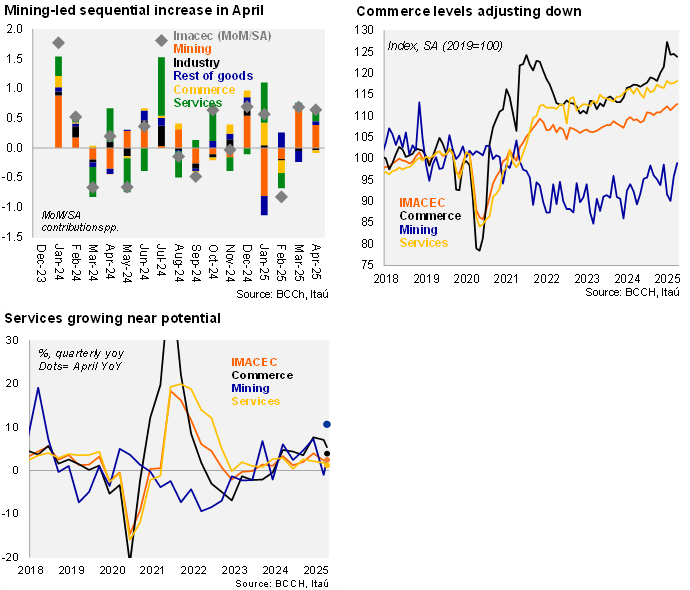

The monthly GDP proxy (IMACEC) was pulled up sequentially by mining. The GDP proxy rose 0.6% MoM/SA, while non-mining activity rose by 0.3% MoM/SA. Activity was pulled up by the 3.3% MoM/SA mining increase along with gains in services (mostly personal health services), already anticipated in the INE sectorial data published late last week. Commerce (-0.5% MoM/SA) and manufacturing (-0.4% MoM/SA) were drags. Overall, the economy increased by 2.5% YoY in April (Bloomberg consensus: 2.2%; Itaú: 2.9%; 3.7% in March). After adjusting for seasonal and calendar effects, IMACEC increased by greater 3.3%. Non-mining activity increased by 1.8% YoY (2.8% in March), while after adjusting for seasonal and calendar effects, activity increased by 2.4%.

Commerce has driven growth, but as the tourism boom encounters more demanding base effects, the marginal effect diminishes. Activity increased 2.2% YoY during the quarter ending in April (2.3% in 1Q25; 3% in 2H24). Mining production picked up to 2.6% YoY in the quarter (-1% in 1Q25; near 5% in 2024). Commerce in the quarter continued to grow at an upbeat 5.4% YoY, but down from above-7% growth in the prior two quarters. Despite the April sequential gain, activity over the quarter rose by a 1.9% QoQ/Saar (2.8% in 1Q). Non-mining activity increased at a similar 1.9% QoQ/Saar (5.1% in 1Q25).

Our Take: Risks to our 2.2% GDP growth call this year lean to the upside. Imports of capital goods remain upbeat and the extent of the global trade conflict appears to have moderated. The effects of less contractionary monetary policy should also continue to materialize, as we expect the Chilean economy to consolidate its recovery. We expect a policy rate cut in September, but risks tilt towards an earlier start especially core inflation dynamics remain weak, the CLP stays well-behaved and global oil price lays low.