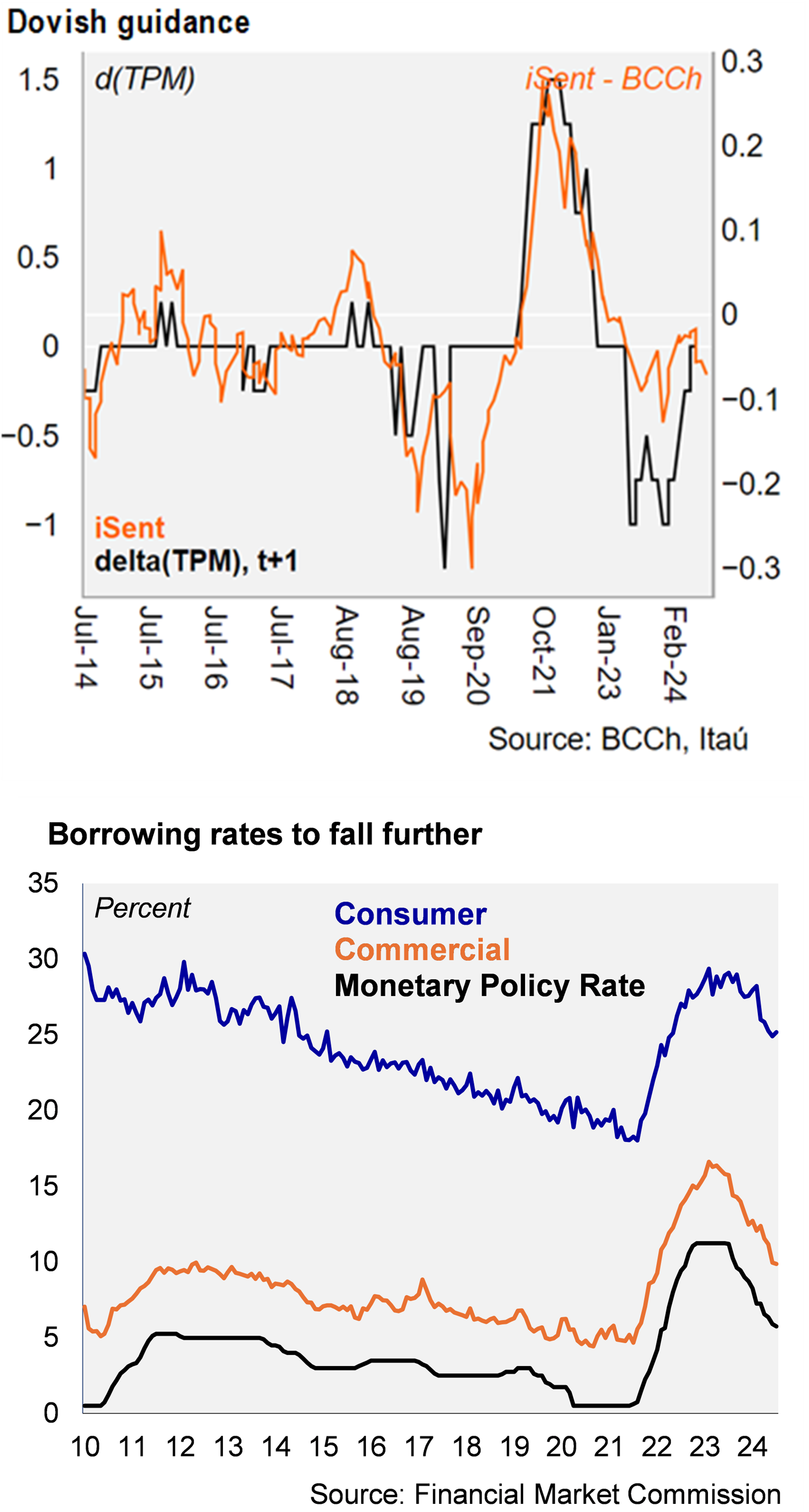

At the September Monetary Policy Meeting, the Board of the Central Bank of Chile (BCCh) unanimously opted to resume the rate cutting cycle with a 25bp cut to 5.5%. Following the pause in July, the market consensus consolidated around a resumption of cuts this month as domestic activity cooled, global financial conditions are set to ease and medium-term inflation expectations are anchored. The communique’s guidance states that under the BCCh’s central scenario, the process of taking the policy rate towards neutral (0.5-1.5% real range; 3.5-4.5% nominal) may unfold more swiftly than outlined in the June scenario. We interpret this guidance as proceeding with continuous cuts. The June IPoM had the center of the 33% confidence interval for the policy rate averaging 5.5% in 4Q24 and 4.57% in 4Q25. With the decision, the one-year ex-ante real rate reached 1.7% (from 1.95%). Our sentiment tracker of the BCCh’s communication shows a clear dovish tilt.

On the global front, short and long-term rates have fallen since the last meeting. Copper has registered significant volatility, while oil prices have dropped. Locally, short-term interest rates have fallen, in line with the monetary policy outlook, while long-term rates have also decreased. While loan rates have declined, bank credit remains weak, especially its commercial component.

Domestically, activity expectedly lost momentum in 2Q after the strong start to the year, while medium-term inflation expectations are anchored. The July IMACEC rebounded, led by specific events (education). Overall, consumption has shown signs of weakening while investment has stabilized at low levels. The increase in total inflation (to 4.4%) was above the 2Q IPoM estimate, but with the difference mainly explained by volatile items.

Looking ahead to Wednesday’s IPoM, the communiqué suggests limited changes to the activity outlook (currently 2.25-3.0% for 2024), although with a breakdown of softer consumption. In conjunction with anchored inflation expectations, the effect of the current supply shock is expected to be transitory, supporting the policy rate path falling towards neutral in the near term.

Our Take: We had expected a yearend rate of 5.5% before further cuts in 2025 to 4.5% (the upper bound of the neutral range). However, the updated guidance is coherent with two further cuts this year to 5% and reaching neutral during 1H25. The minutes of the meeting will be released on September 23 while the next monetary policy meeting is scheduled for October 17.

Andrés Pérez M

Vittorio Peretti