2025/11/13 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

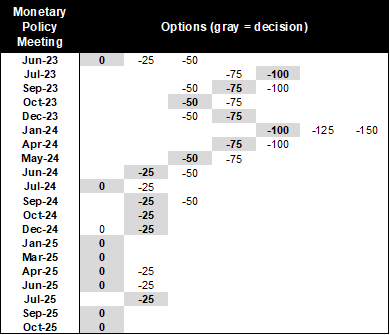

The only plausible option at the October meeting was to hold the policy rate at 4.75%, but the discussion about future action was robust. In October, the BCCh unanimously maintained the policy rate at 4.75% and repeated the forward guidance of requiring additional data to discard upside inflationary risks prior to resuming cuts toward the neutral rate range. The meeting’s minutes revealed that the Board only formally assessed the option of maintaining the policy rate, as in September, in the context of data that had been broadly consistent with the September IPoM’s baseline scenario and inflation risks that still warranted caution. Going forward, updated National Accounts data (November 18), additional inflation prints, and the December IPoM’s medium-term inflation forecasts will be key.

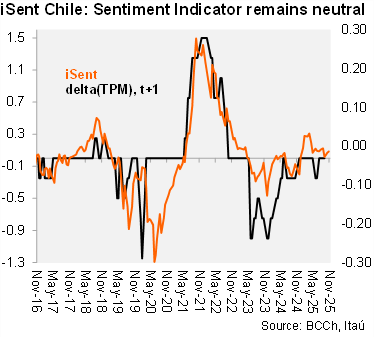

The evolution of inflationary risks highlighted in the September IPoM was discussed. On the one hand, it was mentioned that, although leading indicators showed some more dynamism in spending, this was largely explained by the performance of investment in machinery & equipment, with a significant imported component, and therefore had less inflationary implications than other spending components, such as consumption. Regarding costs, it was noted that the exchange rate had appreciated, reinforcing expectations of lower pressures on tradable goods in the short-term. This was further supported by wages moderation and lower oil prices. As for inflation dynamics, it was highlighted that medium-term inflation expectations remained broadly in line with the target. However, the median two-year inflation expectation in the Financial Traders Survey (EOF) was marginally higher than 3%, and this phenomenon needed to be monitored still for some time

The board’s discussion showed differing views on the next steps for monetary policy. One board member highlighted elevated core inflation and inflation pressures, in the context of a policy rate that was already very close to the upper half of neutral levels. Another member stated that a 25bp cut could have been discussed, because of lower inflation risks, yet would have been quickly dismissed. Another member mentioned that the policy rate should continue declining if inflationary risks moderate, as could be interpreted from recent data on wages, the exchange rate and activity.

Our Take: A December cut is still on the table. We expect continued soft inflation data relative to the BCCh’s projections (3.7% YE rate versus BCCh’s 4.0%). We forecast core inflation ending the year 10–20bps below the BCCh’s 3.7% estimate. We expect the BCCh’s cycle to conclude in December at 4.5%. This week’s survey of analysts showed 70% of respondents in favor of a December cut. At yesterday’s close, the curve was pricing in half a cut at the last meeting of the year. The December meeting will be held of the 16th.