2025/08/13 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

At the July monetary policy meeting, the Board only evaluated the option to cut the policy rate for the first time this year by 25bps to 4.75%. The forward guidance states that if the June IPoM’s central scenario materializes, the TPM will gradually approach its neutral range (3.4-4.5% nominal).

The scenario abroad was mostly in line with IPoM’s baseline scenario, despite persistent global uncertainty. Global growth prospects remained broadly unchanged, oil prices returned to levels consistent with the report’s statistical cutoff, and although U.S. tariff policy could exert upward pressure on prices, the Federal Reserve was still expected to ease its monetary stance.

Domestically, economic activity aligned with expectations while core inflation came in somewhat higher. GDP dynamics were moderating after strong early-year growth due to temporary factors (fiscal front-loading, tourism boom). Inflation declined faster than anticipated in June, though core inflation was slightly higher (and likely surprised again to the upside in July). Employment creation has been sluggish, unemployment is rising, but wage growth remains strong. The most likely scenario pointed to economic activity near trend, a nearly closed output gap, and inflation converging to 3% by mid-2026. With inflation expectations aligned with the 3% target, all Board Members agreed that the monetary policy path in the IPoM remained valid, supporting a 25bp cut in the policy rate, a move consistent with prior communications and widely anticipated by markets.

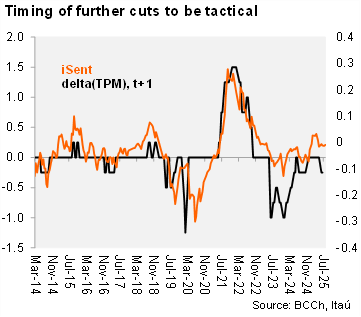

Our Take: The minutes give the sense that the Board was open to cutting again in the September meeting (in line with the IPoM corridor and recent comments by Board member Griffith-Jones). Nevertheless, a second consecutive upside surprise in core inflation, a weakened CLP and market pricing that has shifted towards 4Q25, lower the odds of a cut next month. Going forward we expect the timing of further cuts will depend primarily on tactical factors related to both the local and external environment. Anchored inflation expectations, a sluggish labor market, and weak commercial credit dynamics support a reduction toward the nominal neutral rate of 4%. However, rising sequential core inflation pressures, elevated wage growth, and resilient non-mining activity argue for a gradual pace of cuts as the BCCh approaches neutral, and the end of the cycle. We anticipate a pause in September, with the Board considering both the options to hold and cut by 25bps. The next monetary policy meeting will be held of September 09, a day after the release of August’s inflation. The 3Q IPoM will be published the following day.