2025/10/28 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

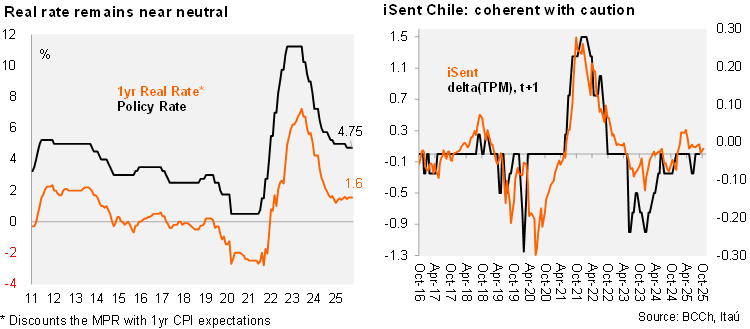

Following September’s hawkish hold, the Central Bank Board expectedly held the policy rate at 4.75% and retained the forward guidance of needing to accumulate more data before embarking on its next move.

The decision was unanimous.

Forward guidance: The current scenario, while evolving in line with expectations in the September Monetary Policy Report, still presents risks to the trajectory of future inflation, which warrants gathering more information before continuing the process of converging the policy rate to its neutral range.

The Central Bank’s nominal neutral policy range is 3.5% to 4.5%, but recently the Board has signaled a bias towards the upper half of the range.

The minutes, to be published on November 13, will provide additional clarity on the policy options discussed in the meeting. We expect the Board only discussed holding yet might signal an option of cutting was swiftly dismissed, thereby opening the door for a December cut. In September, the Board only considered staying on hold.

Local interest rates have shown limited changes compared to the September Meeting, while the CLP has appreciated. Credit dynamics showed no major changes.

Activity has evolved in line with the forecasts in the September Monetary Policy Report. High-frequency indicators suggest private consumption was around expectations, while investment appears more dynamic, with the machinery and equipment component standing out. The labor market continues to provide mixed signals. Wages have moderated their annual growth rates.

In September, total and core inflation were signaled to be in line with the IPoM scenario. The two-year inflation expectations according to the analyst survey sit at 3%, while the traders survey points to 3.1%.

The one-year ex-ante rate remains at 1.55%.

Our Take: For now, we expect 1x25bp cut to 4.5% in the December policy meeting dependent on the continuation of softer inflation data. We expect core inflation of 0.0% for October (3.5% YoY). The curve has priced in 14bps of easing for the December meeting. The forward guidance suggests a cautious approach to further easing. The Board sees no urgency to cut rates, preferring to gather more data before moving deeper into the neutral range. The December meeting will be more data-rich, with three additional CPI prints since the IPoM (only one before October), and takes place two days after the expected presidential runoff. Softer inflation dynamics, particularly on the services front, along with a CLP recovery, dovish Fed outlook, and reduced electricity price pressures ahead may open the door to resuming the easing process, but risks tilt to postponing the resumption to early 2026.