All eyes on the MoF. As we have mentioned in previous reports, the MoF has been an active participant in the local foreign exchange spot market in recent years. For context, in March of 2020 the MoF announced they would competitively auction dollars from the Treasury to finance the high and rising expenditure needs related to the pandemic, further enhancing fiscal transparency, and providing additional guidance regarding the Government’s participation in the local FX market.

Dollar sales finance the deficit, not with an exchange rate target in mind. Dollar sales through auctions finance the government’s fiscal needs (primarily in pesos), disregarding exchange rate considerations, in line with Chile’s free-floating exchange rate regime.

Stock of dollar holdings. The Central Government’s official dollar holdings are mainly booked in the Treasury and the sovereign wealth funds (Stabilization Fund and the Pension Reserve Fund). The SWFs are entirely invested abroad, with the Stabilization Fund reaching roughly USD4.8 billion (1.4% of GDP), and the Pension Reserve Fund at USD9.7 billion (2.9% of GDP), both by the end of September. Separately, the Central Bank also manages international reserves, which as of the end of October reached USD44.6 billion (roughly 13.8% of GDP).

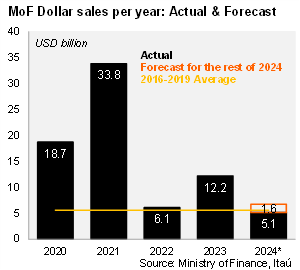

Dollar flows to the Treasury. Dollar assets in the Treasury are accumulated primarily from offshore bond sales, loans from multilateral financial institutions, copper-related revenue, periodic withdrawals from the sovereign wealth funds, and (less common) transfers from state-owned companies. The MoF enjoys a dollar surplus on a flow basis, as dollar inflows largely exceed dollar outflows. The latter are mainly in the form of foreign currency denominated debt amortization and interest payments, periodic injections to the SWFs and other funds. Dollar sales year-to-date through November 15 reached USD5.1 billion, well below the USD10.8 billion sold during the same period in 2023, yet somewhat closer to the USD5.9 billion year-to-date of 2022.

Changes in the recent guidance. On November 13, the MoF and Budget Office announced on their websites that the weekly maximum cap on dollar sales would increase from USD 200 million to USD 400 million. In our view, the announcement was driven by the accumulation of liquid dollar holdings at the Treasury, the sizable seasonal 4Q deficit, and important amortizations of local currency notes due by month’s end (USD 1.8 billion).

Our take: This time is different. Even though the MoF has tended to sell well below the cap of their guidance throughout most of the year, a deeper look at the details suggest they are likely to sell their USD400 million weekly cap at least through mid-December. According to the most recent Treasury Asset report (available here), the MoF had USD688.1 million in dollar-denominated liquid assets at the Treasury by the end of September. We estimate that this balance rose to roughly USD1.4 billion by the end of October, primarily reflecting the Stabilization Fund Withdrawal (here) and mining-related revenues. As such, the MoF is likely to sell the USD400 million weekly maximum cap at least through mid-December. The MoF is scheduled to publish updated fiscal data for the month of October on November 29.