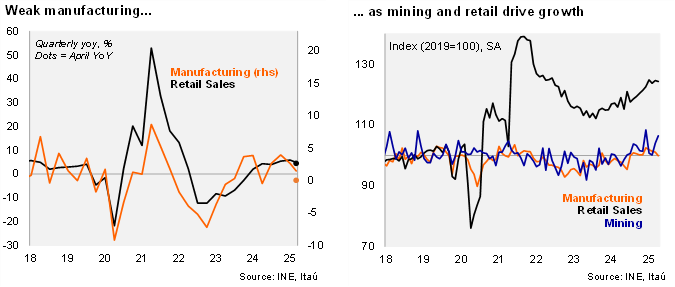

Mining production continues to recover from the large decline in January, leading to a double-digit annual increase in April. Retail sales levels ticked down from March to April but still grew at an upbeat annual rate. Meanwhile, manufacturing weakness has consolidated, falling sequentially for the fourth consecutive month. Mining production rose by a strong 2.4% MoM/SA in April (building on the 3.9% gain in March), leading to annual growth of 10.1% YoY (5.4% in March), favored by improved ore-grade and base effects. Manufacturing fell 1.2% sequentially, resulting in production levels remaining flat from April 2024 (+5.4% in March). The weak manufacturing print came in below our 1% estimate and the Bloomberg market consensus of 2.3%. Food processing continued to advance favorably (3.9% YoY; 1pp contribution), but was countered by a notable decline in beverages (-0.6pp). Retail sales edged down by 0.3% MoM/SA, leading to annual growth of 4.5% YoY (Itaú: 4%; Bloomberg consensus: 4.4%; 7.2% in March), hindered by more demanding base effects. The continued influx of consumer tourism and a rising real wage bill will likely support retail sales dynamics, but growth rates are expected to normalize during 2H25 due to base effects.

The continued mining recovery bodes well for investment spillovers to the rest of the economy. Mining production rose 3% YoY in the rolling-quarter (5.2% in 2H24). Recent signs of improving investment dynamics have been pulled up by the mining sector, yet, as overall business sentiment recovers, there are signs that the improving investment dynamics are spilling over to other sectors. Retail sales remained a key activity driver increasing by 4.9% YoY in the quarter (4.7% in 2H24), with durable retail sales rising 6.5% YoY and non-durable goods increasing 4.5%. Separately, the pull from manufacturing is fading, with production growing by 1.5% YoY during the rolling-quarter ( 3.3% in 2H24). In seasonally adjusted terms, retail sales increased 4.2% QoQ/saar (5.4% in 2H24), while manufacturing fell 3.6% QoQ/saar (+4.5% in 2H24).

Our Take: We expect April’s IMACEC, to be published by the BCCH on Monday, to rise by 2.9% YoY (3.7% in March), amid better mining dynamics. The INE will publish May sectoral data on June 30. We expect GDP growth of 2.2% this year, but risks tilt to the upside amid better-than-expected growth to-date and an improved mining outlook. The economic recovery is yet to meaningfully translate into job market rebound. While the activity recovery and disinflation process have unfolded broadly in line with expectations, the Central Bank has opted for a cautious approach amid still elevated global uncertainty, preferring to accumulate more information before embarking on lowering rates further. We expect a rate cut in September, but risks tilt towards an earlier start especially core inflation dynamics remain weak, the CLP stays well-behaved and global oil price lays low.