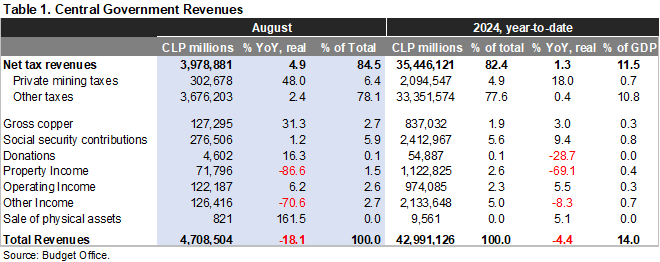

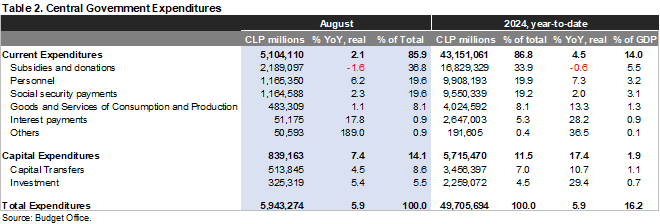

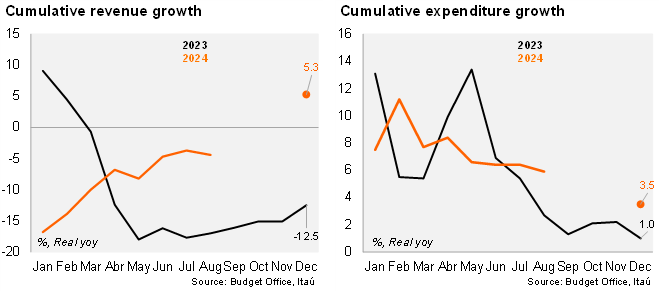

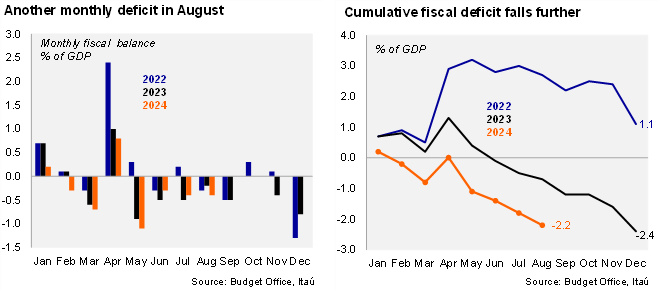

Short-term stress on fiscal accounts persisted in August. With all eyes on the presentation of the 2025 budget bill, the Budget Office reported data on the fiscal accounts through August. The combination of falling real revenues (-10.3% YoY) and rising real expenditures (2.5% YoY) led to the fourth consecutive monthly deficit (0.4% of GDP in August, same as in July). On revenues, the annual decline in August was mainly driven by an 86.6% fall in lithium-related rents as cyclically related revenue rose by 2.4% (see Table 1 below). Cumulative revenue growth in the year slipped to -4.4% YoY (-3.7% in July), well below the recently revised annual revenue growth forecast of 5.3% (down from 6.2%). On the spending side, current expenditure growth slowed in August to 2.1% YoY, mainly driven by a 1.6% decline in subsidies and donations (base effects from the PanAmerican Games held in 2023), while capital expenditures increased by 4.9% YoY (see Table 2 below). Cumulative expenditure growth in the year reached 5.9% (6.4% through July), implying a material spending constraint would have to be implemented through year-end to comply with the MoF’s spending growth forecast of 3.5%.

The cumulative fiscal deficit rose higher in August to 2.2% of GDP, already exceeding the MoF’s 2.0% year-end nominal deficit forecast. The monthly fiscal balance in August reached a deficit 0.4% of GDP, above the 0.2% of GDP of August 2023. The year-to-date fiscal balance now reaches -2.2% of GDP (-0.7% YTD as of August 2023), exceeding the MoF’s annual nominal deficit target of 2.0% of GDP. The fiscal balance tends to deteriorate during the fourth quarter of every year, with 4Q23 accumulating a whopping deficit of 1.2% of GDP, suggesting the MoF will miss their nominal forecast even with a significant spending restraint.

12-month rolling fiscal deficit edged higher. On a 12-month moving average basis as of the end of August, the central government’s revenues reached 21.4% of GDP, and expenditures 25.2% of GDP, leading to a cumulative deficit of 3.9% of GDP, the greatest since early 2022, reflecting the material fiscal deterioration throughout the course of this cyclical adjustment.

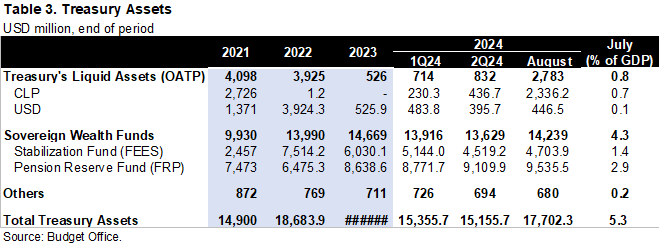

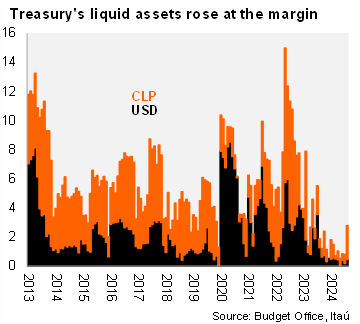

Debt issuance contributed to higher liquid assets at the Treasury. According to the Budget Office’s Monthly Asset Report, the Treasury’s liquid assets by the end of August reached a total of USD2.782 million, of which USD2.336 million were denominated in CLP assets, and the remaining USD446.53 million in dollar-denominated assets; the jump in the month likely reflects debt issued during the period. Assets in the sovereign wealth funds rose in the month likely due to portfolio performance, with the Stabilization Fund reaching USD4.7 billion and the Pension Reserve Fund USD9.5 billion.

Low dollar sales through year-end. We expect the MoF to sell roughly USD400 million per month through year-end, equivalent to the upper bound of our estimate for monthly mining-related revenues. The MoF's dollar sales finance shortfalls in the central government's deficit, with expenditures are primarily in CLP, and do not target a given level of the exchange rate.

Our take: The MoF is likely to miss its structural deficit target this year. The combination of persistently weak revenues and strong spending have led to a cumulative nominal fiscal balance through August of 2.2% of GDP, above the MoF’s 2.0% forecast. As mentioned earlier, the deficit ramps up significantly during the final quarter of the year, suggesting an even greater deficit by year-end. As such, the MoF is set to mess this year’s structural deficit target of 1.9% of GDP, further eroding the credibility of the fiscal institutional framework. Considering that the MoF’s USD2.25 billion 4Q24 issuance plan, completing the USD16.5 billion annual plan, is below the roughly USD3.8 billion in debt maturing in the period, financing shortfalls could be covered by slightly more debt issuance or additional withdrawals from the Stabilization Fund. Our nominal deficit forecast of 2.3% of GDP for this year is biased to the upside. The next monthly fiscal report (September) is scheduled for October 30.