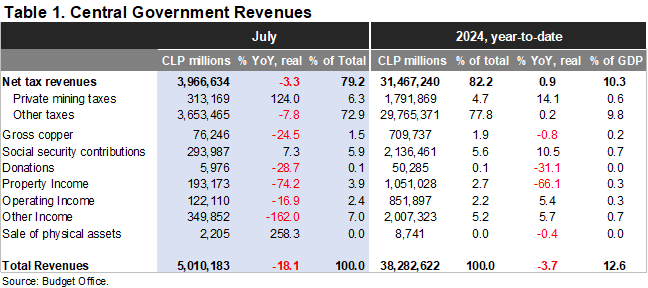

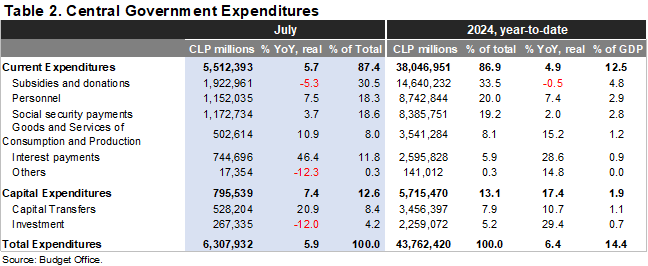

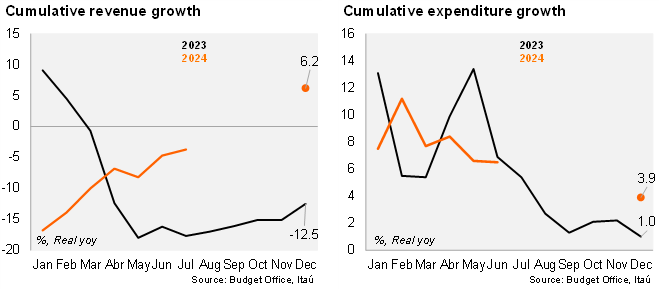

The short-term stress on Chile’s fiscal accounts persisted in July, accumulating a deficit of 0.4% of GDP in the month, as real fiscal expenditures rose by 5.9% YoY, while real revenues increased by 4.0% YoY. On the spending side in July, current expenditures rose by 5.7% YoY and capital expenditures by 7.4% YoY, which led to a 6.4% YoY year-to-date total spending growth, well above the +3.9% annual rise projected by the MoF. Revenues in the year through July have fallen by 3.7% YoY, well below the MoF’s forecast for the year of an increase of 6.2% YoY.

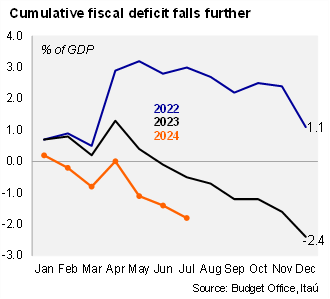

The cumulative fiscal balance fell further in July, posing headwinds to meet the MoF’s annual deficit target. The monthly fiscal balance in July reached a deficit 0.4% of GDP, similar to July 2023. The year-to-date fiscal balance now reaches -1.8% of GDP (-0.5% YTD as of July 2023), edging closer to the MoF’s annual nominal deficit target of 1.9% of GDP. The fiscal balance tends to deteriorate during the fourth quarter of every year, with 4Q23 accumulating a whopping deficit of 1.2% of GDP, suggesting the MoF would have to implement a massive spending adjustment towards this year-end to comply with the deficit target.

12-month rolling fiscal deficit edged higher. On a 12-month moving average basis as of the end of July, the central government’s revenues reached 21.7% of GDP, and expenditures 25.3% of GDP, leading to a cumulative deficit of 3.7% of GDP, well above the annual cumulative deficit of 2.4% reached in July 2023, reflecting the fiscal deterioration throughout the course of this cyclical adjustment.

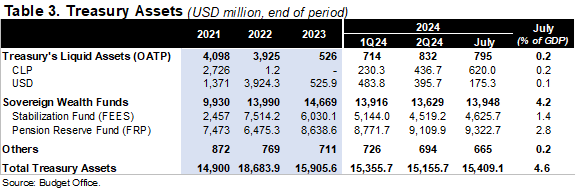

“Raspando la olla” … liquid assets remain at historically low levels. According to the Budget Office’s Monthly Asset Report, the Treasury’s liquid assets by the end of July reached a total of USD795.24 million, of which USD619.98 million were denominated in CLP assets, and the remaining USD175.27 million in dollar-denominated assets. Assets in the sovereign wealth funds were essentially unchanged in the month, with the Stabilization Fund reaching USD4.6 billion and the Pension Reserve Fund USD9.3 billion.

Low dollar sales through year-end. We expect the MoF to sell roughly USD400 million per month through year-end, equivalent to the upper bound of our estimate for monthly mining-related revenues. The MoF's dollar sales finance shortfalls in the central government's deficit, with expenditures are primarily in CLP, and do not target a given level of the exchange rate.

Our take: The short-term stress on Chile’s fiscal accounts persists, as spending remains strong and revenues have yet to materially turn the corner. If the MoF plans on complying with this year’s structural deficit target of 1.9% of GDP, spending will have to be reduced significantly through year-end, in contrast to historical patterns. Hopes for a greater revenue boost from higher copper prices have faded as spot prices have fallen towards USD4.10, leading to an average price year-to-date of USD4.21 (below the MoF’s annual forecast of USD4.3 per pound). Financing shortfalls could be covered by slightly more debt issuance or additional withdrawals from the Stabilization Fund. We expect a nominal deficit of 2.3% of GDP this year. The next monthly fiscal report (August) is scheduled for September 30, with the MoF expected to present the 2025 budget bill by the same date.