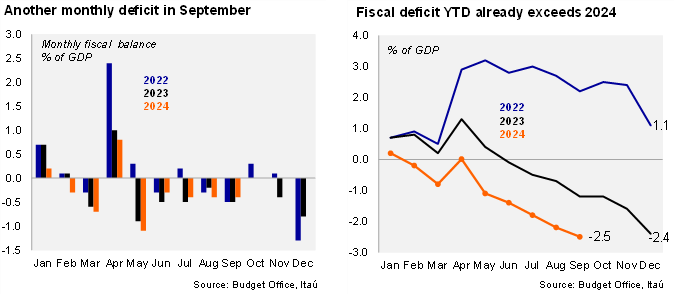

The cumulative fiscal deficit rose higher in September to 2.5% of GDP, exceeding the MoF’s 2.0% year-end nominal deficit forecast and last year’s annual deficit (2.4%). The monthly fiscal balance in September reached a deficit 0.4% of GDP, below the 0.5% of GDP of September 2023. The year-to-date fiscal balance now reaches -2.5% of GDP (-1.2% YTD as of September 2023), diving well below the MoF’s annual nominal deficit target of 2.0% of GDP. The fiscal balance tends to deteriorate during the fourth quarter of every year, with 4Q23 accumulating a whopping deficit of 1.2% of GDP, suggesting the MoF will miss their nominal forecast even with a significant spending restraint.

12-month rolling fiscal deficit fell at the margin. On a 12-month moving average basis as of the end of September, the central government’s revenues reached 21.5% of GDP, and expenditures 25.2% of GDP, leading to a cumulative deficit of 3.7% of GDP (-3.9% of GDP in August).

Debt issuance contributed to higher liquid assets at the Treasury. According to the Budget Office’s Monthly Asset Report, the Treasury’s liquid assets by the end of September reached a total of USD3.2 billion (up from USD 2.782 billion by the end of August), of which USD2.51 billion were denominated in CLP assets, and the remaining USD688.1 million in dollar-denominated assets; the jump in the month likely reflects debt issued during the period with large CLP amortizations due by the end of October and November. In this context, the MoF also announced a revised 4Q24 local currency issuance calendar that raised debt issuance by roughly USD400 million to USD2.65 billion, exhausting the 2024 annual debt issuance limit. Assets in the sovereign wealth funds rose in the month likely due to portfolio performance, with the Stabilization Fund reaching USD4.76 billion and the Pension Reserve Fund USD9.7 billion. The MoF reported a USD1 billion withdrawal from the Stabilization Fund in early October, which should take AUM in the FEES to USD3.7 billion, the lowest level since December 2021 (USD2.5 billion).

Constant dollar sales through year-end. We expect the MoF to continue selling at a roughly USD50 million pace for the rest of the year, sourced from mining related revenue and the early-October USD1 billion withdrawal from the Stabilization Fund. The MoF's dollar sales finance shortfalls in the central government's deficit, with expenditures primarily in CLP, and do not target a given level of the exchange rate.

Our take: How large will the deficit target miss be? Even though revenue dynamics are improving at the margin, their performance throughout the year and frontloaded spending have led to a cumulative nominal fiscal balance through September of 2.5% of GDP, well above the MoF’s 2.0% forecast. So, how large will the miss be? Considering that the deficit usually ramps up significantly during the final quarter of the year (-0.9% of GDP in 4Q22, -1.2% in 4Q23), the nominal deficit this year is likely to approach at least 3.0% of GDP. The structural deficit target of 1.9% of GDP is also likely to be missed, eroding the credibility of the fiscal institutional framework. Assuming revenues recover in line with the MoF’s forecast, the Autonomous Fiscal Council has called for a spending adjustment this year end of roughly 0.5% of GDP to reach the structural deficit target. The next monthly fiscal report (October) is scheduled for November 29.