2026/01/02 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

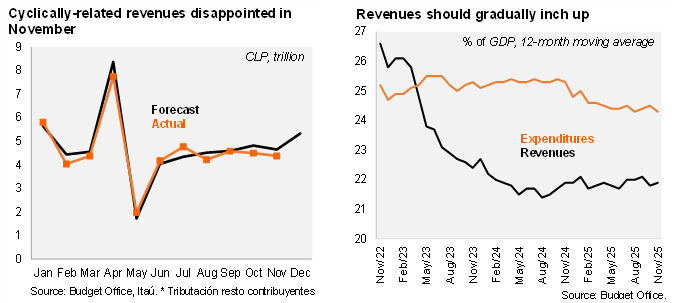

According to the Budget Office’s monthly report: following the October plunge (-10.7% YoY), the Central Government’s real revenues jumped back in November rising by 6.9%. Even though revenues rose, cyclically-related real revenues (tributación resto contribuyentes, comprising roughly 80% of total revenues) disappointed again, falling by 1.4% YoY, a smaller contraction with respect to October (-9.4%), below our forecast for the month (again). However, private mining revenue growth was strong, rising by 51% YoY, taking revenues in the year up by 50.4% YoY, reflecting the first full year of the new mining royalty law, elevated copper prices, and greater copper production. Codelco’s payouts rose by 14% in the month, while property rents (mostly tracked due to its relationship with lithium-related payments) sky-rocketed by 213%, driven by base effects in dividend payments from a SOE. Total real revenues accumulated in the year through November have increased by 5.0% YoY (4.8% as of October), still below the MoF’s annual watered-down revenue forecast (6.8%).

Real spending fell by 3.4% YoY in November. Current expenditure contracted by 1.0% YoY, mainly driven by a 12.5% decline in subsidies and donations, which contrasted with yet another important spending rise in personnel (9.1% YoY, education-related); current expenditures year-to-date are up by 3% accumulating 92.1% of the annual budget, slightly above 2024's pace. Capital expenditure fell by 17.0% YoY in November, leading to a cumulative rise in the year of 3.3%, taking this component’s expenditure to 74.3% of the annual budget, in line with last year. Capital spending likely contracted in December to meet spending forecasts, in the context of low liquid cash balances. Total spending in the year through November increased by 3.0%, still above the 2.6% official forecast.

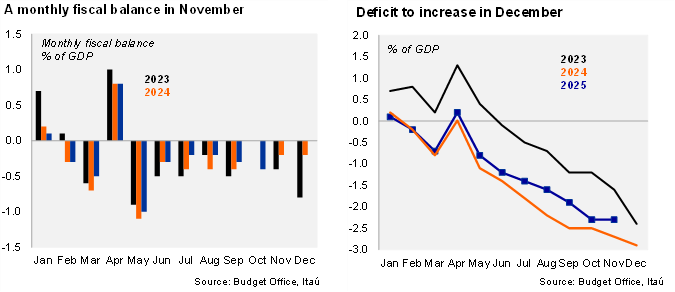

November’s monthly fiscal balance rose to 0.0% of GDP, well above the deficits for the month in 2023 (-0.4%) and 2024 (-0.2%). As a result, the cumulative fiscal balance through November was unchanged sequentially at 2.3% of GDP, below the 2.7% deficit through November 2024 (see chart), yet already above the MoF’s annual 2.0% forecast. On a 12-month moving average basis as of the end of November, the central government’s revenues rose by 10bps to 21.9% of GDP, and expenditures fell by 20bps to 24.3%, leading to a nominal deficit of 2.5%, improving from 3.4% of GDP a year earlier. We expect a gradual narrowing of the nominal deficit in the coming quarters, primarily due to an improvement in revenues.

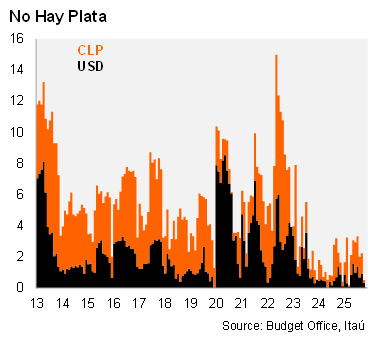

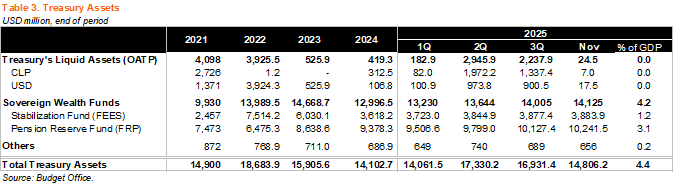

No Hay Plata -- Liquid assets at the Treasury fall to the lowest on record since 2010. Liquid assets in the Treasury fell in November to roughly USD25 million (from USD757 million in Nov-24), the lowest monthly balance on record since 2010. It is no surprise that in this context, the MoF announced a revised larger issuance local currency plan for 4Q25 to complete USD16.7 billion through December. AUM in the sovereign wealth funds were little changed (see table).

Our take:

• Fiscal dynamics should improve going forward. We forecast the 2025 nominal deficit forecast at 2.5% of GDP (2.8% in 2024), and then down to 1.5% in 2026, primarily due to revenue improvements. If the current level of copper prices persists, along with the uptick in lithium prices, revenues could jump by at least 1% of GDP, lowering financing needs and eventually leading to much-needed savings in the Stabilization Fund. The MoF will miss the structural deficit target again this year, eroding the credibility in Chile’s fiscal institutional framework. The MoF’s forecast considers the 2026 structural deficit at 1.1% of GDP.

• On the financing front: The 2026 budget law authorizes gross debt issuance in 2026 for a total of USD17.4 billion (and an additional USD600 million in loans from multilaterals). We believe the MoF will announce their issuance plan in early January, likely for a gross total of USD17 billion. Issuance should kick off in the following days with a sizable foreign currency issuance (USD3-4 billion), followed by local currency auctions. Of note, an important share of the foreign currency issuance should be used to finance dollar and euro-denominated amortizations (~USD1.6 billion equivalent) due towards the end of January.

• Dollar sales in 2026: Dollar sales address the government’s gross financing needs, disregarding exchange rate considerations. We estimate gross financing needs (most of which are below the line) close to USD18billion in 2026, which could eventually decline if revenue dynamics improve further, most of which is financed through local currency issuance. Net dollar inflows (primarily from mining-related revenue, foreign currency issuance, and amortizations) should reach at least USD10.1 billion in 2026. Such an amount would allow for the largest dollar sales since 2023 (USD12.2 billion). Having been absent since late October (in the context of critical levels of liquid dollar assets at the Treasury), we expect the MoF to renew dollar sales during the second half of January, maintaining the guidance of up to USD300 million per week. As in previous years, the MoF is authorized to hedge up to USD4 billion in foreign currency debt in 2026; official records suggest the outstanding stock of hedges reach about 3% of gross public debt, roughly USD4.5 billion.

• On policy and reforms: Congressional activity in the coming weeks is likely to focus on the pubic sector’s annual wage adjustment (+3.4% nominal), with market estimates of a sizable fiscal cost (0.5% of GDP); discussions have focused on a norm included in the bill that would hinder layoffs in the public sector. We believe the latter is unlikely to be approved by Congress. The government’s remaining legislative initiatives including changes to the financing structure of the state-guaranteed tertiary education program (CAE), tax reforms, corrective measures, and minor modifications to the management of the sovereign wealth funds (see our report) are unlikely to see the light during the administration’s term (ends March 11, 2026).

• Upcoming data: The Budget Office should publish end-December data on January 30, and the 4Q25 Public Finance Report in February.