2025/12/31 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

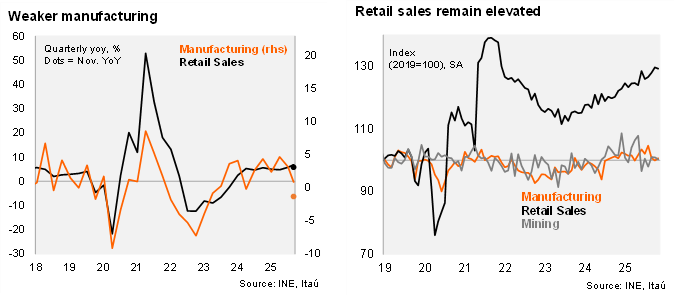

According to the National Statistics Institute (INE), real retail sales rose 5.8% YoY in November (8.4% in October), slightly below Bloomberg’s market consensus and our call of 6.2%. The main product lines behind the result were electronics, clothing, and miscellaneous consumer goods with increases of 15.9%, 11.6% and 5.6%, respectively. Sequentially, retail sales dropped 0.3% MoM/SA, the first monthly contraction since July25. Meanwhile, manufacturing output fell 1.3% YoY, below market expectations of a flat variation over twelve months (Itaú: +0.5%), mainly due to decreases in wood and pulp production (-17.0% and -5.2%), along with manufacture of machinery and equipment which decreased by 15.7%. Sequentially, manufacturing rose by 0.7% (-0.8% in October). Mining production remained weak (-1.3% YoY), driven by lower ore grades and reduced mineral processing. Mining levels dropped 0.7% MoM/SA. As a result, overall industrial production declined 0.8% over twelve months, with a mild 0.2% MoM/SA rise at the margin. Looking forward, we expect November Imacec to grow 1.6% YoY, with Non-mining activity rising 2.0% (to be released on Friday).

Retail sales were resilient at the margin, while mining shows signs of recovery. Retail sales rose by 6.2% QoQ/saar in the quarter ending in November (same figure in October; 3.7% in 3Q), while manufacturing fell 11.1% QoQ/saar (-2.5% in October; +3.2% in 3Q25). Mining rose by 10.1% QoQ/saar (-6.5% in October; -13.7% in 3Q).

Our take: Despite the slight downside surprise in retail sales, commerce activity remains resilient at the margin, in the context of lower inflation and borrowing rates, as well as improving household confidence. The mining sector shows some signs of recovery, although challenges persist in restoring production levels following this year’s supply shocks. With robust non-mining activity and an improved investment outlook, we project GDP growth of 2.4% for both this year and 2026.