Revenue dynamics improved in March… The central government’s real revenues fell for the third consecutive month in March, yet only by 0.8% YoY, after a 9.7% YoY decline in February. Revenues have contracted in annual real terms in eight of the last nine months, with the weak revenue start in 2024 coming on the back of a 12.5% YoY real contraction in 2023. Revenue dynamics in March were mixed, with cyclically-related revenues rising, while copper and lithium-related revenue contracting, all in annual real terms. As of March, real revenues have declined by 10% YoY (-13.9% as of February), suggesting a significant turnaround would be required to achieve the MoF’s projected +8% real rise in revenues for 2024.

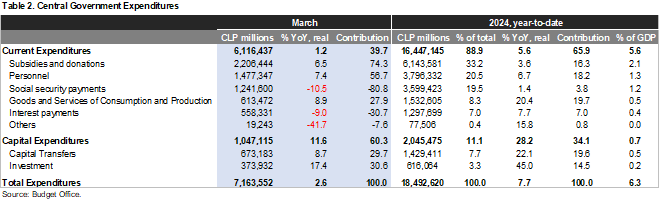

… as expenditure growth slowed materially. The central government’s real expenditures rose by 2.6% YoY in March (15.1% in February). Current expenditures rose by 1.2% YoY in March, down from the large 9% YoY increase in February. Capital expenditures rose again by double-digits, up by 11.6% YoY, yet down from the ramp up in public investment and capital transfers to regions from the previous months. Spending growth seems to have normalized after the frontloaded first two months of the year, that led spending to rise by 11.2% YoY through February. Expenditures in the year through March have increased by 7.7% YoY, closer to the MoF’s 2024 projected 5.6% YoY rise.

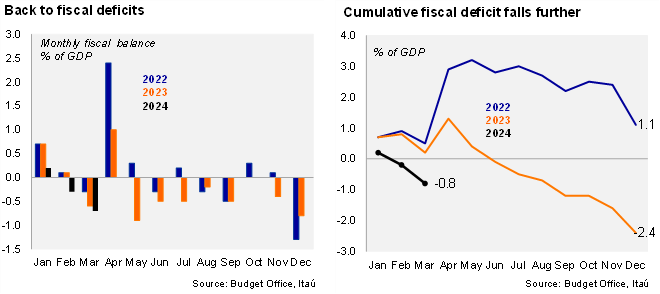

Fiscal balance fell deeper into the red in March. The monthly fiscal balance in March reached -0.7% of GDP (-0.3% in February, -0.6% in March 2023), leading to a YTD balance of -0.8% of GDP (+0.2% of GDP YTD as of March 2023). The MoF’s 2024 nominal and structural fiscal balance forecast is 1.9% of GDP, implying a moderate fiscal consolidation from the 2.4% of GDP and 2.6% of GDP nominal and structural deficits in 2023. Gross public debt reached 40.7% of GDP by the end of 1Q24, and the MoF projects a rise to 41.2% of GDP by the end of 2024.

12-month rolling fiscal deficit widened further. On a 12-month moving average as of the end of March, the central government’s revenues reached 22.1% of GDP, and expenditures 25.6% of GDP, leading to a cumulative deficit of 3.4% of GDP, well below the annual cumulative surplus of 0.8% reached in March 2023, reflecting the fiscal deterioration throughout the course of this cyclical adjustment.

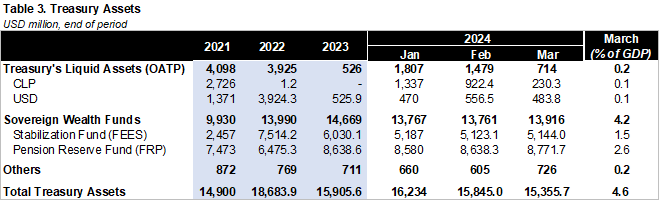

Don’t expect large dollar sales in the near term. According to the Budget Office’s Monthly Asset report, the MoF’s liquid dollar balances by the end of March reached USD483.8 million, down slightly from the USD556.45 million in the previous month. The MoF sold USD420 million in March, taking sales in the year up to USD1.92 billion, and has not sold dollars so far in 2Q24. The MoF is unlikely to sell dollars in the near term, considering the seasonal surplus in peso cash balances that occurs in tax season. That being said, dollar inflows from a local currency issuance with direct participation of foreigners, yet to be announced, could lead to dollar sales in the coming months. We estimate dollar sales in 2024 in the lower part of the USD8-10 billion range, below the USD12.2 billion of 2023.

Our take: Even though revenues contracted again in March, fiscal data reveal a welcome and earlier-than-expected improvement in cyclically related revenue, as copper revenues should begin to tick up, reflecting greater spot prices. Spending growth expectedly slowed, after a brisk start in the first two months of the year. Still, the strength of revenue growth in the April tax season (data to be released on May 31) will be key in determining the headwinds to fiscal accounts. The seasonal surplus in CLP liquid assets at the Treasury in May, suggest dollar sales are unlikely in the near term. The 1Q24 Public Finance Report scheduled for May 13.