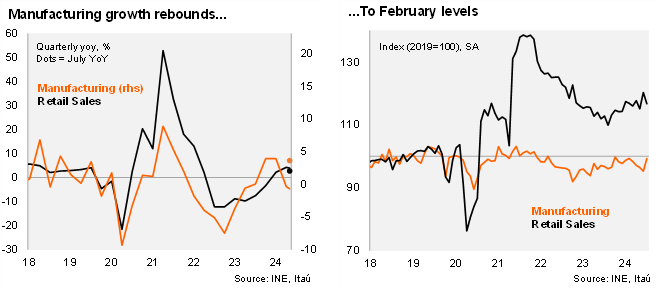

Retail sales (including vehicles) fell 3% MoM/SA, driven by Cyber Day related base effects, unwinding part of the 4.6% rise in June, leading to an annual increase of 2.7% YoY. The annual increase was down from 8% in June given the absence of significant online sales events. The 2.7% print came in around the Bloomberg market consensus, while above our 2% call. Separately, manufacturing gained 4.2% MoM/SA, leading to a 5.1% YoY increase (-4.8% in June), well above both the Bloomberg market consensus and our call of 0.5%. Manufacturing was boosted by food processing. Mining increased 2.9% (2% in June). As a result, industrial production (grouping manufacturing, mining, and utilities) rose 1.9% MoM/sa and 3.6% YoY (-1% in June). We expect an IMACEC increase in July of 2.7% (to be published on September 2; 0.2% in June).

Mining has been a key driver of growth this year. Total retail sales increased by 4.0% during the quarter ending in July (4.3% in 2Q), with durable retail sales rising to 6.6% YoY (8.8% in 1Q) and non-durable goods increasing 3.3% (3.2% in 1Q). Separately, total industrial production rose 1.6% in the quarter (1.2% in 2Q). Manufacturing contracted 0.7% YoY (-0.4% in 2Q), while mining rose 3.9% (2.6% in 2Q). In seasonally adjusted terms, mining rose 3.5% QoQ/saar, retail sales increased a milder 1.8%, while manufacturing decelerated the rate of decline to fell -5.1% QoQ/saar (-10% in 2Q).

Our take: The transitory education drag to activity in June is expected to unwind in July, while the sequential uptick in mining is favorable for overall activity. Nevertheless, underwhelming activity during 2Q24 means risks are tilted to the downside for our 2.5% GDP growth estimate for 2024. Weaker activity, a milder global impulse, the gradual deterioration of the labor market, along with anchored two-year inflation expectations and a less restrictive global financial conditions scenario lead us to expect a 25bp rate cut to 5.5% at the September monetary policy meeting.