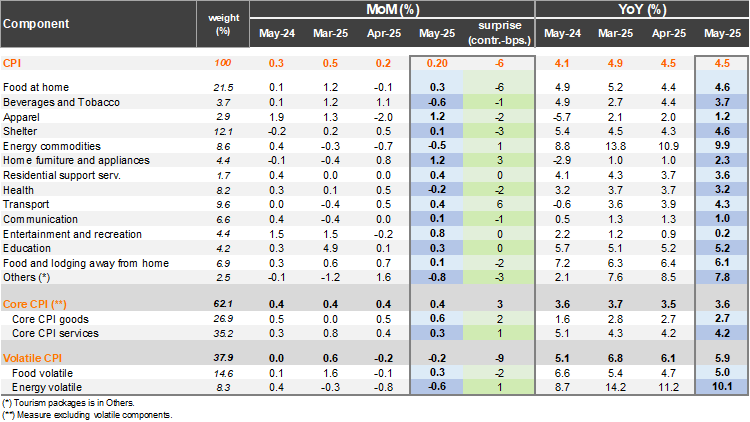

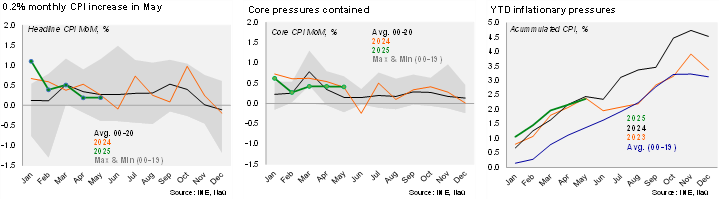

According to the INE, consumer prices increased by 0.20% from April to May, in line with the Bloomberg market consensus, while being 6 bps below our forecast. The bulk of the downside surprise to our call came from volatile items (excluding food and energy). The 0.42% core inflation increase was broadly in line with our estimate. Overall, second-round effects from the previous electricity adjustments remain contained. The price increase was driven by the household maintenance and equipment division (up 1.0% MoM, contributing 6 bps), lifted by durable goods. The food and non-alcoholic beverage division rose 0.3% (adding 6bps). Key downside drags came from drops in insurance prices, the reversion of interurban bus fares post Easter, and falling wine prices.

Sequential price dynamics are consistent with annual inflation near or below the 3% target. In annual terms, headline inflation was steady at 4.5%. Annual inflation has been above the 3% target since early 2021. Core inflation ticked up 10 bps to 3.6%. Core goods and services inflation were stable at 2.7% and 4.2%, respectively. Volatile inflation fell by 20 bps to a still elevated 5.9%. Excluding food and energy prices, inflation sits at 3.7%. Sequentially, the annualized headline inflation accumulated over the last quarter reached 3.0% (the lowest since 3Q23), while core pressures came in at a below target 2.0%.

Our Take: We expect consumer prices to fall by between 0.1% and 0.2% during June, driven primarily by the effects of cyber-day. For July, we estimate a 7.3% electricity price increase (2.2% of the basket), resulting in a total CPI of around 0.6%. Annual inflation should decline more quickly during the final quarter of the year given more demanding base effects. Additionally, the evolution of international oil prices, exchange rate dynamics (an accumulated appreciation of 6.9% this year), and the apparent absence of second-round effects from the prior electricity price increases increase the odds of a swifter disinflation path. Our yearend inflation forecast of 4.0% is biased downward. Relevant medium-term inflation expectations are anchored to the 3% target. Although the pace of economic activity in Chile has exceeded expectations this year, partly due to temporary effects, risks of lower global growth ahead persist amid the trade war. We expect the Central Bank to resume rate cuts for the remainder of the year, closing the year at 4.5% (from the current 5.0%). Our baseline scenario is for a cut in September, but risks tilt towards a sooner start. We do not rule out a surprise cut already this month. Core inflation has fallen considerably faster than the Central Bank’s path outlined in the 1Q IPoM (we estimate a 3.6% average for 2Q versus the 4% in the IPoM). The INE is scheduled to announce June’s inflation on July 8.