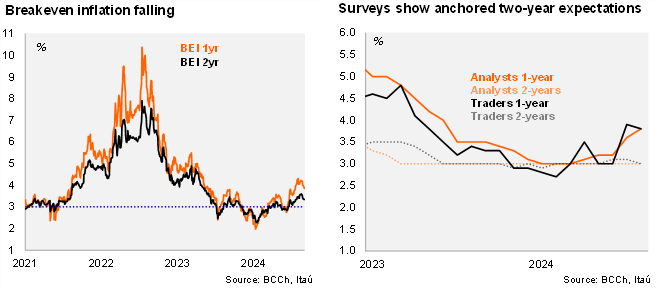

We expect the BCCh to continue its easing cycle in September with a 25-bp cut. At the July meeting, the Board assessed cutting (-25bps) or pausing at the July meeting, as opposing inflation risks reared their heads. The minutes revealed that the depreciation of the Chilean peso and confirmation that the INE would not consider subsidies in its electricity price tracking, had pushed up the BCCh's 2H24 and 1H25 inflation outlook. On the external front, the weakening of the Chinese economy and lower copper prices could lead to a weaker external impulse for the Chilean economy, one of the drivers that had led to an upward revision in the June IPoM’s forecasts. Overall, the scenario pointed to opposing inflation risks, as weaker activity softened demand-side pressures, while supply shocks boosted the CPI outlook, but that neither risk was imminent nor dominant. The Board favored a pause in July (at 5.75%) to reevaluate the medium-term economic outlook in the September IPoM as well as the adequate policy response. So far, the reaction of inflation and interest rate expectations in the market showed the incorporation of the transitory nature of the price shock, with both analyst and financial operator surveys maintaining the relevant two-year CPI outlook anchored to the 3% target, along with a large majority favoring a cut in September, paving the path for a cut at this meeting.

The September IPoM (to be published on September 4) should lay out the groundwork for an easing cycle that should incorporate pauses, as risks to the disinflation path and expectations linger. The global scenario is set to be less restrictive than envisioned in June. The Federal Reserve has signaled the start of a rate cutting cycle and our international scenario considers cuts of 25-bps in each of the remaining three meeting in the US. The BCCh’s June forecast considered no Fed cuts this year (and a total of 70bps in 2025). Terms-of-trade are favorable for Chile, resulting in the CLP appreciating by over 3% since the last meeting.

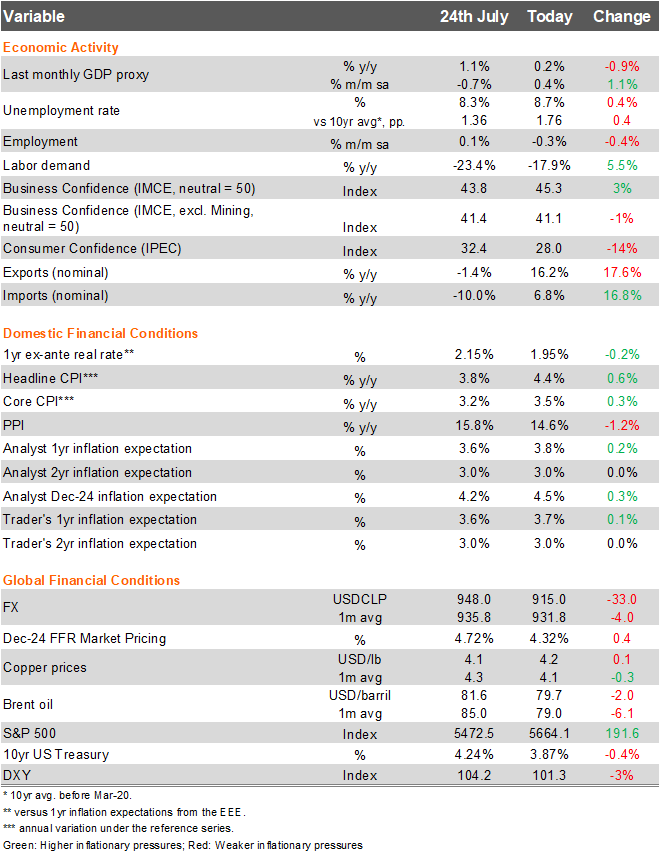

Domestic demand has underwhelmed. Importantly, we believe the IPoM will recognize downside surprises to activity, a gradual deterioration of the labor market, and weak credit dynamics, which, put together place downside pressure on inflation over the medium-term. Activity in 2Q came in at 1.6%, around 1pp lower than forecasted in the 2Q IPoM. Both private consumption and investment dynamics have faltered, while official labor market statistics have worsened (employment contracted sequentially in July for the first time since 2023), in line with complementary data that had raised signs of concern. Credit conditions have remained restrictive, and the levels of commercial loan stock continues to move sideways. Business sentiment and household confidence remain downbeat. The expected global impulse is likely to be reduced compared to the June outlook as concerns grow over the strength of the Chinese economy.

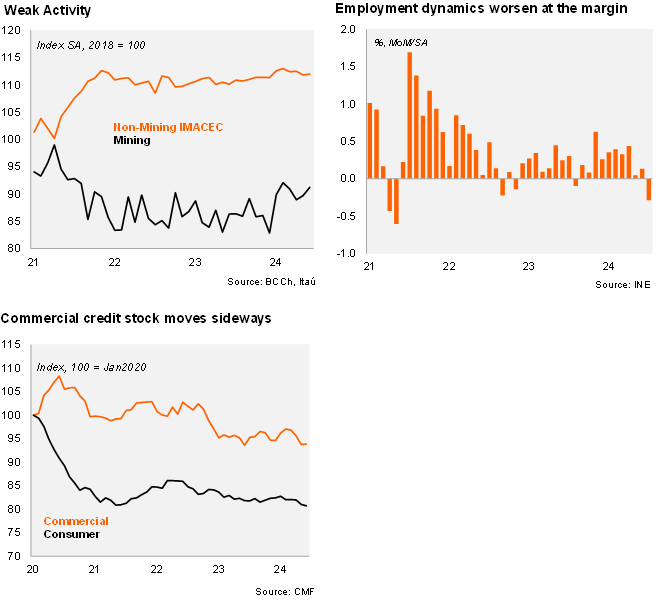

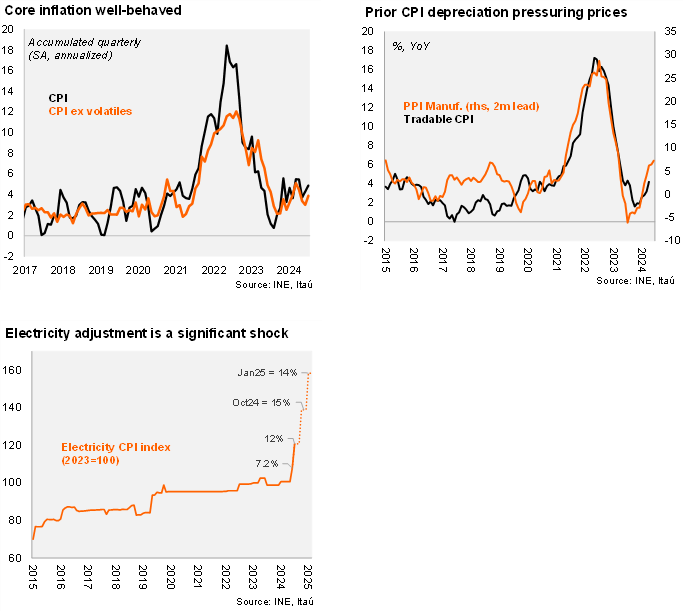

However, electricity prices should lead the BCCh to revise their inflation forecast up. The 7.2% and 12% electricity price increases in June and July, along with an expected 15% hike in October will likely result in yearend headline CPI ending well above the current BCCh forecast of 4.2%. Confirmation by the National Statistics Institute that subsidies would not be considered in the measurement of prices will lead to additional adjustments by the BCCh. While headline inflation pressures are rising, core inflation dynamics are likely to be broadly in line with expectations. A higher 2024 CPI estimate will have spillover effects into 2025 through indexation mechanisms, but softer domestic demand and reduced disposable income would likely keep core inflation near the target next year.

The value of credibility and the market understanding the nature of the supply shock. While the supply shock of electricity prices should lead to higher inflation over the following quarters, reflected in higher short-term inflation expectations, survey-based inflation expectations at the two-year horizon remain anchored at the 3% target. The one-year inflation forecast from both the analyst and trader surveys have risen to around 3.8%. While analysts’ two-year CPI expectation has been cemented at 3%, traders briefly raised their expectations before converging back to the BCCh’s target, reinforcing the transitory nature of a supply-side shock. Break-evens have recently declined at the margin.

IPoM to include a revision of the structural parameters. We believe the September IPoM is likely to include text boxes that provide details on the annual revision of the structural parameters, last reviewed in December 2023. Non-mining trend GDP growth was estimated at an average of 1.9% for the 2024-2033 period, while the mining GDP growth was forecasted at 1.5% for the same period, which led to an overall average trend growth of 1.9%. We believe the BCCh’s trend growth forecast is unlikely to change materially. However, we expect the BCCh to revise their real neutral rate range up slightly, in line with recent adjustments by other central banks. The BCCh currently estimates the real neutral range at 0.5%-1.5% and could revise the range up by raising the floor of the range. The BCCh has raised its range for the real neutral rate over the past several years, from 0.25%-0.75% in June 2021 to 0.5%-1.0% in December 2022 then 0.5-1.5% in December 2023.

We expect a 25bp cut. The June IPoM had the center of the 33% confidence interval for the policy rate averaging 5.5% in 4Q24 and 4.57% in 4Q25. While short-term inflationary pressures are tilted to the upside, they are supply driven and transitory. On the other hand, weaker domestic demand, and a softer global impulse point to a loss of demand-side pressures ahead. Overall, to ensure the convergence of inflation to the 3%, the Board will need to lower rates over the policy horizon. Emphasis on incoming data, along with the signaling of pauses and fine-tuning, will pose challenges for the market to interpret the next decisions. Nevertheless, we expect a 25bp cut in September to 5.5%, followed by a pause in October. Risks tilt to an additional cut in December. We see the cycle concluding at 4.5% in 2025.