The June meeting saw a unanimous decision to hold the monetary policy rate (MPR) at 5%. As was the case in the previous meeting, the option to cut by 25bps was also assessed but ended up being dismissed due to tactical considerations.

Pros and Cons of cutting by 25bps: Some Board Members indicated that, while market expectations largely expected rates on hold in June, there was also consensus that the MPR would be lowered in the short term. Therefore, they estimated that a cut in June should not generate major disruptions to financial variables. Others in the Board noted that the macroeconomic impact of bringing forward the MPR cut to June was low, given that the market implied path already included a cut in the short-term. So, the benefits of the decision were small, compared to the potential misinterpretations that could be made.

Effects of the conflict in the middle-east so far had a limited impact on oil prices and financial market variables. Meanwhile, the global trade conflict had led to more benign effects than expected from a shock of such magnitude.

Pros to holding the rate at 5%: All Board Members agreed that, in an uncertain environment, maintaining the policy rate was the most appropriate decision. Additionally, the June IPoM would signal that under the baseline scenario the MPR would gradually approach its neutral range in the coming quarters.

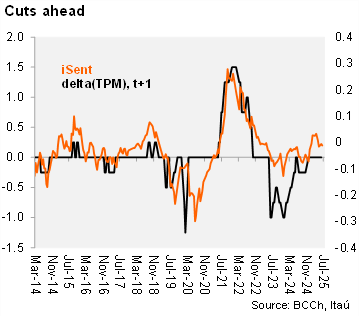

Our Take: The IPoM published the day after the June decision showed rate cuts over coming quarters towards a terminal rate of 4%. The disinflation path is seen consolidating with headline inflation reaching 3% in early 2026, while medium-term CPI expectations are anchored. We expect weak commercial credit dynamics, along with growing labor market slack and annualized sequential inflation pressures (SA) that are below target levels will be enough to lead the Board to cut by 25bps later this month (July 29) to 4.75%. CLP dynamics have been well-behaved, despite low interest rate differentials and the expectation of further narrowing later this year. Factors that could halt the Board in its easing path will be linked to global developments that raise uncertainty and financial market volatility. We see a yearend rate of 4.25%.