2025/09/09 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

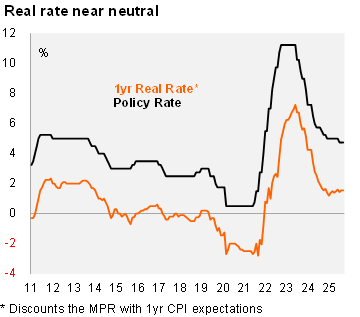

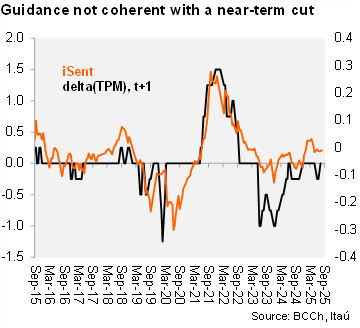

Following the July cut, the first of the year, the Central Bank Board expectedly held the policy rate at 4.75%. The decision was unanimous. However, the forward guidance swung hawkish with greater concern over recent core inflation dynamics. The statement mentions that the September IPoM (to be released tomorrow) would project a similar headline inflation path (3.7% yearend) but with higher core inflation over the next 12 months. The Board notes that the core inflation persistence requires close monitoring before continuing the policy rate convergence to neutral. As a result, odds of a rate cut in the October meeting, with only one inflation print by then, should decline materially. The curve had priced in 13bps of easing for next month's meeting. The previous forward guidance indicated that if the central scenario of the June IPoM materialized, the MPR will be lowered to its neutral nominal range over the coming quarters. The minutes, to be published on September 26, will provide additional clarity on the policy options discussed in the meeting, however they likely only considered holding. The press release made no reference to structural parameter updates. We believe there is room to raise the real neutral rate range by 25bps to 0.75-1.75% (nominal: 3.75%-4.75%), implying less space for additional cuts ahead. The one-year ex-ante rate sits at 1.55%. For now, we expect 1x25bp cut to 4.5% which we had expected in October, but now see in the December policy meeting dependent on inflation data.

Upbeat non-mining activity, anchored inflation expectations but keeping an eye on core CPI. In the second quarter, domestic demand exceeded BCCh expectations, lifted by investment in machinery and equipment and private consumption. Credit dynamics have been broadly unchanged. The labor market continues to provide mixed signals, with an elevated unemployment rate amid slow job creation, while wage growth remained strong. Headline inflation has continued to decline, as outlined in the June IPoM. However, core inflation has been higher than expected, both for goods and services. Given that core CPI tends to be more persistent, the Board sees a growing need to closely monitor its evolution and fundamentals. Two-year inflation expectations from both the analysts and traders’ surveys are at 3%.

Our Take: The Central Bank is at the fine-tuning stage of its current cycle. The timing of further cuts will depend primarily on the evolution of core inflation. If the BCCh revises the neutral rate range as we expect, reaching the center of the of the range would imply two further cuts of 25bps throughout the policy horizon. The September IPoM will provide greater clarity on the expected rate path. Anchored inflation expectations, a sluggish labor market, and weak commercial credit dynamics support the plan to take the policy rate to the center of the neutral nominal range. Yet, still high sequential core inflation, elevated wage growth, and resilient non-mining activity argue for a gradual pace of cuts as the BCCh approaches neutral, and the end of the cycle. With only one additional CPI data point before the October 28 meeting, we believe the odds of a cut are low. Nevertheless, the possibility of a more dovish Fed going forward may provide a window of opportunity for additional easing across EMs. For now, we expect one 25bp cut during 4Q25 to 4.5%, with our bias leaning towards December. Market reaction tomorrow is expected to bring a moderate rise in short-term rates and CLP appreciation.