The Central Bank’s Board unanimously kept the monetary policy rate (MPR) at 5.0% for a third consecutive meeting, in line with our expectations and the market consensus. The Board noted that the uncertain environment still favors a cautious approach. As a result, the Board retained the neutral forward guidance. The communiqué noted that changes in global trade policy have worsened the outlook for global growth and raised uncertainty. The magnitude and timing of these effects on the local economy remain uncertain. Regarding inflation, although it will remain high in the immediate future, its recent performance and its main determinants reaffirm the prospects for convergence outlined in the March Report. Nevertheless, the need for caution remains. The real ex ante rate, that is, discounting the one-year inflation expectation according to analysts (3.6%) from the current MPR (5.0%), sits at 1.4%, close to the ceiling of the BCCh's neutral real range (0.5-1.5%).

Uncertainty is the name of the game. Since the March meeting, uncertainty over the global economic outlook rose considerably following the start of the US-led trade conflict. While global growth is expected to slow, inflation pressures will likely be mixed (higher in the US; lower elsewhere). These developments have been accompanied by episodes of high volatility in global financial markets. During the inter-meeting period, the price of copper (BML) has fallen by around 3%, while the price of a barrel of oil (WTI-Brent average) has fallen by nearly 12%. Local financial conditions have improved, with a decline in short- and long-term interest rates, an appreciation of the peso, and a rise in the stock market. Credit remains unchanged.

Activity and inflation evolving broadly in line with the BCCh expectations. Activity indicators continue to show improving dynamism, largely due to exports, along with a gradual recovery in domestic demand. The labor market continues to show limited slack. Headline inflation of 4.9% in March was unsurprising, but core price pressure has underwhelmed, due to both goods and services. Two-year inflation expectations have been moving toward the 3% target, although some measures remain above that figure.

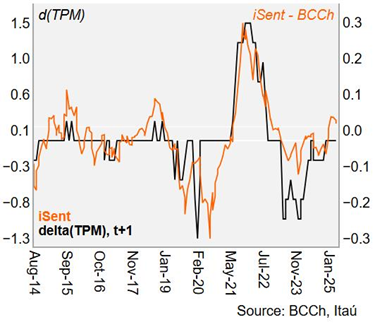

Our Take: We see a YE rate of 4.5%. Today’s decision is in line with our view of rates-on-hold as further information is accumulated, before likely lowering the MPR during 2H25 as the both the global economy slows and ex-US inflation pressures show signs of fading. Our iSent indicator also points to rates on hold in the near term. We believe the BCCh only discussed the option of maintaining the policy rate in this meeting, which we'll learn with the minutes (May 15). In our view, the retention of neutral forward guidance is an attempt to prevent the market from expecting a rate cut as soon as the next meeting, given the heightened levels of uncertainty. The next monetary policy decision is scheduled for June 17, with the IPoM to be released the following day; the Federal Reserve will announce their decision on June 18.