In line with the consensus and our expectation, the Board of the Central Bank of Chile unanimously decided to lower the monetary policy rate by 25 bp to 5.25% at the October meeting. The move is in line with the updated guidance in the September IPoM and the statement signals that, barring large divergences from the baseline macro scenario, additional cuts are expected in the process to reach neutral. The BCCh has cut rates by a total of 600bps from the cycle peak (11.25%) starting at the end of July 2023. Following the October decision, the one-year ex-ante real policy rate fell to 1.55% (from 1.8%), touching the ceiling of the BCCH's neutral real range (0.5-1.5%).

The start of the Fed’s cutting cycle, stimulus in China and geopolitical conflict in the Middle East have driven global dynamics since the last meeting. The global financial market response saw long-term interest rates rise, coinciding with a stronger dollar. Oil and copper prices have been volatile, with the former rising on geopolitical risks, while the latter responded to Chinese stimulus. The domestic financial market response has been in line with global trends. The transmission of monetary policy to loan rates continues to unfold as expected, yet new loan dynamics remain soft, particularly in the commercial sector. The third-quarter Banking Credit Survey showed somewhat more flexible supply conditions.

Despite volatility, inflation has been in line with expectations and medium-term CPI expectations remain anchored to the 3% target. Headline inflation during 3Q came in a touch below the IPoM scenario due to volatile components, while core inflation has evolved in line with the BCCh’s scenario. Domestic activity and demand indicators have also been in line with the central bank’s baseline scenario. High-frequency indicators linked to consumption and investment have been relatively stable for some time.

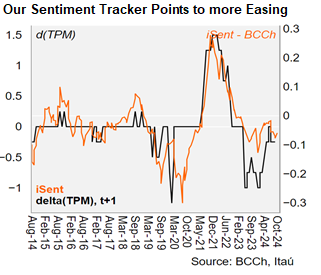

Our Take: We expect the BCCh to maintain the pace of 25 bp cuts in the following meetings until reaching the center of its neutral range (4%) in June 2025. The minutes of the RPM will be released on November 5, with focus on the policy options discussed by the Board. We expect that the Board discussed cuts of 25 bp or 50 bp for this RPM, same as in the September meeting, although we do not rule out that it only discussed the 25 bp cut. The decision of the last RPM of the year will be published on December 17 (IPoM on December 18).

Andrés Pérez M.

Vittorio Peretti

Andrea Tellechea Garcia