2025/08/01 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

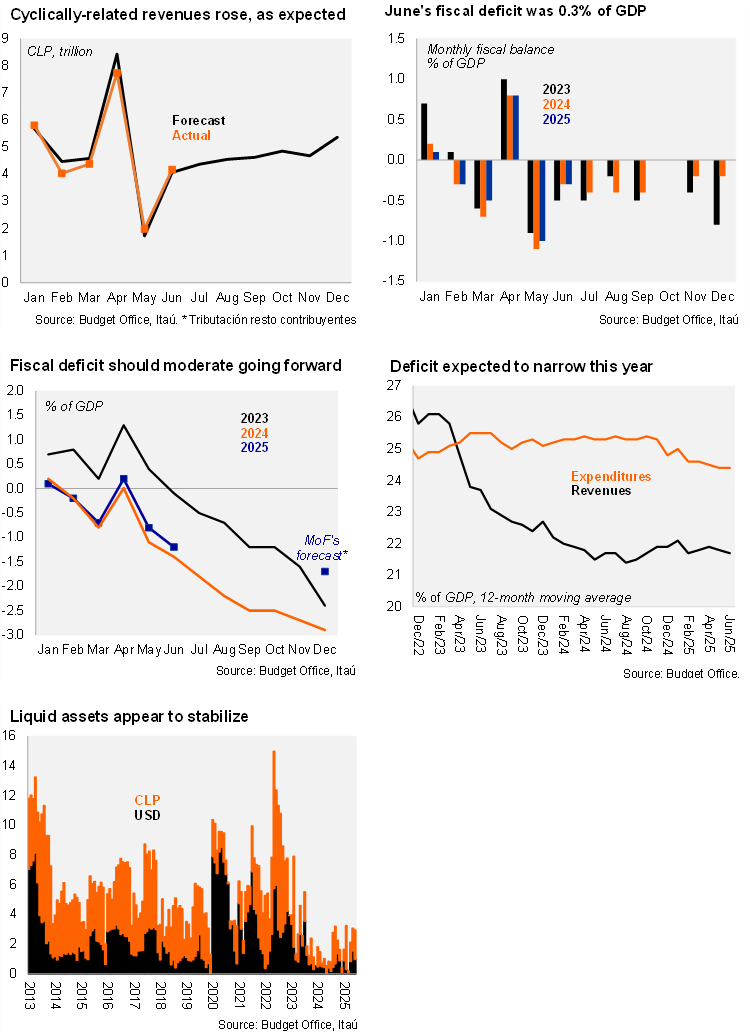

The Central Government’s real revenues fell by 3.2% YoY in June, affected by the lingering effects of tax refunds. Cyclically-related real revenues (tributación resto contribuyentes, comprising roughly 80% of total revenues) slipped again at the margin (-7.0% YoY in June), yet was essentially in line with our forecast (see chart); we expect this component to improve for the rest of the year. In contrast, mining-related revenue from both privates and Codelco continues to outperform, reflecting the first full-year of the new mining royalty law, elevated copper prices, and greater copper production. Despite the sustained support from mining-related payments, total real revenues accumulated in the year through June have only increased by 4.3% YoY (5.8% in May), below the MoF’s annual 7.6% forecast (does not consider greater revenues from “corrective measures”, which mostly rely on legislative approval).

Spending growth was flat in June. Real spending in the month was flat on an annual basis (-0.05% YoY), with current expenditure rising by 4.8% YoY, mainly driven by an increase in personnel and subsidies. Current expenditure through June has increased by 2.5% YoY, accumulating 50.2% of the annual budget, like in 2024 (50.2%). Capital expenditure, in contrast, fell by 23.1% YoY in June, leading to a cumulative rise in the year of 4.2%, taking this component’s expenditure to 41.0% of the annual budget, slightly above last year’s progress at the time (40.6%. We believe that after frontloading in the first half of the year, capital spending is likely to slow to meet the official aggregate spending forecast of 2.2% YoY. Total spending in the year through June has increased by 2.7%, gradually approaching the official forecast.

June’s monthly fiscal balance reached -0.3% of GDP, same as June 2024. The cumulative fiscal balance through June fell to a deficit of 1.2% of GDP, a slightly smaller deficit than the 1.4% through June in 2024.

The 12-month rolling fiscal deficit rose to 2.7% of GDP in June, from 2.6% in May. On a 12-month moving average basis as of the end of June, the central government’s revenues reached 21.7% of GDP, and expenditures 24.4% of GDP, leading to a cumulative deficit of 2.7% of GDP, improving from 3.6% of GDP a year earlier. We expect a gradual narrowing of the deficit, primarily due to an improvement in revenues.

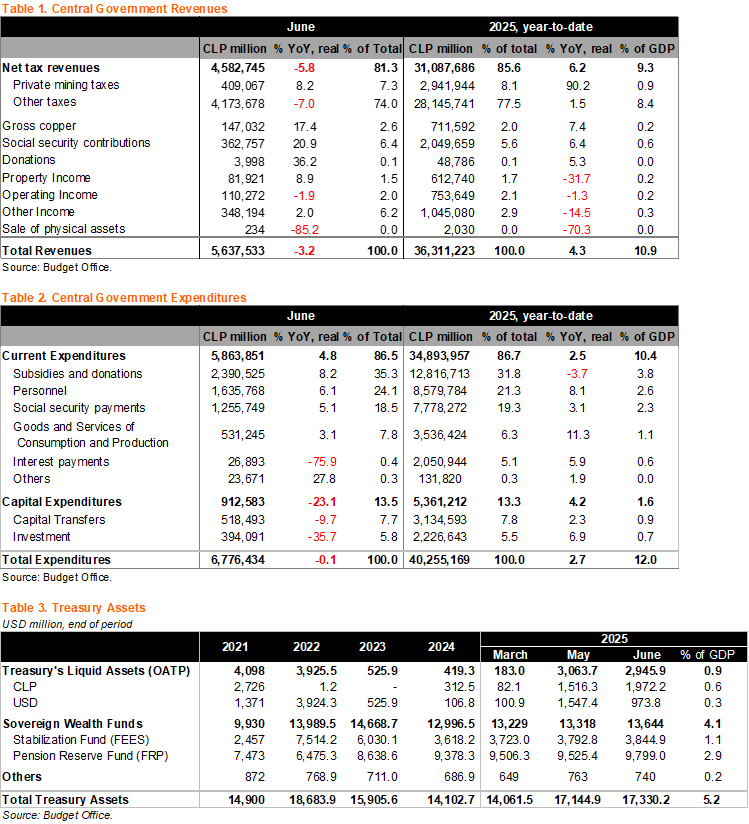

Liquid assets at the Treasury were essentially flat sequentially in June. Cash levels at the Treasury (Otros Activos del Tesoro Público ) were supported by gross debt issuance (roughly USD2.5bn in June). Liquid assets in the Treasury fell to USD2.9 billion in June (from USD3.1bn in May), above June 2024’s level (USD836 million). As we mentioned last month, cash buffers appear to be improving, a welcome development. AUM in the sovereign wealth funds were little changed, likely reflecting valuation effects. The Stabilization Fund (FEES) was flat at USD3.8 billion, and the Pension Reserve Fund (FRP) was up again, to USD9.8 billion. We expect withdrawals totaling up to roughly USD900 million by the end of the year from the FRP to finance a loan to the social security fund, as part of the implementation of the pension reform.

Gross public debt rose to an estimated 41.5% of GDP by 2Q25.

Our take: We maintained our nominal deficit forecast of 2.0% of GDP for this year. This year’s fiscal consolidation forecast rests on additional spending restraint and continued revenue improvement. We believe that the MoF will continue with its USD16 billion annual debt issuance plan, despite improving cash levels at the Treasury, with all eyes on the announcement of up to USD2.5 billion in local currency short-term notes during 3Q25. The recently announced tax reform is likely to face resistance in Congress. The Budget Office will release July’s fiscal data on August 29.