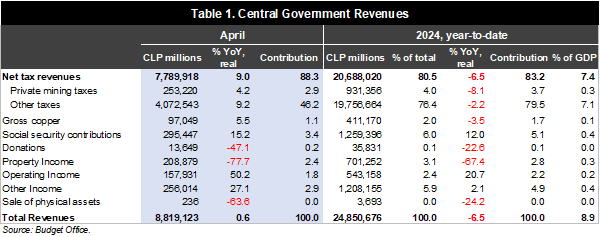

Revenue dynamics improved further in April but remain far from the momentum needed to achieve the official revenue growth forecast. April is a key month for fiscal revenues due to the Tax Season (averaging 14% of annual revenues between 2012-2019, 13.2% in 2023), usually leading to a monthly surplus and an improvement in the Treasury’s liquid balances. In this context, revenue results for April this year seemed particularly relevant considering the weak revenue start to the year (-10% YoY in 1Q24; -12.5% full the full year of 2023), and the ambitious 7.4% projected rise in official forecasts. Turning to the actual results, the good news is that the central government’s real revenue growth turned positive in annual terms in April (+0.6% YoY), building on the gradual improvement we saw in the previous three months. Cyclically related revenues and copper revenues both rose significantly, while lithium-related revenue contracted (mainly reflecting lower lithium prices). However, even though revenue growth turned positive, they appear below target as we estimate that the shortfall in cyclically related revenues (tributación resto contribuyentes, 79% of total 2024 forecasted revenues) through April is equivalent to 5% of the official forecast. Altogether, real revenues as of April have declined by 6.5% YoY (-10% as of March), implying a significant improvement would be needed to achieve the +7.4% official 2024 forecast.

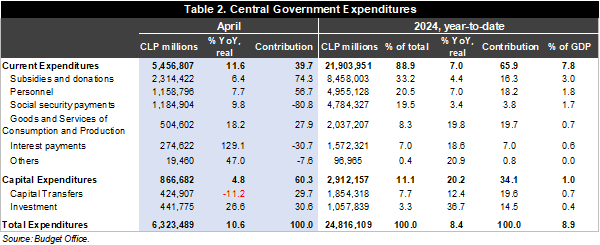

Spending remains unexpectedly strong. The central government’s real expenditures rose by a whopping 10.6% YoY in April (2.6% in March). Current expenditures rose by 11.6% (1.2% in March), with increases across the board, especially in subsidies & donations, personnel, and pension payouts. Capital expenditures rose by 4.8% YoY, down again from the large increases in public investment and capital transfers to regions from the first two months of the year. Spending growth remains unusually strong and front-loaded rising by 8.4% YoY year-to-date, well above the MoF’s 2024 projected 4.9% YoY rise.

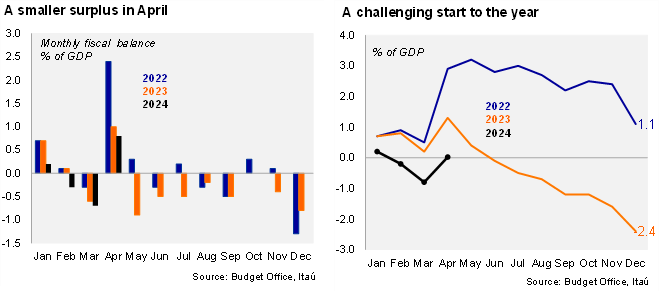

Cumulative fiscal balance improved in April. As expected, the monthly fiscal balance in April snapped back to a surplus of 0.8% of GDP (-0.7% in March), below the 1.0% surplus of April 2023. The year-to-date fiscal balance now reaches 0.01% of GDP (1.3% YTD as of April 2023). The MoF’s 2024 nominal (structural) fiscal balance forecast is 1.9% (2.2%) of GDP, implying a moderate fiscal consolidation from the 2.4% of GDP and 2.7% of GDP nominal and structural deficits in 2023. Gross public debt reached 40.7% of GDP by the end of 1Q24, and the MoF projects a rise to 40.6% of GDP by the end of 2024.

12-month rolling fiscal deficit widened further. On a 12-month moving average as of the end of March, the central government’s revenues reached 21.8% of GDP, and expenditures 25.4% of GDP, leading to a cumulative deficit of 3.5% of GDP, well below the annual cumulative deficit of 0.4% reached in April 2023, reflecting the fiscal deterioration throughout the course of this cyclical adjustment.

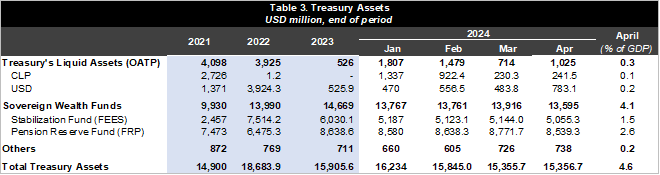

Liquid assets remain low. According to the Budget Office’s Monthly Asset Report, the Treasury’s liquid assets by the end of April reached a total of USD1,024 million, of which USD241.5 million were denominated in CLP assets, and the remaining USD783 million in dollar-denominated assets. The sequential increase in dollar denominated assets in April appears in line with our estimate of monthly copper-related revenues (likely in the order of USD400 million per month). No withdrawals nor injections to the Sovereign Wealth Funds were reported, leading the Stabilization Fund (USD5,055 million) and the Pension Reserve Fund (USD8,539 million) to have marginal valuation changes in the month.

The MoF will resume dollar sales in June. After being on the sidelines since March 21 this year, the Ministry of Finance announced guidance on dollar sales for June through August at a weekly maximum of USD200 million, taking daily maximums through this period well below the roughly USD150 million daily average in which the MoF sold dollars this year (only 13 days). As mentioned earlier, the MoF had a total of USD783.09 million in liquid dollar denominated assets by the end of April, and likely accumulated another roughly USD400 million from copper-related revenues, and probably USD500 million from dollar inflows related to the end-May local currency issuance (in which offshore accounts pay for local currency bonds in USD); the latter might be reflected in the June balance. The MoF's dollar sales finance shortfalls in the central government's deficit, with expenditures are primarily in CLP. We expect the MoF to sell towards the bottom of the USD8-10 billion range this year, including the USD1.92 billion they sold through March, below 2023’s USD12.2 billion.

Our take: Overall, April’s fiscal data did not change our view regarding the short-term stress in Chile’s fiscal accounts. True, revenues continue to improve, yet were below the mark in the key tax season, while spending growth roared back after the slowdown in March. Higher-than-projected copper revenues from above budget spot prices should yield some relief, as spending will have to be reined in to meet the official forecasts. Liquid assets at the Treasury remained unusually low and revenues tend to plummet in May, which likely explain the changes (greater issuance) to the issuance calendar through the Central Bank’s auction system for June, the recent issuance of CLP bonds with direct participation of non-residents, and the resumption of dollar sales. With roughly USD6.7 billion in Treasury issuance in the year through May, the following months should see more supply to reach the annual gross plan of USD16.5 billion. We expect a nominal deficit of 2.3% of GDP this year. The May monthly fiscal report is scheduled for June 28.