2026/02/04 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

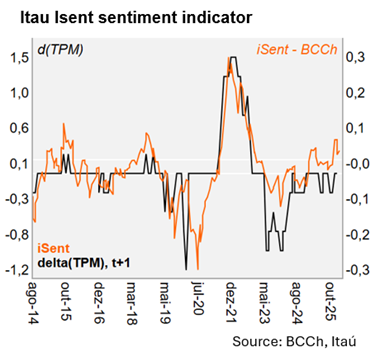

All eyes of inflation. The January monetary policy meeting centered on the evolving outlook for inflation, which was expected to fall below 3% in the first half of the year due to favorable cost factors such as CLP appreciation and lower international fuel prices. Despite this temporary decline, medium‑term inflation was still projected to converge toward the 3% target, supported by improving economic fundamentals and a largely closed output gap. Inflation expectations at the two‑year horizon remained well aligned with the target, reinforcing confidence in the medium‑term scenario.

Activity fundamentals remain strong. Economic activity had shown weaker‑than‑expected results, particularly in the November Imacec, though this reflected mainly temporary supply‑side issues rather than a shift in underlying demand dynamics. Short‑term indicators continued to show consumption and investment behaving broadly as anticipated. Meanwhile, medium‑term expectations for activity and demand were improving, supported by better business and household sentiment, and stronger external conditions—including higher copper prices—despite growing geopolitical and institutional risks. The discussion also emphasized the need to monitor the potential impact of productivity improvements and the possibility that better investment fundamentals could lift potential growth over time.

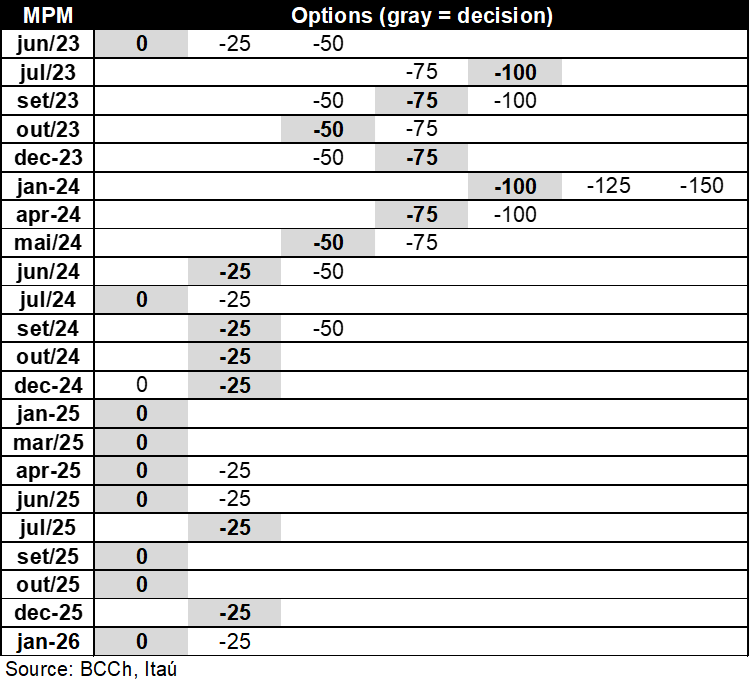

Opening the door for a 25-bp cut in March. Regarding policy options, Board members agreed the Monetary Policy Rate should move toward the midpoint of the neutral range (4.25%), leading to two viable options: holding the rate at 4.5% or cutting it to 4.25%. A rate cut was supported by lower short‑term inflation, which would help preserve the intended real monetary impulse outlined in the previous report. However, maintaining the rate was seen as consistent with market expectations and helped avoid financial volatility. Moreover, concerns about possible upward medium‑term inflation risks—stemming from stronger growth prospects and uncertainty around the persistence of recent productivity gains—led several members to caution against adjusting policy based solely on temporary inflation surprises.

Our Take: The faster-than-expected disinflation underway will likely result in a March rate cut to a terminal rate of 4.25%. Monetary policy is within the neutral range and comes after a prolonged battle at converging inflation to the target. We believe the Board will favor a cautious approach after implementing the next cut, evaluating inflation and activity dynamics during the start of the year. The swift CLP recovery will drag prices down, but a terms-of-trade led economic rebound could boost medium-term inflation pressures. While our scenario sees rates at the 4.25% neutral level, the balance of risks leans towards higher rates over the forecast horizon given the upside bias to growth. The next monetary policy meeting takes place on March 24 with the IPoM to be published on March 25.