We expect the BCCh to cut the monetary policy rate by 25 bps to 5.25% and signal further rate cuts ahead as the Board targets reaching neutral levels during 1H25. Since the last meeting (September 3), the Fed implemented a larger-than-expected rate cut, the domestic labor market continued to show signs of loosening, commercial loan dynamics have yet to improve, core inflation remained well-behaved (increasing an accumulated 0.4pp during August and September), and the relevant two-year inflation expectations remined anchored to the 3% target. There is widespread consensus that the Board will cut 25bps: 97% of respondents to the BCCh’s trader survey favored such a decision; the Bloomberg survey of market analysts shows unanimity; and the rate curve has priced in 25bps for some time. In sum, the Board has a straightforward opportunity to meet market expectations and advance along its desired path of reducing the restrictiveness of monetary policy. Assuming a 25bp cut to 5.25%, the one-year ex-ante real rate (utilizing the BCCH’s analysts survey), would reach 1.55% (1.7% in September; 1% neutral).

Shifting expectations on the speed of the Fed’s easing cycle; rising geopolitical risks; Chinese stimulus keep the global environment noisy. Financial markets continue to be volatile, with changes in risk appetite, influenced by US macroeconomic data, Fed action and signaling, expectations of a fiscal stimulus package in China along with the escalation of the Middle East conflict. The nearing US election will also add to market volatility amid uncertainties over economic plans as well as the smooth transition of power. The net-effect, in our view, supports lower rates. The Fed has signaled a certain degree of comfort with recent inflation dynamics to continue lowering rates, and global financial conditions, consolidating the opportunity for emerging economies to follow suit. The stimulus measures in China are not expected to be a significant growth game-changer for Chile, preventing a boom in domestic demand inflationary pressures.

|  |  |

Despite a softer August activity print (-0.2% mom/sa), activity dynamics are improving after a weak 2Q. IMACEC rose by 2.2% YoY in the quarter ending in August, above the 1.6% in 2Q24. Non-mining rose by 1.5% (0.6% contraction in 2Q). At the margin, activity increased 1.8% qoq/saar, after the 2.2% decline in 2Q. Nevertheless, there are mixed signals ahead. Business sentiment remains weak, imports of capital goods are soft, commercial credit dynamics have yet to improve. The banking system’s stock of outstanding real loans in Chile fell in August by 2.04% YoY, after declining by 0.56% YoY in July (-2.8% in August 2023). Outstanding real commercial loans in Chile plummeted in August falling by 4.45% YoY, (-2.99% in July, -5.87% in August 2023). The fiscal scenario (accumulated nominal deficit of 2.2% of GDP as of August), suggests fiscal spending cuts ahead to meet deficit targets. While imports of capital goods in September posted annual growth of 2.7% YoY, it was the first increase in two years. Non-mining business confidence as measured by the IMCE remained low at 41.9 in September (50 = neutral; stable from August), while the labor market has shown a gradual deterioration with the unemployment rate up to 8.9% (SA; 8.4% in January).

|  |  |

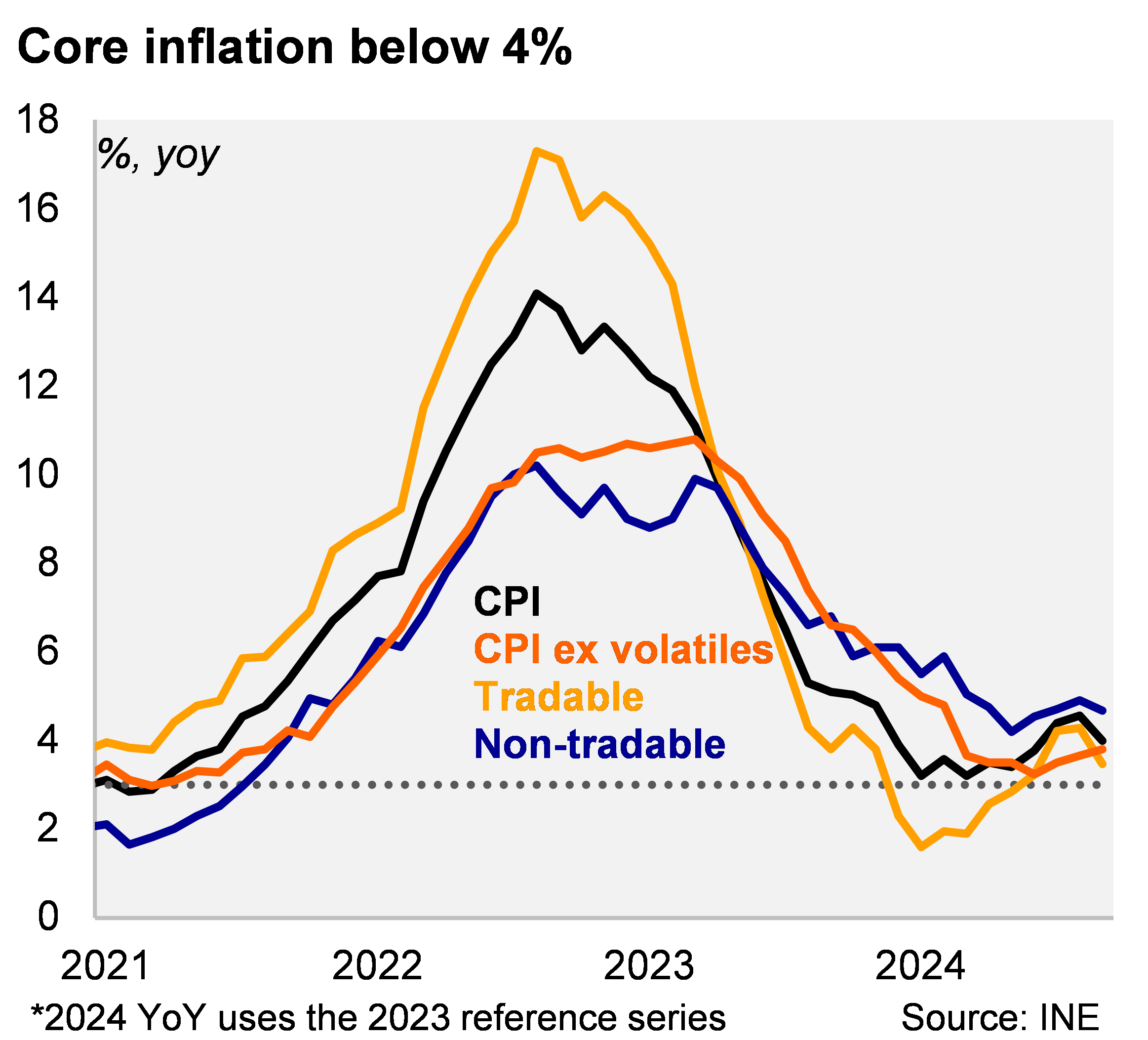

Anchored inflation expectations reinforce the transitory nature of the electricity price shock. Headline inflation rose by 0.8pp, to 4.0% YoY, between March and September, largely due to higher energy costs. Electricity prices were adjusted by 7.2% MoM in June and a further 12% in July. We forecast another 19% monthly increase in October. Core inflation (excluding volatiles), however, has been lower, sitting at 3.8% YoY in September (+0.1pp from March). Recent CLP dynamics (broadly stable from levels in October last year) and evidence from manufacturing producer prices signal that the upside pressure on tradable inflation is easing at the margin. Despite the volatility and higher headline inflation pressures, the market continues to view a convergence towards the 3% target during 2026. The BCCh’s analyst survey kept the two-year CPI outlook at 3% for the 20th consecutive month, while traders completed three months at 3%. Market breakevens have continued to trend down, with the two-year positions sitting at 3.2%, down from the 3.6% highs recorded this year in August.

|  |  |

Our Take: The central bank will continue to cut rates and gradually reach 4% in June next year. Overall, inflation risks stem from transitory supply factors: an electricity price adjustment; potential oil price spike if the Middle East conflict escalates further; a market risk-off move amid US elections and geopolitical events that may weaken emerging market currencies. Nevertheless, a negative output gap in Chile, still restrictive loan supply conditions, and weak job growth dynamics at the margin suggest limited scope for sustained passthrough of cost-push pressures to final consumer good prices, and hence room to further ease the contractionary monetary policy stance. The minutes of the meeting will be released on November 5, while the final meeting of the year will take place on December 17.

Andrés Pérez M.

Vittorio Peretti

Andrea Tellechea Garcia