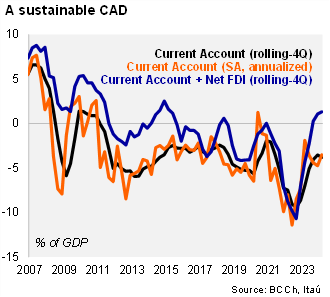

The current account balance in 1Q24 came in at a deficit of USD 0.1 billion, well below market expectations (BBG: USD -1.5 billion; Itaú: USD -1.6 billion). The large trade surplus of goods (revised up from monthly tracking) helped keep the current account near balanced. The deficit is a narrowing from the USD 3.7 billion deficit in 4Q23, while moderately larger than the USD 0.5 billion surplus in 1Q23. The rolling-4Q CAD came in at 3.7% of GDP (3.6% in 2023). The income deficit remain elevated, but narrowing from highs in the prior two quarters. The post-March spike in copper prices will likely lead to a growing income deficit in coming quarters. The financing breakdown of the CAD remained favorable with sufficient funding derived from long-term FDI. External debt as a share of GDP came in 83%, up from 76% in 4Q23. The improvement in Chile’s balance of payments, driven by the normalization of domestic demand, lowers the CLP’s vulnerability to external shocks in the context of narrowing interest rate differentials with the U.S.

A large trade surplus for goods continued at the start of 2024. The USD 6.5 billion surplus was a tick above the surplus one year earlier, while up USD 1.7 billion from 4Q23. Exports of goods dropped 2.5% yoy (8.3% fall in 4Q23), as higher copper exports were offset by weakness in manufactured goods. Copper exports were boosted by prices (6.5% yoy) and to a lesser extent, volumes (1.5% yoy). Imports of goods fell 4.1% yoy (9.7% down in 4Q23), as rising consumer goods imports were more than offset by double-digit declines from energy and capital goods purchases. The services trade deficit narrowed marginally over one year as the 1.3% fall in exports (primarily due to transportation) was countered by the 3.4% import drop of services. The rolling-4Q income deficit continued to tick up to USD 18.1 billion (USD 17 billion last year; USD 14.2 billion in 2022), lifted by the return of FDI in Chile.

FDI dynamics consolidate a sustainable financing mix. Net FDI in 1Q24 came in at USD 2.6 billion, far above the quarter’s mild CAD. The USD 4.2 billion of direct investment into Chile was led by profit reinvestments. The rolling-4Q net FDI reached USD 16.8 billion (5.1% of GDP; USD 15.5 billion in 2023), exceeded the comparable CAD of USD 12.5 billion. Portfolio investment registered a moderate net inflow of USD 1.0 billion in the quarter, led by external debt issuance by firms, banks and finally the government. The stock of external debt reached 83% of GDP in December (76% a year earlier), lifted by greater private company debt (while banks and the public sector reduced the external debt share).

Our take: We expect the gradual recovery of domestic demand to prevent a significant narrowing of the CAD this year compared to the 3.6% in 2023, but copper price dynamics will consolidate a sustainable-financed CAD scenario. The tight monetary policy has succeeded in correcting Chile’s external imbalances from prior highs of a CAD nearing 10% of GDP. The re-balanced economy and anchored inflation expectations support the continued loosening of monetary policy. We expect a 50bp rate cut in this week’s Monetary Policy Meeting (May 23) to 6%, then gradually declining to 5.25% by this yearend, before falling further next year as the Fed embarks on lowering in respective rates.