Since the early April monetary policy meeting, domestic activity consolidated a gradual recovery, inflation and yearend CPI expectations rose, while global financial conditions tightened. The activity pick-up has been in line with the central bank’s baseline scenario, supporting a transitory return into a positive output gap. Supply pressures are supporting a pick-up in inflation and subsequent expectations. Further supply side pressures, including electricity price adjustments, should keep short-term inflationary pressures elevated. However, a 5% CLP appreciation since the last meeting, amid soaring copper prices may, if sustained, could alleviate the inflation pressures. Globally, volatile macroeconomic data has seen significant repricing on the Fed's rate cuts for this year. In all, the US 10y Treasury rate is up by around 20bps from the early April meeting. Overall, we believe there is still room for the BCCh to lower rates, but nearing both the Fed and local neutral rates merits a strategy that offers greater policy flexibility. As a result, we foresee a 50bps cut to 6% this month, and thereafter to 5.25% with cuts of 25bps. Risks tilt to fewer cuts this year. Following the expected cut in May, the one-year ex-ante real rate would fall 60bps to 2.8% (1% neutral). The rate cut cycle would total 525bps.

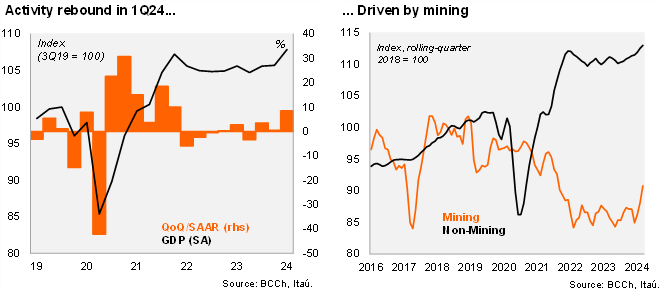

A mining-led growth uptick in 1Q24. Headline IMACEC increased 2.5% YoY in the quarter (0.4% in 4Q23), with non-mining up 1.8% (0.8% in 4Q). Services growth eased 0.3pp to 2.0%, but mining jumped to 6.9% (2.5% fall in 4Q23) and the drag from commerce diminished 3pp to a 0.5% drop. At the margin, the 8.4 % qoq/saar acceleration was primarily due to mining (30%), but non-mining activity also improved (from 2.3% to 5.6% qoq/saar). Broadly steady service growth near 5% was supported by recovering commerce and manufacturing activity. Overall, the activity numbers in 1Q24 were in line with the BCCh’s expectations, coherent with a transitory return to a positive output gap. Leading indicators, such as business sentiment, imports of capital goods, mild real credit growth suggest the pace of the economic recovery will be contained. Think-tank ICARE’s business sentiment in April dipped, putting an end to a three month recovery path, while imports of capital goods continue to fall at a double-digit pace, consistent with weak investment dynamics. Sequential employment growth and rising wages have led to an improving real wage bill that is sustaining a gradual uptick in private consumption. Meanwhile, front-loading of fiscal expenditure slowed in March and an expected adjustment for the remainder is expected. We expect GDP growth of 2.4% this year (BCCH: 2.5%), with an upside bias.

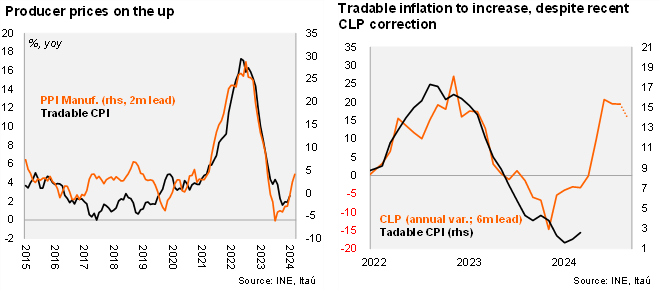

Tradable inflation starts to tick up, reflecting the CLP's depreciation in the first months of the year, while services inflation gradually edges down. Annual inflation rose 30bps to 4.0% in the spliced series, and by the same magnitude to 3.5% in the reference series. Core inflation also rose 0.5% in the month, leading to a 0.2pp drop to 3.5% (reference series). Tradables increased by 0.7% MoM, corresponding to a 2.6% YoY increase in the reference series, up 0.7pp from March. Non-tradables increased by 0.3% MoM, but led to the yearly rate falling from 5% to 4.8% (reference series; services -0.2pp to 4.7%). At the margin, we estimate that inflation accumulated in the quarter was 5.3% (SA, annualized), in line with 1Q24, while up from 3.3% in 4Q23. Meanwhile, core inflation reached 3.8% (SA, annualized, 4.3% in 1Q24 and 2.7% in 4Q23). April's inflation print reaffirms the challenges of inflation converging to the 3% target, amid significant supply shocks and indexation. Looking ahead, further supply pressures stemming from expected electricity price increases should keep inflation elevated. The recent appreciation of the CLP, amid soaring copper prices, may provide some relief to tradable price pressures. We expect a yearend CPI rate of 4.1% (BCCh: 3.8%).

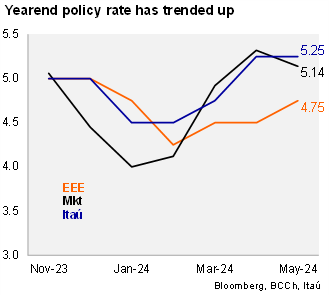

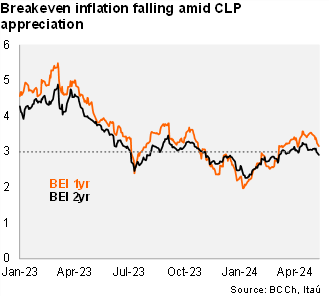

Yearend inflation expectations tick up, fewer cuts seen this year. The central bank’s monthly analyst survey showed expectations for a 50-bp cut this month, and then down to 25bps in June. Specifically, regarding the distribution of rate calls for the May meeting, 82% of the surveyed analysts expect a 50-bps cut, and 9.7% expect a smaller 25-bp reduction. The policy rate is seen at 4.75% by yearend 2024 (up 25bps from the April survey). Following the upside CPI surprise in April, analysts’ 2024 yearend median CPI call was revised up again by 10bps to 3.8% (the survey's yearend inflation expectations have increased from 3% in February). Looking at the longer term, one-year ahead inflation expectations also rose again by 10bps to 3.2%, while two-year ahead inflation expectations remained anchored at the BCCh’s 3% target for the fifteenth consecutive month (while breakevens move deeper below 3%).

The BCCh has much less room left to get to neutral, and the main risk we see going forward continues to be the external scenario, especially heightened geopolitical tensions and market jitters related to Fed repricing. Furthermore, the BCCh acknowledges that the latter is leading to greater exchange-rate volatility, in the context of swiftly narrowing interest-rate differentials. We expect the BCCh to moderate the size of cuts again to 50 bps in the May 23 monetary policy meeting, taking the policy rate to 6.0% (leading to a total of 525 bps in cuts throughout the easing cycle since July). We envisage a year-end rate of 5.25%, with cuts of 25 bps as of June. Risks tilt to fewer cuts. During 2025, as the Fed embarks on policy easing, we see the BCCh resuming its cutting cycle and taking the policy rate to 4.5% (the upper bound of the 3.5%-4.5% neutral range).