The BCCh Board viewed holding the policy rate at 5% and cutting the MPR by 25bps as valid options to consider in April. The decision to stay-on-hold considered better-than-expected domestic growth dynamics and although inflationary risks are diminishing, it was not evident that they had dissipated completely. While more information was required to assess the impacts of the external scenario on the Chilean economy, the initial reaction was that a potentially lower inflation trajectory could require the policy rate to near the neutral range sooner than outlined in the 1Q IPoM (4.5% average during 1Q26).

A cut in April would have led to market confusion. Several Board Members agreed that lowering the rate at this Meeting could lead to misinterpretations about the impact of the external scenario on the local economy or trigger undesirable market volatility, in an already volatile environment. All Board Members agreed that the best option was to wait and gather more information on the evolution of the external scenario and on the development of inflation and its main domestic drivers.

The evolution of the external environment will be important in determining the pace of the cutting path ahead. It is worth noting that the deterioration of the external environment mentioned in the minutes—a result of the abrupt increase in trade tensions—has been partially reversed following the agreement between the US and China. Additionally, the current implied rate path for the Federal Reserve contemplates fewer cuts than a month ago. Yet, on the local front, softer than market-expected inflation pressures in April reaffirm the view of diminishing inflation risks. Medium-term inflation expectations have been converging to the 3% target. The labor market maintained limited slack levels, showing slow job creation, but the outlook for investment had rebounded. While the tariff announcements had triggered significant volatility in global financial markets, domestic financial conditions had improved. Overall, the initial BCCh signaling is that aside from the negative effects on growth, tariff measures were likely to imply a diversion of trade flows that could, at least in the short term, place downside price pressures to goods.

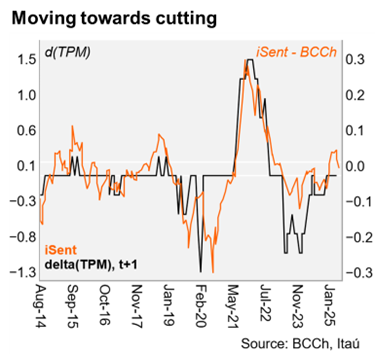

Our Take: While we thought cuts would be discussed in the upcoming meetings, the discussion of a cut in the April meeting comes as a surprise to us and will likely lead to the implied market path to bring forward the cuts, in turn generating upward pressure on the exchange rate. The consideration of a reduction in the MPR in April in Chile adds to the "dovish" surprises in Colombia (a unanimous 25bp cut to 9.25%) and Peru (a 25bp cut to 4.5%). The next monetary policy report will be on June 17, the day before the Fed meeting (Monetary Policy Report also released on June 18). Our baseline scenario contemplated a 25bp cut in September and another in December, with the risk that the cuts will begin earlier. The minutes confirm these risks.