At the July Monetary Policy Meeting, the Board of the Central Bank of Chile (BCCh) unanimously held the monetary policy rate at 5.75%, surprising both the market consensus and our call for another 25bp cut (market prices were at -11bps). In contrast to the June’s split decision, when Stephanie Griffith-Jones favored a 50bp cut, today’s decision was unanimous. The communique’s guidance states that under the BCCh’s central scenario, the bulk of the expected cuts for 2024 have been accumulated during 1H24 (in line with the June guidance). The decision is also coherent with the view of eventual easing down the road. As a result, we cannot rule out further cuts this year, but initially believe that significant inflationary pressures on the horizon (from electricity and tradable prices) will challenge this scenario. In our view, the decision winds down the first tranche of cuts that began exactly one year ago with the jumbo 100bps cut from 11.25%. The BCCh has reduced the policy rate by a total of 550bp in the cycle. Following the decision, we estimate that the real ex-ante one-year rate, obtained by discounting the analyst survey’s one-year inflation expectation (3.6%) from the policy rate (5.75%), fell to 2.15% after the decision (2.55% after the previous decision), above the BCCh’s current real neutral range (0.5% - 1.5%). The upwards revision to inflation expectations has led to monetary policy being less restrictive without having to cut, potentially a justification behind the decision to already hold rates in July.

Globally, lower US inflation has heightened expectations that the Fed may start cutting rates, despite still strong activity. The economic performance in China has been weaker-than-expected. Since the last meeting, long-term global rates have fallen, the US dollar strengthened, and commodity prices fell. Domestically, short and long-term interest rates dropped, but credit dynamics remained weak (particularly on the commercial front)

Chilean activity underwhelmed in 2Q24, while core inflation pressure have been softer than expected. Looking ahead, the pipeline for large investments posted a significant increase. Although sentiment remains pessimistic, the outlook from both companies and households has improved. Inflation in June was in line with the 2Q IPoM, while core prices came in below expectations (mainly from goods and transitory factors). The relevant two-year inflation outlook remains anchored at the 3% target.

Our Take: The BCCh may be done for now. Facing higher short-term electricity related inflationary pressures and rising inflation expectations, the BCCh is set to assess their impact along with the overall effects of the tranche of cuts on the inflationary and activity outlook. Our yearend policy rate stands at 5.50%, consistent with the guidance, which leaves the door open for additional cuts. We see additional cuts in 2025 towards the ceiling of the neutral range (4.5%). The BCCh will publish the July policy meeting minutes on August 16; consistent with the BCCh’s updated communication policy, Board members are expected to maintain a silent period until then. The next monetary policy meeting is scheduled for September 3 and the IPoM the following day; the latter is likely to include a revision to the structural parameters, including an upward revision to the center of the neutral rate range.

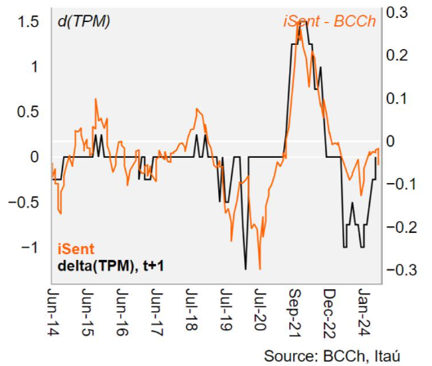

Our Central Bank sentiment classifier reflects the mixed signaling from the BCCh’s statement, consistent with a potentially short-lived pause.