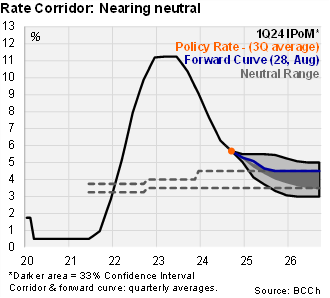

The September IPoM outlines a scenario of slightly weaker domestic demand, but with higher short-term inflationary pressures. The transitory nature of the supply-shock and softer activity support a swifter inflation fall over the two-year policy horizon, allowing for a somewhat faster path towards neutral. The updated policy rate corridor points to additional cuts during 4Q24 (from the current 5.5%) and to reach the neutral range (3.5-4.5%) during 2Q25.

Activity dynamics softened by more than expected in 2Q24, as we had anticipated, particularly due to the deterioration of private consumption. Nevertheless, the evolution of fundamentals suggests the private consumption softening during the quarter is expected to be transitory. Investment has stabilized after a notable drop during 2H23, however, there is a stark divergence between the mining sector and other areas of the economy. The transmission of monetary policy in the bank lending channel through loan rates has unfolded as expected, yet bank credit remains weak (particularly the commercial component, consistent with weak investment in non-mining sectors). An appreciation of the real exchange rate and better financing conditions are projected over the policy horizon. The inflation uptick to 4.4% YoY in July was largely due to higher energy costs, while core inflation (excluding volatiles) stood at 3.4%. While one-year inflation expectations are rising, the relevant two-year outlook is anchored to the 3% target. The central bank views such a combination as a sign that the market has internalized the transitory nature of the cost shock. On the external front, the central bank highlights the focus on the United States as markets assess growth prospects and the according Fed policy response. The IPoM’s baseline scenario now sees the FFR averaging 5.4% this year (5.5% in June) and 4.3% next year (4.85 in June). The Chilean peso has followed the movements of global financial markets, responding to the volatility of the external scenario. The external pull is similar to that proposed in June with trading partners growing by around 3% during 2024-2026, although international financial conditions somewhat more favorable, while terms-of-trade a bit weaker (copper prices are seen averaging USD 4.15/lb this year, USD 4.3 in June, while USD 4.3/lb is still expected for 2025 and 2026).

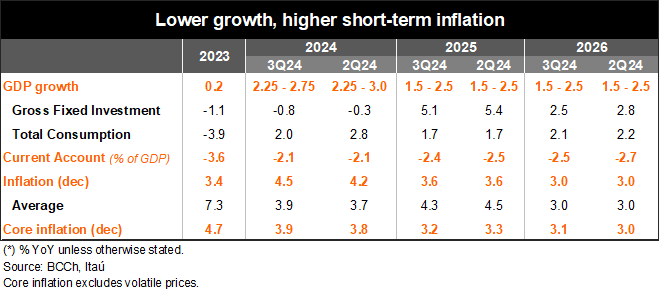

Inflation seen converging to the 3% target in early 2026. For this year, the GDP growth estimate range was reduced by cutting the ceiling by 25bps to 2.25%- 2.75%, incorporating weaker activity during 2Q24 (1.6% vs 2.6% expected in the June IPoM). For 2025 and 2026, the growth estimate remains within the 1.5% and 2.5% range. Part of the downward revision for this year came from private consumption (from 2.5% to 1.7%). While the lower cost of credit and the increase in real wages suggest the downturn should be short-lived, employment growth has slowed at the margin, an aspect that the Board will monitor closely. Public consumption is revised downwards this year given the structural balance target and the need to wind down expenditure during 2H24. The central bank expects total inflation to rise in the short term, mainly due to the greater rise in volatile components. Part of this is due to the direct and indirect effects of the increase in electricity rates of June and July. The increase in maritime freight rates at a global level and the depreciation of the peso in recent months also play a role. Headline inflation is estimated to close the year at 4.5% (+30bps versus the June scenario). The core inflation forecast ticked up 10bps to 3.9%. In the medium term, inflation is seen declining more rapidly than anticipated in June, given the lower inflationary pressures from weaker domestic demand, and the IPoM estimates the convergence to the 3% target during the initial months of 2026.

Regarding the monetary policy strategy, the reduced risk of inflationary persistence in the medium-term allows for the easing cycle to continue. Under the baseline scenario, the path to neutral will be swifter than outlined in the June edition. The average of the 33% confidence interval in the rate corridor shows a 4Q24 average of 5.27% (versus 5.51% in June), 4.49% in 2Q25 (5.14% in June) and 4.13% in 4Q25 (4.57% in June). The evolution of the local economy is a key factor in determining the sensitivity scenarios (borders of the corridor). The floor of the rate corridor may occur in a situation in which the weakness of activity and demand in the second quarter is prolonged or deepened by different factors, including a weaker labor market (resulting in weaker inflationary pressures). Meanwhile, the upper limit could be reached if the rise in inflation turns out to be more persistent than expected or if its second-round effects are more persistent, which could be accentuated by the dynamism of mining investment and respective spillovers to the real economy. The main risks to the current scenario are linked to the external environment, aligned to negative geopolitical and financial scenarios.

Structural parameter update brings no relevant news. The estimate of non-mining trend growth did not present major changes with respect to the previous calculation, averaging growth of 1.8% over the 2025-2034 period. The real neutral rate range remains at 0.5% and 1.5% (3.5-4.5% nominal, with a working assumption of 4%). We had signaled the possibility of the central bank raising the floor of the range by 25bps.

Our Take: The transitory nature of the supply shock is key to permitting the continuance of the rate cutting cycle. We had expected the Board to enter a period of evaluation, remaining at 5.5% for some time to ensure the inflation convergence path consolidated before resuming the cutting cycle as global financial conditions eased and the domestic shock faded. Nevertheless, the weaker domestic demand, the internalization by the market that higher inflationary pressures should be transitory, and a scenario of earlier rate cuts by the Fed provide room for further rate cuts in the near term. Barring significant surprises to the scenario we believe the most likely scenario includes 2x25bp cut to 5% during the final quarter of the year. Pauses could take place under scenarios of global risk aversion, reflected in excess volatility in the exchange rate.