2025/09/26 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

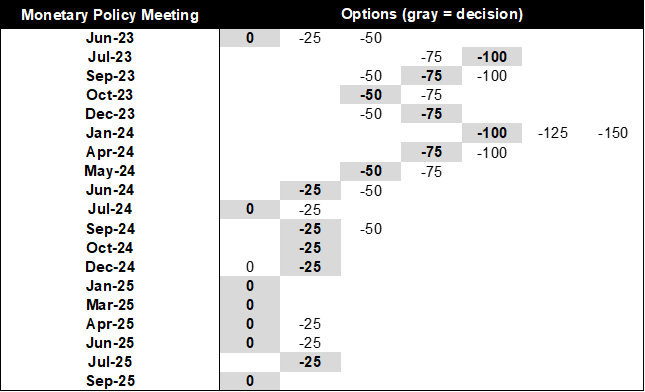

At its September meeting, the Central Bank of Chile’s Board unanimously agreed that holding the policy rate at 4.75% was the only plausible option, noting that with the rate now near neutral levels, further adjustments require careful evaluation. While markets anticipated an update to structural parameters, the Board opted to delay revisions to the neutral rate range (currently 3.5%–4.5%), citing elevated uncertainty. However, several members signaled that the neutral rate likely lies in the upper half of that range. The IPoM’s rate corridor projects the policy rate at 4.25% in 2026, reaching 4.0% only in 2027, an implicit indication of the bias towards a higher endpoint, in our view.

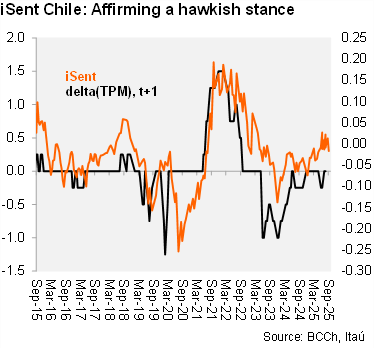

The minutes reinforce the hawkish tone of the September meeting and IPoM, effectively ruling out a rate cut in October. While the baseline scenario supports a gradual convergence to neutral, near-term inflation risks remain elevated. The external backdrop continues to pose challenges—geopolitical tensions, financial volatility, and fiscal fragility in major economies—but the main risks are domestic. Strong private consumption, persistent cost pressures, and inflation inertia—partly due to electricity price adjustments and labor costs—require close monitoring. Although medium-term inflation expectations remain anchored, the Board emphasized the need to prevent price stickiness from becoming entrenched.

Our Take: The guidance suggests a cautious approach to further easing. The Board sees no urgency to cut rates, preferring to gather more data before moving deeper into the neutral range. Based on BCCh’s one-year inflation forecast, the ex-ante real rate is ~1.55%, near the estimated neutral real rate of 0.5%–1.5%. We do not expect a rate cut in October. The December meeting will be more data-rich, with three additional CPI prints (only one before October). A CLP recovery, dovish Fed outlook, and favorable base effects should support the inflation convergence process. We expect a final rate cut in March to 4.25%, for now. The structural parameters update, likely in December, may reflect stronger investment dynamics, and lift the neutral rate range. The BCCh has gradually raised the mid-point of the real neutral rate range from 0.5% in 2021 to 1% at the end of 2023, and is likely to raise the mid-point again in December.