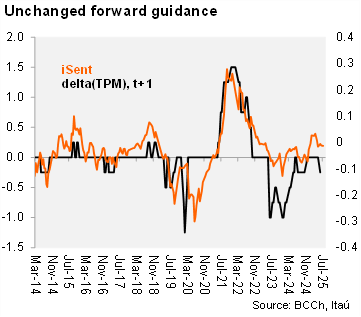

In its fifth monetary policy meeting of the year, the Central Bank of Chile (BCCh) unanimously cut the monetary policy rate (MPR) by 25-bps to 4.75%. This was the first policy rate movement of 2025, breaking a string of pauses since the 25-bps cut last December. The Board likely considered maintaining the MPR at this RPM, in addition to the unanimous decision to cut. The minutes, to be published on August 13, will provide additional clarity. The forward guidance remained the same as in June, signaling that if the central scenario of the June IPoM materializes, the MPR will be lowered to its neutral range over the coming quarters (nominal: 3.5%-4.5%).

Weaker external pull, slowing job creation, anchored inflation expectations. The press release notes that the average U.S. tariff level would be higher than their forecast, based on the information available at the cutoff date of the June Monetary Policy Report (IPoM), likely resulting in a weaker external impulse (although terms-of-trade improved since the June meeting). On the local financial market front, short- and long-term interest rates showed limited changes since the last meeting and credit has not varied significantly. Activity has evolved in line with forecasts in the June IPoM. Transitory boosts (exports, tourism, fiscal frontloading) at the start of the year are normalizing. Investment dynamics remain favorable. The labor market shows slow job creation and an increase in the unemployment rate, in a scenario where wage growth has remained high. June headline CPI was lower-than-expected, while core price pressure surprised to the upside. Survey-based inflation expectations at the policy horizon are anchored.

Our Take: Today’s decision was widely expected and confirms our view that the economy requires a less contractionary monetary policy. The Central Bank is responding appropriately and in a timely manner. The macroeconomic scenario is consistent with additional cuts over the coming quarters towards the nominal neutral rate of 4%. Inflationary pressures have moderated at the margin, inflation expectations over the relevant horizon are anchored, while the weakness of the labor market and credit dynamics suggest that the economy should accumulate some negative slack. Furthermore, tariff uncertainty is likely to generate negative effects on global activity over time. We expect the MPR to end the year at 4.25%. The timing of further cuts will depend primarily on tactical factors related to the external environment, which could generate greater volatility in financial markets. Our baseline scenario, for now, sees rate cuts in September and December. Market pricing is tilted towards a cut in October. As the BCCh continues to lower rates and the Fed stays on hold, the CLP will likely remain pressured in the short-term. High copper prices, a weaker global dollar trend and an election cycle focused on growth will likely see a recovery by yearend (to 930) from current spot levels. The one-year ex-ante real rate sits at 1.45% (neutral range: 0.5-1.5%; 1.6% at the June meeting). The next MPM will be on September 9. We forecast a 0.7% CPI increase in July and a yearend rate of 3.8%. We expect the Fed to keep the FFR in the 4.25-4.50% range tomorrow.