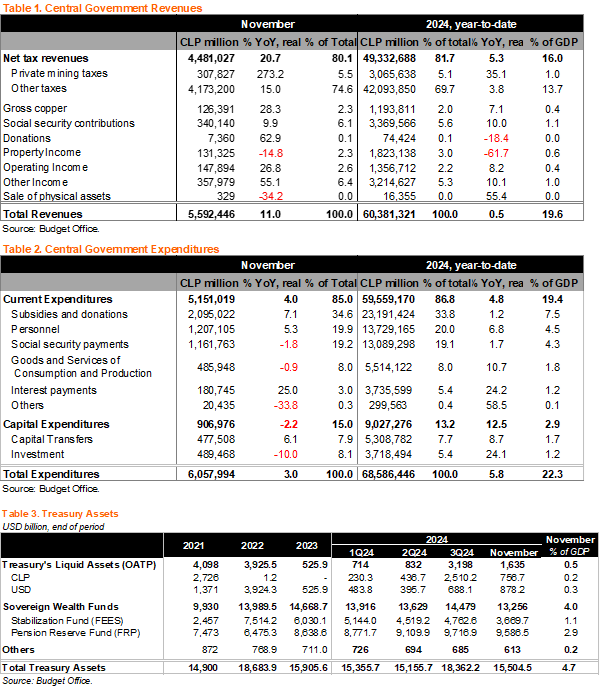

Revenue recovery gains steam. As we’ve anticipated in previous months, the stalled real revenue recovery continued in November rising by 20.9% YoY, driven by cyclical factors, and private mining (also base effects on mining due to the implementation of the revised royalty law); real revenues through November rose by 0.5% YoY, still well below the MoF’s annual 5.3% forecast. Once again, all revenue components printed positive on an annual basis, with the exceptions of lithium-related property rents and the sale of physical assets. Importantly, cyclically related revenues rose again by double digits, increasing by 15% YoY (see Table 1 below). Despite the improvement in the month, cumulative revenue growth in the year rose at the margin to 0.5% YoY (-1.2% through October), still well below the MoF’s annual revenue growth forecast (+5.3%), setting the stage for a sizable revenue miss this year.

Spending spree decelerated in November. Following the 11.8% YoY spending jump in October, mainly driven by a 103% YoY rise in interest payments, real expenditure growth decelerated to 3% in November (see Table 2 below). Current expenditure growth rose by 4.0% YoY, mainly driven by greater personnel costs, subsidies and donations, and another substantial rise in interest payments. Capital expenditures fell by 2.2% YoY. Cumulative expenditure growth in the year reached 5.8% (6.1% through October), implying an unprecedented spending constraint would have to be implemented in December to comply with the MoF’s spending growth forecast of 3.5%.

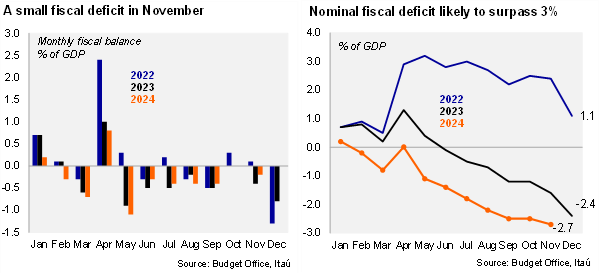

The cumulative fiscal deficit in the year through November rose to 2.7% of GDP, leaping further above the MoF’s 2.0% year-end nominal deficit forecast and last year’s annual deficit (2.4%). Even though the revenue kick continued in November, the monthly fiscal balance still reached a deficit of 0.2%, smaller than the 0.4% deficit of November 2023. The year-to-date fiscal balance now reaches -2.7% of GDP (-1.6% YTD as of November 2023), diving well below the MoF’s annual nominal deficit forecast of 2.0% of GDP. The average monthly fiscal deficit for December between 2022 and 2023 has been roughly 1.1% of GDP, suggesting the MoF will miss its nominal forecast by a long shot, even with a significant spending restraint.

12-month rolling fiscal deficit fell to a still large 3.4% of GDP. On a 12-month moving average basis as of the end of November, the central government’s revenues reached 21.9% of GDP, and expenditures 25.3% of GDP, leading to a cumulative deficit of 3.4% of GDP, down from 3.7% the previous month (deficit of 2.9% of GDP in November 2023).

Low liquid assets at the Treasury by the end of November. Liquid assets in the Treasury (Otros Activos del Tesoro Público) fell to USD1.6 billion by the end of November (USD1.3 billion by the end of October). AUM in the sovereign wealth funds were little changed in the month, likely reflecting valuation effects. The Stabilization Fund (FEES) reached USD3.7 billion, and the Pension Reserve Fund (FRP) USD9.6 billion.

Our take: While we expect the revenue recovery continued in December, the underwhelming results of the voluntary foreign asset disclosure program (expected by the MoF to reach 0.2% of GDP this year, yet preliminary results were negligible), along with the seasonal ballooning in spending, suggest the MoF is likely to end the year with a nominal deficit of at least 3% of GDP. The structural deficit target of 1.9% of GDP is also likely to be missed by a long shot, eroding the credibility of the fiscal institutional framework. In this context, with limited dollars in liquid assets, the MoF is unlikely to regularly sell dollars during the first few weeks of January. We expect the MoF to announce their 2025 debt program in the coming days, which we envisage to total roughly USD16 billion in gross terms. The next monthly fiscal report (December) is scheduled for January 31.