2025/11/03 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

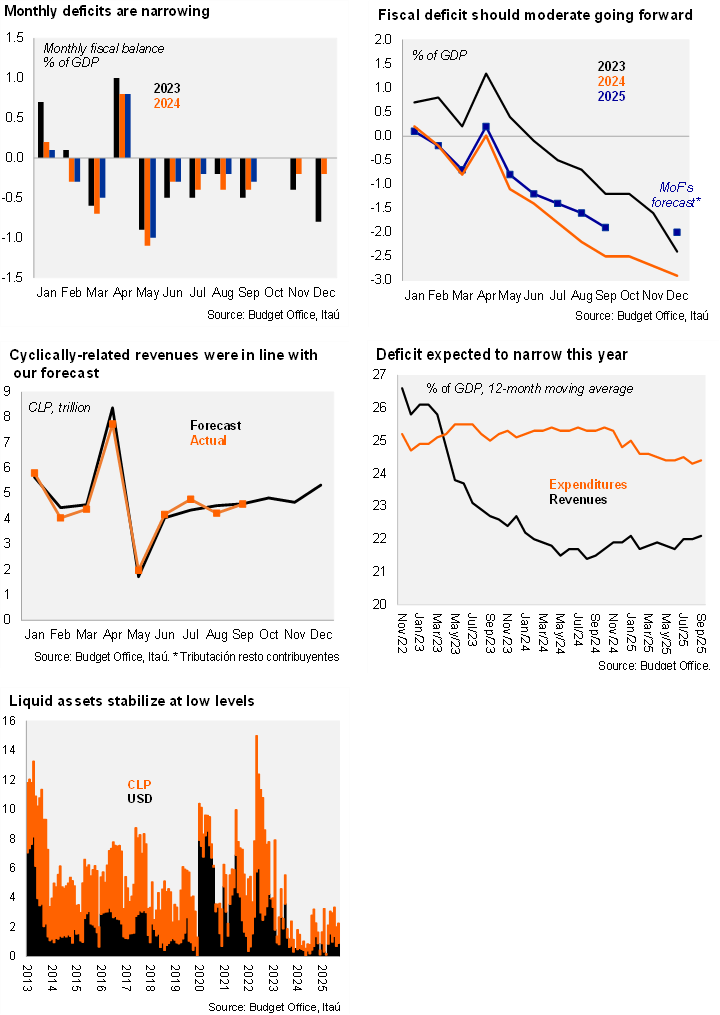

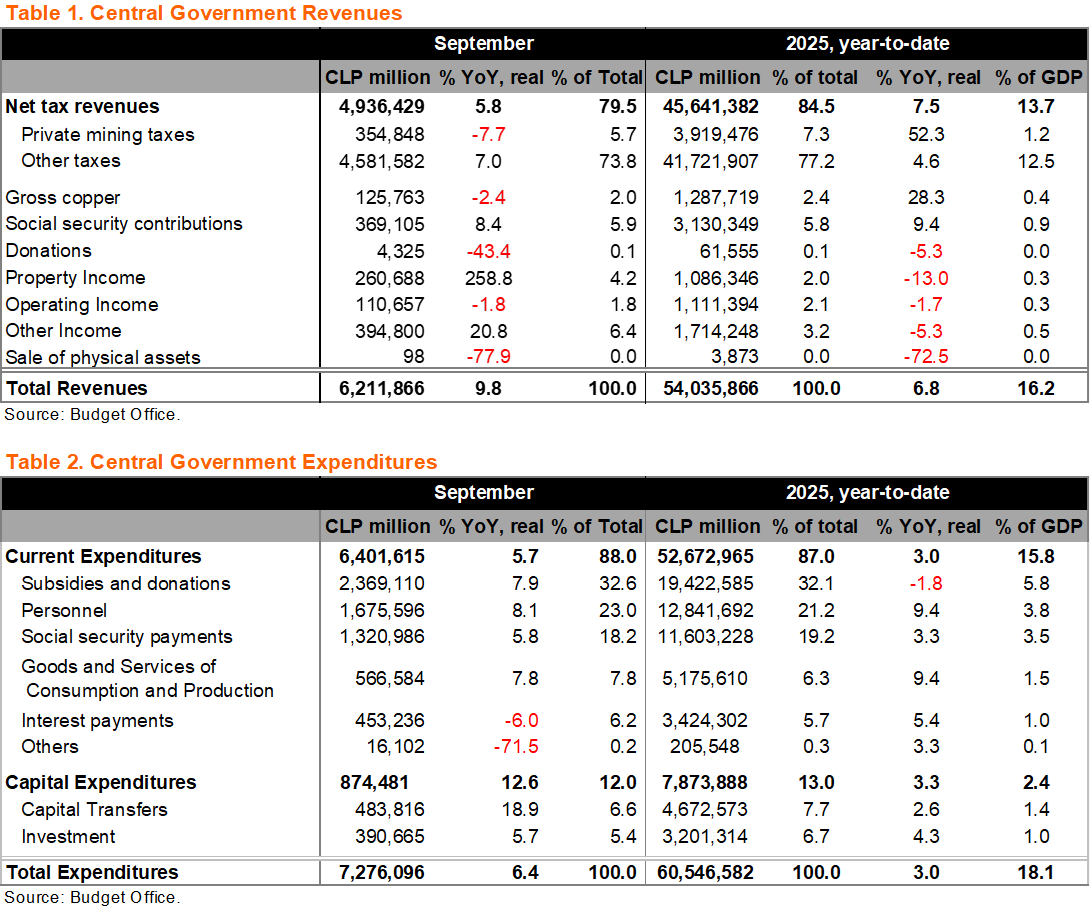

The Central Government’s real revenues rose by 9.8% in September, concluding a much-needed solid revenue recovery during 3Q25. Cyclically-related real revenues (tributación resto contribuyentes, comprising roughly 80% of total revenues) rose by 7.0% YoY, after rising by 9.1% in August, in line with our forecast, taking cumulative misses in the year to slightly above 1% (see chart). Even though private mining revenue fell again on an annual basis in September, these revenues in the year are up by 52.3% YoY, reflecting the first full year of the new mining royalty law, elevated copper prices, and greater copper production. Total real revenues accumulated in the year through September have increased by 6.8% YoY (6.5% in August), in line with the MoF’s watered-down revenue forecast.

Real spending rose by 6.4%YoY in September. Current expenditure increased by 5.7%, mainly driven by higher subsidies and donations (health-related), staff (education-related), and others; current expenditures year-to-date are up by 3.0% accumulating 75.9% of the annual budget, in line with 2024. Capital expenditure rose by 12.6% YoY in September, leading to a cumulative rise in the year of 3.3%, taking this component’s expenditure to 60.2% of the annual budget, same as in 2024. Capital spending is likely to halt by yearend to meet spending forecasts and low liquid cash balances. Total spending in the year through September has increased by 3.0%, gradually falling towards the 2.6% official forecast.

September’s monthly fiscal balance reached -0.3% of GDP, slightly below the -0.4% of September 2024. The cumulative fiscal balance through September rose to a deficit of 1.9% of GDP, a smaller deficit than the 2.5% through September 2024 (see chart).

The 12-month rolling fiscal deficit remained unchanged at 2.3% of GDP. On a 12-month moving average basis as of the end of September, the central government’s revenues rose by 10bps to 22.1% of GDP, and expenditures did so by the same rate to 24.4%, leading to a nominal deficit of 2.3%, improving from 3.7% of GDP a year earlier. We expect a gradual narrowing of the deficit, primarily due to an improvement in revenues.

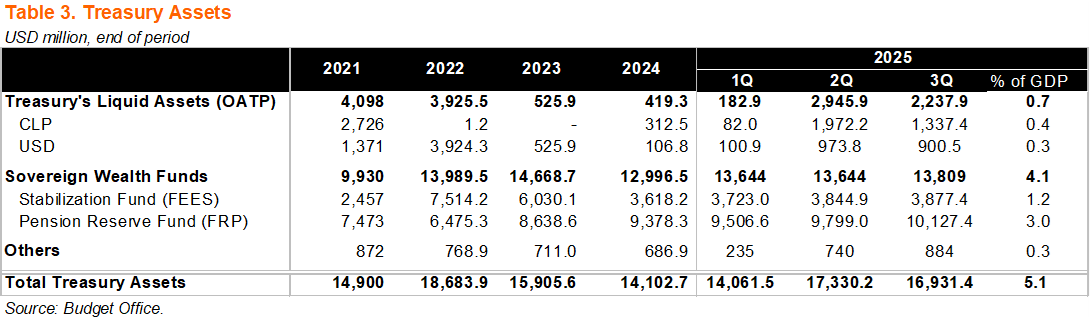

Liquid assets at the Treasury fell slightly in 3Q25. Liquid assets in the Treasury fell in 3Q25 to USD2.2 billion (from USD2.9 billion in 2Q), below 3Q24 (USD3.2 billion). Cash buffers have improved since the critical levels earlier in the year, driven by debt issuance and greater revenues, as we have mentioned in previous reports. AUM in the sovereign wealth funds were little changed, likely reflecting valuation effects. The Stabilization Fund (FEES) was flat at USD3.9 billion, and the Pension Reserve Fund (FRP) was up to USD10.1 billion. The USD200 million twenty-year loan from the PRF to the social security fund (as part of the implementation of the pension reform) is not reported as a withdrawal, rather still included in the AUM. Loans totaling USD900 million (including this year’s USD200 million) are projected to take place in the following years through 2027; see our report on sovereign wealth funds here.

Our take:

• No surprises at the margin. Revenue improvements are taking place in line with our view for the fiscal accounts, leading us to be somewhat more constructive than consensus. Still, spending growth will have to contained during the final quarter of the year. Our 2025 nominal deficit forecast of 2.0% of GDP is likely to be revised slightly higher; our forecast implies a deficit of only 0.1% of GDP for 4Q25, well below the 0.4% of last year during the same period. The MoF seems set to miss the structural deficit target again this year, eroding the credibility in Chile’s fiscal institutional framework.

• On the financing front: The MoF continues to implement its 2025 gross financing plan (revised from USD16 billion to USD16.7 billion, see our note on the issue here). The 2026 budget bill requests gross debt issuance for next calendar year for a total of USD17.4 billion (and an additional USD600 million in loans from multilaterals); we expect next year’s issuance to kick off in early January with a sizable foreign currency denominated debt, followed by local currency auctions.

• On policy and reforms: With elections looming on November 16, (tense) discussions in Congress are mainly focused on the 2026 budget, which must be approved by the end of the month. Separately, the revenue-neutral tax reform – according to official estimates – presented by the administration in July (during former Minister Marcel’s tenure), was split; measures that postpone property taxes for households, among others were presented in a separate bill. Measures that enhance this year’s revenues – so called corrective measures – failed to advance materially in Congress. The bill that presents minor modifications to the management of the sovereign wealth funds has yet to be discussed in Congress (see our report on the issue).

• Upcoming data: The Budget Office will release October’s fiscal by the end of November.