2025/12/16 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

Activity is looking better. The statement recognizes that while activity has been broadly in line with their forecast, investment in machinery and equipment surprised again to the upside, consistent with our view. Importantly, the statement mentions improvement in the labor market, although challenges persist. We believe the positive characterization of the activity and labor market outlook should be accompanied by an adjustment of the output gap from a slightly negative path in September to a positive path in December. We also see the 2026 GDP growth forecast revised up.

Short-term inflation forecast. The statement anticipates that the new BCCH scenario considers inflation falling to 3.0% in 1Q26, well below the 3.4% foreseen in the September forecast (had foreseen reaching 3.0% in 4Q26). We forecast inflation at -0.13% MoM in December, essentially in line with market pricing, ending the year at 3.5%. Our scenario considers core CPI at -0.03% MoM in December, consistent with 3.4% YoY. As such, headline inflation should reach 3.0% in January, incorporating a 2% monthly decline in the electricity price component in the month.

Inflation expectations, check! The statement recognizes the improvement in survey-based inflation expectations, explicitly mentioning the analyst and trader survey medians are at the 3% target; the October statement mentioned the trader’s survey was at 3.1%.

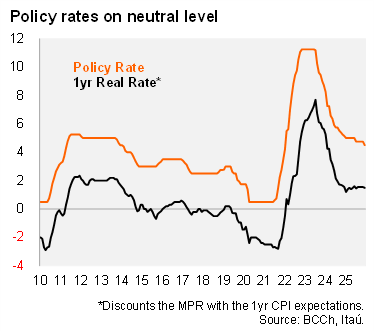

Neutral. The shift in guidance is consistent with the fact that the policy rate is already in the ceiling of the Central bank’s nominal neutral range estimate of 3.5% to 4.5% (from September 2024 IPoM). Recently some Board members have signaled a bias towards the upper half of the range. We expect the IPoM to maintain the neutral rate range estimate, also signaled by the plural in the guidance.

Up next. The meeting’s minutes will be published on January 5, and the next monetary policy meeting is scheduled for January 27.

Upcoming changes in the BCCh Board. Stephany Griffith Jones will end her term at the Board later this month and will be replaced by Kevin Cowan; the latter being confirmed by the Senate this evening. As such Cowan will participate in next year’s first monetary policy decision. Cowan is a well-known economist with senior policy and academic experience, having been vice-president of the financial market regulator (CMF), head of the financial policy division at the BCCh and Executive Director at the IADB, among others.

Our take: Having taken the policy rate down to the ceiling of the BCCh’s neutral range, the forward guidance shifted from needing more data before resuming cuts, towards a data dependent guidance that is similar to historical text prior to closing cycles. However, the guidance retained a “plural” reference to potentially more than one adjustment. The one year real ex ante policy rate fell to 1.5% from 1.75%, at the ceiling of the real neutral estimate.

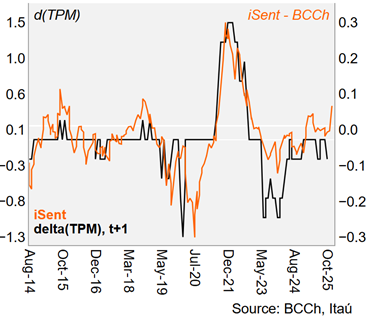

iSent: Coherent with a forward guidance shift