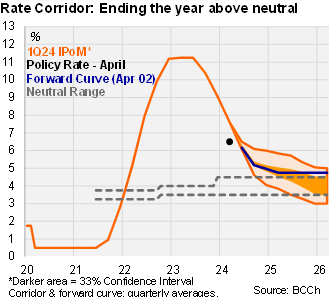

Our Take: The 1Q24 IPoM raised inflation and growth forecasts, but kept the medium-term rate path broadly in line with the December IPoM. Nevertheless, the easing cycle has been front-loaded compared to the December signaling, likely responding to the swifter-than-expected inflation fall last year, with a total of 175bps in cuts during the first two meetings of this year. The acknowledgement to closely monitor upside inflation pressures stemming from CLP depreciation, rising global costs, and domestic price readjustments is, in our view, consistent with the expectation of smaller cuts as rates get closer to neutral territory. We expect cuts of 50-bps in the near term, and then eventually slowing to 25bps once the policy rate approaches the upper end of the 3.5-4.5% neutral range.

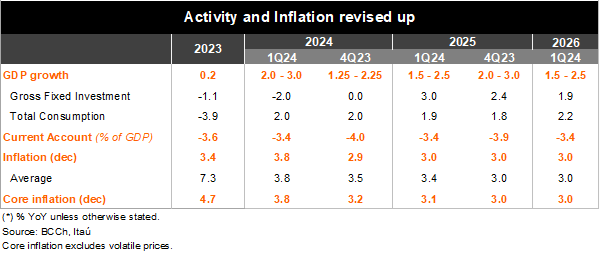

Activity revised up with a transitory return to a positive output gap. The economy is expected to grow between 2-3% this year (up from 1.25-2.25% expected in December), responding in large part to the transitory acceleration in 1Q24 (driven by supply factors including electricity generation, among others) and a greater external impulse (supported by a weaker REER). The better activity performance at the start of the year leads to a temporary positive output gap. For both 2025 and 2026, the economy is expected to grow around 2%, in line with an economy converging to its potential, with growth revised down for 2025 to 1.5-2.5%, from 2-3% in the December IPoM. The forecast shows private consumption playing a key role as lower inflation and financing costs, along with recovering sentiment, boost spending. In contrast, gross fixed investment is expected to contract again this year, amid weak fundamentals. Imports of capital goods continue to fall significantly and long-term financing costs remain elevated.

Higher short-term inflationary pressures. The effects of the CLP depreciation, higher global prices and the effective inflationary prints of January and February have led to a higher inflation path than previously envisioned. Additionally, some services prices have risen and are not expected to reverse in the near term. CLP weakness will be reflected mostly in volatile prices and gasoline. For core prices, a moderate pass-through is expected in line with the negative output gaps in the tradable consumption sectors. Inflation is seen ending the year at 3.8% (3% expected in December), while core inflation will also end the year at 3.8% (+60bps from December), consolidating a slower, but still downward trend.

The correction of prior macroeconomic imbalances allows for further gradual rate cuts. The Board anticipates that, in line with the central scenario of the IPoM, rate cuts will continue with the magnitude and timing of the cuts being data-dependent. The center of the corridor’s 33% confidence interval points to a 5% average policy rate during 4Q24 (25bps below the December report) and 4.0% in 4Q25 (broadly in line with December). The corridors upper bound considers the rate path if domestic demand performs better than the central scenario, while the lower bound anticipates an additional deterioration of domestic demand, reducing inflationary pressures. A scenario where US inflation is even more persistent than expected, forcing the Fed to delay rate cuts further and affecting global financial conditions, would need to be carefully analyzed as to what the effect on the domestic inflation path would be. Elevated global uncertainty could also lead to events that would merit a monetary policy response that drifts above or below the corridor’s borders.