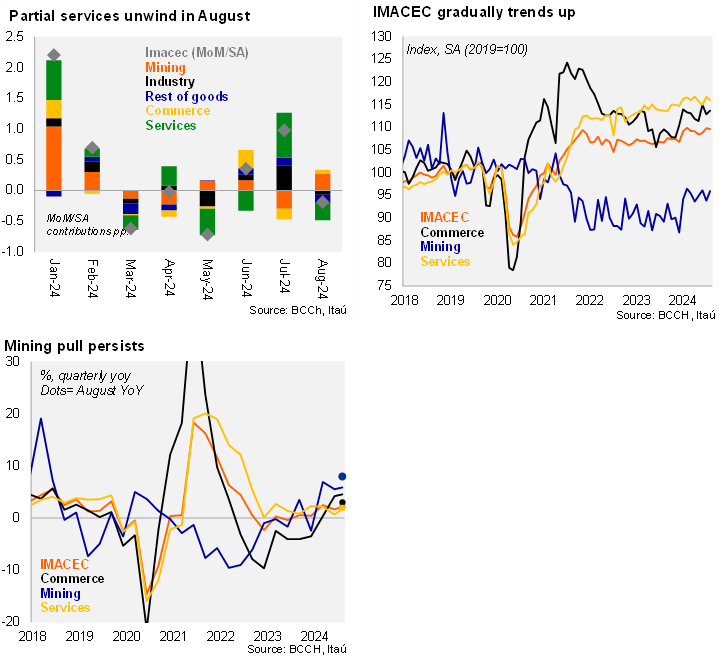

According to the Central Bank, the Monthly Index of Economic Activity (IMACEC) fell 0.2% from July to August, resulting in an annual increase of 2.3% YoY (4.2% in July). The annual increase came in below our call of 2.8% (2.6% prior to the strong sectorial data yesterday) and the Bloomberg market consensus of 2.5%. The month of August had one less working day. Activity was pulled up by mining growth of 8% YoY. Year-to-date mining growth sits at 6.1% YoY, recovering from prior years of weakness. Non-mining activity rose 1.5% YoY (4.4% in July), pulled up by commercial activity (3% YoY), manufacturing (+2.7% YoY) and services (+1.9% YoY). In seasonally adjusted terms, the IMACEC contracted 0.2% MoM/SA in August, partially unwinding the strong 1% gain in July, dragged by declining manufacturing, services (as climate effects halted education operations) and other goods. Nevertheless, the annual increase of the seasonally and calendar adjusted series came in at an elevated 2.8% (in line with July), highlighting the volatility of the original series. Non-mining activity (SA) rose 2.2% (2.7% previously). During the first eight months of the year the Chilean economy has grown 2.3% YoY (0.1% during the equivalent 2023 period). If the economy maintains the level of August towards the end of the year, GDP will expand by roughly 2.1% YoY (0.6% in 2023).

Despite the softer August print, activity dynamics are improving after a weak 2Q. IMACEC rose by 2.2% YoY in the quarter ending in August, above the 1.6% in 2Q24. Non-mining rose by 1.5% (0.6% contraction in 2Q). At the margin, activity increased 1.8% qoq/saar, after the 2.2% decline in 2Q. Manufacturing and commercial activity drove sequential dynamics with a 8.4% and 6.4% qoq/saar increase, respectively. Mining was up 2.9%, while services declined 1.0% qoq/saar (hampered by the education sector).

Mixed signals ahead. Business sentiment remains weak, imports of capital goods are soft, commercial credit dynamics have yet to improve, yet global developments are likely to provide some boost to the domestic economy. The banking system’s stock of outstanding real loans in Chile fell in August by 2.04% YoY, after declining by 0.56% YoY in July (-2.8% in August 2023). Outstanding real commercial loans in Chile plummeted in August falling by 4.45% YoY, (-2.99% in July, -5.87% in August 2023). The fiscal scenario (accumulated nominal deficit of 2.2% of GDP as of August), suggests fiscal spending cuts ahead to meet fiscal targets. Imports of capital goods and consumer goods during the first few weeks of September posted a marginal decline (after a 10% drop in August). Non-mining business confidence as measured by the IMCE remained low at 41.9 in September (50 = neutral; stable from August), while the labor market has shown a gradual deterioration.

Our Take: Activity data in Chile has been especially noisy this year, affected by several transitory shocks, but overall data for 3Q24 is showing an improvement. Recently announced stimulus measures in China, Chile’s main trading partner, and a swift easing cycle in the US could consolidate a soft-landing scenario. We expect GDP growth of 2.5% this year and 2.1% for 2025 as prior downside risks to the scenario have faded.