The BCCh’s 4Q24 IPoM revised inflation up again, moderated domestic demand growth, and projects a slightly higher policy rate path.

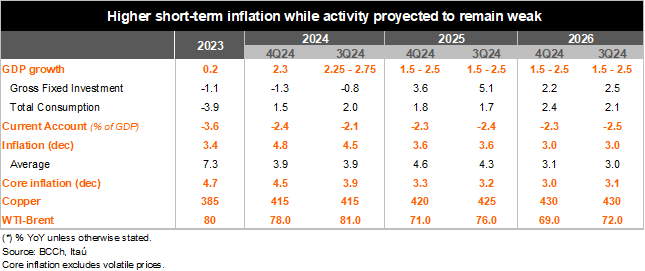

Inflation … déja vu. Inflation was revised up, yet again, due to the persistent depreciation of the CLP, greater than expected labor cost pressures, and electricity prices. For context, the BCCh has revised the YE24 headline CPI forecast in each of the past four IPoMs, starting at 2.9% in December 2023, up to 4.8% now. The YE24 headline CPI forecast was kept steady at 3.6% for the end of 2025. Core inflation was revised up materially to 4.5% (from 3.9% in the September IPoM) by yearend 2024 and to 3.3% by the end of 2025 (up slightly from 3.2%). With inflationary risks still biased to the upside in the short-term, the BCCh’s disinflation path in the medium-term rests on the assumption of domestic demand weakness.

Activity projected to remain weak. GDP is expected to rise by 2.3% this year, in the bottom of September’s range (2.25%-2.75%), as the forecast range for 2025 and 2026 remained unchanged at 1.5%-2.5%. Forecasts for private consumption and gross fixed capital formation growth were revised down for 2024-2026. Importantly, credit dynamics (as we’ve highlighted in our monthly notes) remain persistently weak, consistent with a moderate recovery in non-mining investment. Terms of trade were revised somewhat higher, because of a larger proportional decline in oil prices, relative to copper; with growth in major trading partners not experiencing significant changes. The Fed is projected to cut this month by 25bp and then three more times in 2025. In this context, the output gap was projected slightly more negative yet is forecasted to narrow throughout the policy horizon.

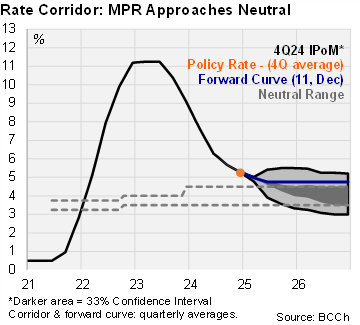

A slightly more gradual policy rate path to neutral. As we had anticipated, the nominal policy rate path maintained the path towards 4%, the center of the neutral rate range (3.5%-4.5%), across the two-year policy horizon. Focusing strictly on the simple average of the floor and ceiling of the 33% confidence interval of the corridor, the policy rate path has a slightly more gradual path towards neutral, reaching 4.25% on average in 4Q25 (4.13% in the September IPoM), implying a total of 100bps of cuts with respect to the average of 4Q24, that is, a 25bps cut per quarter (implying inter-meeting pauses).

Our take: Risks tilt towards a higher terminal rate than forecasted in the corridor. Following yesterday’s cut, the one-year ex-ante real policy rate fell to 1.4%, piercing the upper bound of the BCCh's neutral real rate range (0.5-1.5%). Our policy rate forecast considers inter-meeting 25bp cuts to 4.5% by June, however, this scenario also relies on inflation expectations at the one-year horizon edging down; breakevens have drifted higher, in line with the depreciation of the CLP. Second round inflationary effects from past electricity price hikes and minimum wage increases, surprisingly muted in November’s CPI, are relevant risks in the upcoming months. Separately, our international scenario considers only one 25bp cut by the Fed in 2025. Efforts to support the economy with a more aggressive path to neutral are likely to be met with a weaker and more volatile exchange rate; there is no free lunch. In this context, announcing a reserve accumulation process seems especially challenging. The next monetary policy meeting is scheduled for January 27-28.