In its fourth monetary policy meeting of the year, the Central Bank of Chile (BCCh) unanimously held the monetary policy rate (MPR) at 5.0%, the same level it has been at since December 2024. The decision was in line with our call and market consensus, although a fraction expected a 25bp reduction to 4.75%. With the decision to keep the MPR at 5.0%, the ex-ante real rate (discounting with one year inflation expectations) reached 1.6%, slightly above the upper limit of the neutral range and the lowest level among the region's major economies.

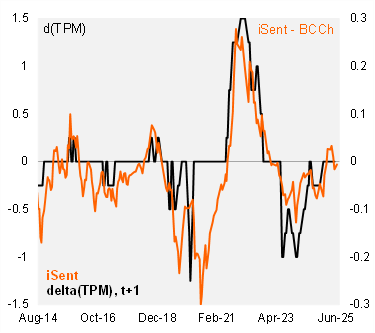

Rate cuts expected during upcoming quarters. According to the statement, June’s Monetary Policy Report (IPoM; to be released tomorrow) signals the MPR is expected to approach its neutral range in the coming quarters (3.5-4.5% nominal). This reflects a movement away from the neutral tone conveyed in the previous decision, although the inclusion of the word “approach” gives the Board a certain degree of flexibility over the timing of future cuts. Reference to the need for “caution” was removed. The baseline policy rate path outlined in the March IPoM signaled cuts in September and December. The domestic activity recovery has been somewhat swifter than expected by the BCCh, while the job growth dynamics are weak amid continued high wage growth. Credit dynamics are mostly unchanged (weak). On the inflation front, the pace of the core disinflation process has been swifter than expected (we estimate by around 30 basis points lower during 2Q compared to the March IPoM estimate). The Board notes that prior upside inflation risks have moderated. However, recent events in the Middle East introduce a new source of uncertainty. Relevant medium-term inflation expectations are once again anchored to the 3% target (after a spike at the start of the year).

Our Take: We believe the Chilean economy is better positioned to face new shocks, which is consistent with a monetary policy scenario closer to the center of the neutral rate range, over time. The central bank expects higher global tariffs to negatively impact Chilean growth, along with low inflationary pressures, factors that further favor lower rates ahead. While we anticipate the cycle to resume in July, the risk is that swings in the external backdrop delay cuts until September. We foresee the cycle concluding at 4% early in 2026. As such, we believe that the evolution of the external environment will be key in calibrating the path toward the neutral level. We expect consumer prices to fall by 0.24% in June, and to end the year at 3.8%. The minutes of the meeting will be published on July 3, while the next meeting is scheduled for July 28-29. Externally, we expect the Fed to keep the FFR in the 4.25-4.50% range tomorrow, with updated projections indicating fewer cuts this year. We expect this year's GDP growth to be revised upward somewhat from the current range (1.75%-2.75%), with the average core inflation path revised down.