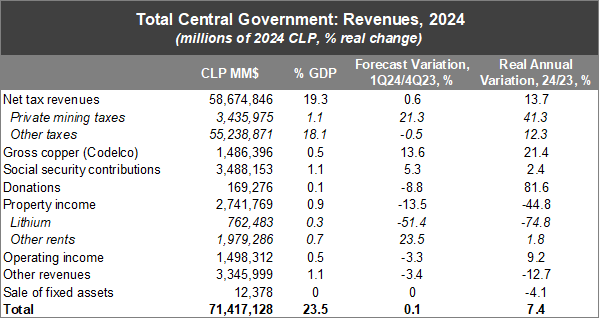

Copper saves the day. The central government’s 2024 revenues are projected to reach 23.5% of GDP, up by 7.4% YoY in real terms (8% in the previous forecast) snapping back from last year’s significant contraction (-12.4% YoY). This year’s smaller-than-expected real increase is explained by 2023 revenues that were revised up, and higher average inflation for 2024. Relative to the previous forecast, copper-related revenues for 2024 were revised up materially, driven by higher projected copper prices (USD4.2 / lb, up from USD3.84 / lb in the previous report). CODELCO and private mining revenues for 2024, were revised up by 13.6% and 21.3% respectively, reaching roughly 6.9% of total revenues, equivalent to roughly USD5.5 billion in dollar-denominated revenues (available for dollar sales to finance the peso deficit). Cyclically sensitive revenues (tributación resto contribuyentes) are projected to rise this year by 12.3% YoY yet were revised slightly down from the previous forecast (-0.5%). Lithium-related revenues, which contributed to at least 1.6% of GDP in revenues in 2022, are projected to reach 0.3% of GDP this year, down by 51.4% from the previous forecast and 74.8% below 2023.

Fiscal spending still projected to increase... Fiscal expenditures are projected to reach 25.3% of GDP, representing a 4.9% YoY increase.

… but an above-target structural deficit could lead to spending cuts. The MoF projects a 1.9% of GDP nominal deficit forecast for this year, unchanged from their previous forecast, down from last year’s deficit of 2.4%. However, this year’s structural deficit was revised up to 2.2% of GDP, above the MoF’s official target of 1.9% (also the previous forecast); the deterioration of the structural deficit is due to higher copper prices and mining revenue. To meet this year’s structural deficit target, equivalent to roughly 0.4% of GDP in nominal terms, the MoF will have to adopt revenue and spending measures, which should become clearer after the results of the Tax Season (data to be released on May 31).

Revenues projected to rise above constrained expenditures. The Budget Office’s forecasts still show a benign medium-term fiscal outlook (2025-2028), with the economy growing at an average annual rate of 2.2% and revenues at 3.5% YoY. Expenditure growth is projected at an average of 0.43% YoY for the 2025-2028 period, substantially below the 4.9% average of 2010-2019. Of note, expenditure forecasts consider approved legislation, and hence are more likely a floor. In any case, the combination of an economy growing roughly at trend, with revenue rising and constrained expenditures contributes to the stabilization of gross public debt at roughly 41% of GDP in 2025.

Our take: The report seems bittersweet. The near-term fiscal outlook looks somewhat better, primarily due to the improvement in mining-related revenue; moreover, spending growth is likely to be revised down to meet this year’s 1.9% of GDP structural deficit target. However, the medium-term outlook remains challenging, with the stabilization of public debt relying primarily on expenditures remaining practically unchanged over time. Still, the strength of revenue growth in the April tax season will be key in gauging the government’s short-term financing needs.