Revenue slump continued in February… The central government’s real revenues contracted for the second consecutive month in February falling by 9.7% YoY, after a 16.8% decline in January. Revenues have contracted in annual real terms in seven of the last eight months, with the weak revenue start in 2024 coming on the back of a 12.5% YoY real contraction in 2023. Revenue weakness is primarily driven by cyclically-related revenues, despite economic activity performing somewhat better than official forecasts last year, and lower copper-related revenue. As of February, real revenues have declined by 13.9% YoY, suggesting a significant turnaround would be required to achieve the MoF’s projected +8% real rise in revenues for 2024.

… as expenditures rose by double digits. The central government’s real expenditures rose by 15.1% YoY in February, rising materially for the second consecutive month (7.5% in January). Current expenditures rose by 9% YoY, primarily due to subsidies and donations, as well as base effects of state-financed pension payouts. Capital expenditures had an eye-popping rise of 86.3% YoY, which were driven by 146.9% YoY increase in public investment and a 66.7% YoY rise in capital transfers to regions. In our view, the large expenditure increases reflect a payback from the lower spending of December 2023 (-5.6% YoY), which were an effort to comply with the 2023 fiscal targets amid low liquid assets. Expenditures in the year have increased by 11.2% YoY through February, well above the MoF’s 2024 projected 5.6% YoY rise.

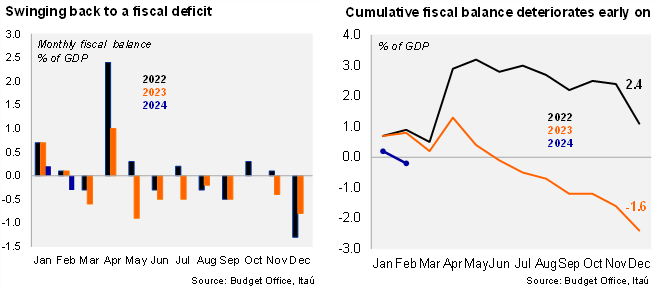

Fiscal balance turned negative in February. The monthly fiscal balance in February reached -0.3% of GDP (+0.2% of GDP in January, 0.1% in February 2023), leading to a YTD balance of -0.2% of GDP (+0.8% of GDP YTD as of February 2023). The MoF’s 2024 nominal and structural fiscal balance forecast is 1.9% of GDP, implying a moderate fiscal consolidation from the 2.4% of GDP and 2.6% of GDP nominal and structural deficits in 2023. Gross public debt is projected to rise to 41.2% of GDP by the end of 2024.

12-month rolling fiscal deficit widened further. On a 12-month moving average as of the end of February, the central government’s revenues reached 22.2% of GDP, and expenditures 25.5% of GDP, leading to a cumulative deficit of 3.4% of GDP, well above the annual cumulative deficit of 1.2% reached in February 2023, reflecting the fiscal deterioration throughout the course of this cyclical adjustment.

Don’t expect large dollar sales in the near term. According to the Budget Office’s Monthly Asset report, the MoF’s liquid dollar balances by the end of February reached USD 556.45 million, up slightly from the USD470.25 million in the previous month, but well below the USD1.8 billion of February 2023. The MoF sold USD420 million in March, taking sales in the year up to USD1.92 billion, below the USD3 billion guidance provided by the MoF in mid-January. The MoF is likely to sell a similar amount (between USD400-500 million) in April. Dollar inflows from a local currency issuance with direct participation of foreigners, yet to be announced, could lead to larger dollar sales in the coming months. The MoF’s dollar sales guidance for 2Q24 should be announced in the near term, but sales should be below the USD1.92 billion materialized in 1Q24. We estimate dollar sales in 2024 in the lower part of the USD8-10 billion range, below the USD12.2 billion of 2023.

Our take: The deterioration of Chile’s fiscal metrics throughout the long downturn of economic activity is mainly a story of revenue weakness, which has persisted in the first months of the year, posing challenges to fiscal forecasts. The combination of lower than expected revenue and expenditure increases have contributed to low liquid assets at the Treasury, as dollar sales are projected to remain low. Further revenue weakness could result in greater debt issuance this year (current plan of USD16.5 billion, which could be ramped up to USD18 billion) and additional withdrawals from the Stabilization Fund (USD800 million withdrawn in January, USD 5.1 billion AUM by the end of February); withdrawals from the Stabilization Fund do not require Congress’ authorization. The next month’s fiscal data (March) will be released on April 30, with the 1Q24 Public Finance Report scheduled for May 13. All eyes are on the size of April’s seasonal revenue jump, to be released on May 31.