2026/01/27 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

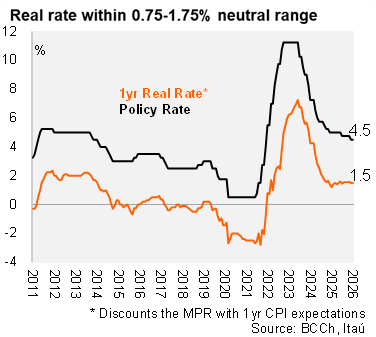

The next rate cut is likely to materialize ahead of the IPoM’s baseline scenario of 2H26. The Central Bank’s Board unanimously left the policy rate at 4.50%, in line with our call and broad consensus. As a result, the one-year ex-ante real rate sits at 1.5%, within the BCCh’s real neutral rate range estimate of 0.75%-1.75%. Importantly, the guidance turned dovish as a swifter disinflation process amid an unsurprising activity evolution called for a review of the required monetary policy response. We believe the Board evaluated a 25bp rate cut at this meeting. The rate path in the Decmber IPoM signaled a final 25bp cut to 4.25% during the latter half of 2026.

Stronger momentum for the Chilean economy materializing on the global front. The rise in copper prices and the strength of the US economy were highlighted. However, the combination of geopolitical, fiscal, and financial factors intensified the risks surrounding the global macroeconomic outlook.

Activity was weak during the close of 2025 but dragged down by transitory factors. Regarding expenditure, short‑term indicators linked to consumption and investment suggest growth in line with expectations.

Inflation continued to surprise to the downside. The core inflation correction is being led by goods. We estimate headline inflation to fall to 2.8% in January. Survey-based inflation expectations remain anchored to the 3% target.

A reshuffled Board. The January meeting saw the debut of Kevin Cowan following the conclusion of Stephanie Griffith-Jones' term in late December.

Up next. Following a schedule adjustment, the meeting’s minutes will be published on February 4, and the next monetary policy meeting is scheduled for March 24.

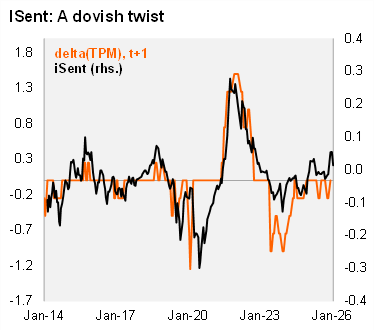

Our Take: The faster-than-expected disinflation underway will likely result in a March rate cut to 4.25% (well ahead of the IPoM’s 2H scenario). We do not expect the cycle to extend beyond 4.25%. Monetary policy is within the neutral range and comes after a prolonged battle at converging inflation to the target. We believe the Board will favor a cautious approach after implementing the next cut, evaluating inflation and activity dynamics during the start of the year. The swift CLP recovery will drag prices down, but a terms-of-trade led economic rebound could boost medium-term inflation pressures. The evolution of medium-term inflation expectations is the key trigger in initiating the next policy response. After a sustained period of above target expectations, surveys reflect a CPI outlook anchored to the 3% target. The direction of the next MP cycle will depend on whether the global scenario prolongs an above-potential economic recovery, justifying tighter MP to keep CPI expectations anchored. Alternatively, there is the risk that several disinflationary supply factors (oil, CLP), in conjunction with a possible global slowdown leads the BCCh to take rates below neutral. While our scenario sees rates at the 4.25% neutral level, the balance of risks leans towards higher rates over the forecast horizon given the upside bias to growth.