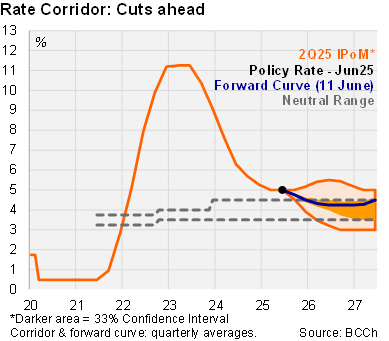

The central bank’s baseline scenario shows a mild negative output gap, a swifter core inflation convergence path, while global uncertainty has increased. The BCCh’s baseline monetary policy path reflects a slightly swifter cutting cycle compared to March, with the possibility of cuts in both the July and September meetings. Thereafter, the path to the 4% terminal rate is slower. The IPoM conveys a domestic scenario that has the output gap closed and gradually swinging negative over the forecast horizon, implying the monetary policy rate edging lower towards the neutral range. Barring an escalation on the global front that stresses financial variables and energy prices, we expect the Board to proceed with a rate cut in July.

INTERNATIONAL: The global scenario has become considerably more uncertain, due to the swings in US trade policy. While the impact of these measures on global activity is not yet evident, the central bank expects this to be negative. Additionally, the escalation of armed conflicts in the Middle East, although the scope and potential impacts on the global economy is still unknown. The BCCh’s baseline scenario sees a delay in implementing the Fed’s 100bp cutting cycle with only one 25bp cut now expected for this year (down from two; in line with Itaú) and three cuts during 2026 (previously two). The terms-of-trade for Chile remain favorable and were revised up.

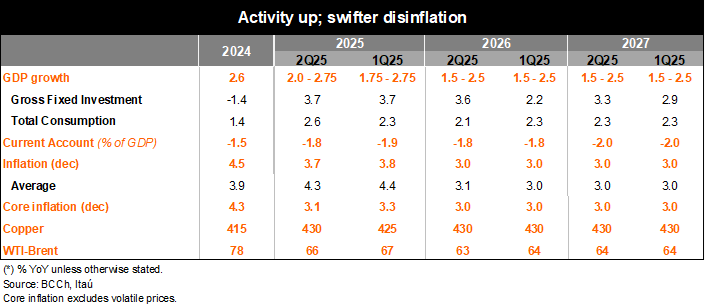

ACTIVITY: The BCCh's forecast assumes that the output gap will maintain a slightly less negative trajectory in the short term compared to the March scenario. This reflects the higher starting point for activity following the improved performance reported at the beginning of this year, which also led to a marginal upward revision of potential GDP. Looking ahead, the factors that temporarily boosted GDP growth in early 2025 are expected to dissipate, and external demand is expected to be somewhat lower than estimated in March. Furthermore, it incorporates the improved outlook for domestic demand, especially for investment. The floor of the forecast range for 2025 was raised by 25bps to 2.0-2.75% (Itaú: 2.6%). Overall, this implies that the output gap will remain slightly negative throughout the forecast horizon, dampening demand-side inflationary pressures.

INFLATION: The headline inflation path is similar to March, expected to converge to 3% during the first half of 2026 and remain there until the end of the forecast horizon. Upside pressures: the improved performance of domestic demand, particularly investment, a somewhat depreciated real exchange rate during the forecast horizon (gradually returning to its equilibrium levels), and the incorporation of new information regarding the electricity tariff readjustment process (we expect a roughly 7% MoM increase in July). Downside pressures: Lower effective data for core inflation, reduced inflation resulting from the redirection of global trade (-0.3pp), and the lower outlook for fuel prices (scenario closed prior to the conflict in the Middle East). The 3.7% yearend inflation estimate (Itaú: 3.8%) incorporated a 10bp downward revision, while the average core path for this year was adjusted down by 30bps to 3.5%.

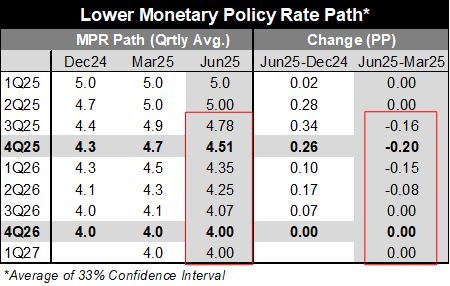

MONETARY POLICY: Inflation has broadly evolved in line with expectations, while the upside risks present in the first half of the year have moderated. Activity has been stronger than anticipated. However, recent events in the Middle East introduce a new source of uncertainty that could lead to more complex scenarios. The baseline scenario of the June IPoM still considers a path towards 4%, the center of the neutral nominal range, but getting there slightly earlier. In March, the average of the corridor's 33% confidence interval reached 4.7% in 4Q25, while now sits at 4.5%.

Our Take: Global developments will play a crucial role in the timing of additional cuts. At this stage, considering the current level of the policy rate, we believe tactical elements on a meeting-by-meeting basis will be key. Scenarios that trigger bouts of global risk aversion accompanied by a swifter weakening of the CLP and rising oil prices should result in a delay in local cuts. We expect consumer prices to fall by 0.24% in June (BCCh implicit estimate: -0.16%), and to end the year at 3.8% (BCCh: 3.7%). The next monetary policy meeting is scheduled for July 28-29. Later today we expect the Fed to keep the FFR in the 4.25-4.50% range tomorrow, with updated projections indicating fewer cuts this year (in line with the BCCh scenario). Structural parameters are likely to be updated in the September IPoM.