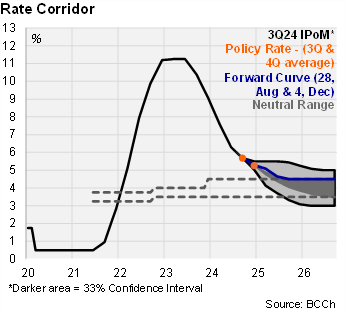

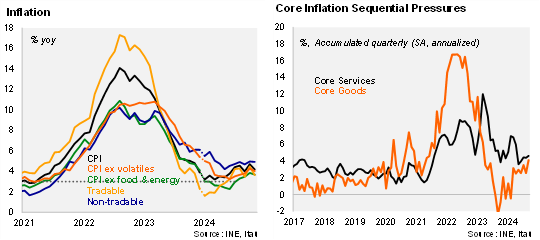

Continuing to signal a path towards neutral. The recent CLP developments, if maintained, should sustain higher core goods prices in the near-term, and prevent a swifter CPI correction in 2025. Another large electricity price hike (+7% MoM) is penciled in for January. Nevertheless, on the activity front, there are limited signs to believe demand-side inflationary pressures are consistent with a sustained above-target CPI. Employment levels have been roughly stagnant over the last semester, real wage growth is slowing, credit dynamics have yet to respond despite strong transmission to rates. The copper price drop may dent the improved mining investment pipeline shown by surveys. Business surveys show limited room to transfer higher cost pressures to final consumer prices. In all, the slow convergence to the target is mainly supply related, along with the second-round effects (albeit limited so far). We don’t expect major changes to the policy rate corridor in the upcoming IPoM, but the forward curve, and market expectations will likely consolidate around the upper bound of the neutral rate range (4.5%), rather than the signaled 4% center point. In this context, we expect the BCCh to maintain its strategy of gradually reducing the policy rate towards neutral with a 25bp cut to 5% in December and with pauses to 4.5% by June 2025.

Following the large October CPI surprise, second-round effects in the November print seem to have been contained, although risks remain for coming months from the rise in electricity prices and the significant minimum wage increase, among others. In parallel, the depreciation of the peso has been persistent. Inflation accumulated in the year through November sits at 4.7%. We expect prices to be flat in December, resulting in a yearend rate somewhat above the IPoM’s 4.5% estimate. Core inflation pressures remain high, but soft domestic demand suggests they are unlikely to linger for long. Core inflation sits at 4.0% YoY (4.3% previously), but sequentially, the annualized core pressure over the last quarter is at a higher 5.2%. Surveys have sustained a one-year CPI outlook at around 3.6%, while the key two-year estimates remain near the 3% target (anchored analysts’ expectations; traders edged up to 3.2%).

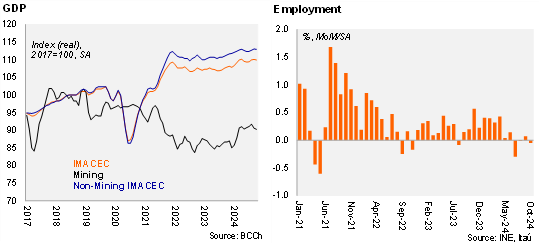

The activity recovery path faces headwinds. Activity increased 0.4% MoM/SA in October, partially unwinding the two consecutive sequential declines in previous months. The annual variation came in at 2.3% (0.3% YoY in September). The mining pull came in at 3.5%. Services were up 2.2%, supported by health and education. Overall, non-mining activity increased a 2.3% YoY (0.4% in September). If the economy maintains the October level towards the end of the year, GDP will expand by roughly 2.1% YoY (0.6% in 2023), near the floor of the 2.25-2.75% range in the September IPoM. Our IMACEC nowcast for November points to a below-consensus 1.5% YoY print, and a marginal monthly sequential rise in activity. The outlook remains challenging. Business sentiment deteriorated in November, commercial credit remains at low level, while the market has incorporated a scenario of higher-than-expected interest rates and inflation globally. On the positive side, imports of capital goods have returned to growth, in line with the mild investment recovery anticipated. Outstanding real commercial loans in Chile contracted again in October by 4.7% YoY, after plummeting by 5.85% in September (-5.27% in October 2023), declining on an annual basis since May 2022. The fiscal scenario (accumulated nominal deficit of 2.5% of GDP as of October), will see a spending pullback at the backend of the year, while the approved 2025 budget saw a cut in real expenditure from the proposed to 2.7% to an approved 2%. Business confidence as measured by the IMCE edged down to 48.7 in October (50 = neutral), the lowest level this year. Meanwhile, non-mining sentiment remains at a lower 42.2 points. Imports of capital goods were up 3% and 10% YoY in September and October, while consumer goods imports are also up at a near double-digit rate. Regarding the labor market, BCCh’s labor demand proxy fell slightly in November to 66.3 from 69.8 in October, remaining well below the historical average (2017-2019 average of 91.6). On an annual basis, labor demand fell again, by 12% YoY (-1.1% in October). Weak labor demand suggests further improvement in the formal labor market appears challenging, as INE’s survey-based data has also shown a deterioration in job creation in recent months. Labor market dynamics are reflecting some loosening that is likely in response to softer activity dynamics and the implementation of legislation that has raised the cost of labor.

A low external deficit. The rolling one-year trade balance as of November rose to USD 21.5 billion (edging closer to 7% of GDP; USD 15.3 billion in 2023). Meanwhile, the annualized quarterly trade balance sits at an elevated USD 24 billion (SA). The large trade surplus this year will support a narrow CAD (2.5% of GDP; 3.6% last year), reducing the vulnerability to global shocks that may arise ahead given geopolitical risks and a potential return to a trade war. The CAD is well funded by net FDI into Chile.

Risks stem from the CLP dynamics and the extent of the upcoming trade war on global activity and inflation. The Chilean peso will remain under pressure. The CLP is likely experiencing some overshooting, but there are also no significant drivers to justify a meaningful recovery ahead. With interest rate levels near the Fed, domestic growth rates similar to the US, and copper prices around medium-term estimates, the Chilean peso is not expected to draw significant EM portfolio flows.