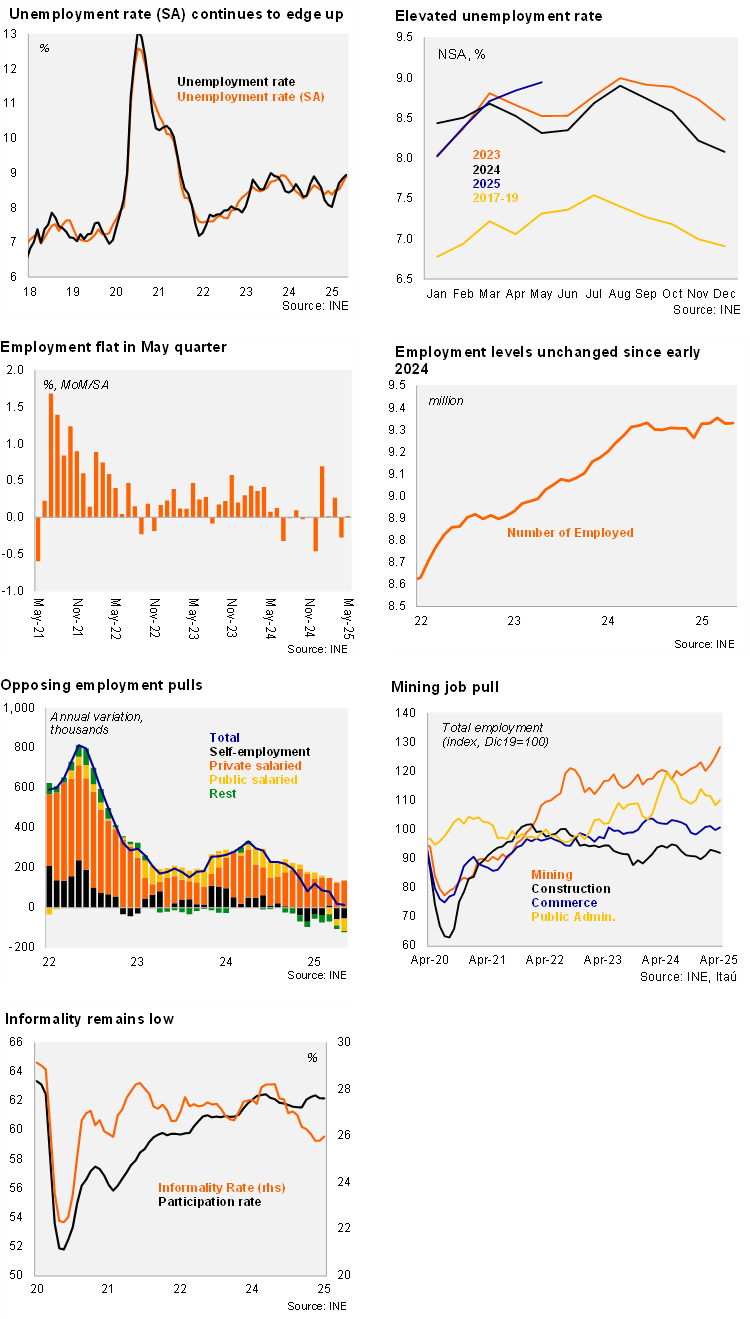

According to the INE’s labor market survey, the unemployment rate for the quarter ending in May reached 8.9% (Bloomberg median: 8.9%; Itaú: 8.8%). The unemployment rate was 0.6pp higher over twelve months. Employment grew by 0.2% YoY (0.9% in 1Q25), while the labor force was up by 0.8% YoY. Annual employment dynamics were lifted by formal posts, while offset by falling informal jobs. Surprisingly, the informality rate reached 26%, down 2.2pp over one year, well below the 2018-2019 average (28.3%). Overall, the participation rate reached 62.2%, steady from May 2024. At the margin, employment (SA) was flat from April to May. The seasonally adjusted unemployment rate reached 8.9% in the quarter, up from 8.5% in 1Q25 (near the cycle peak in late 2023). The unemployment rate (SA) has hovered at or above the upper bound of the BCCh’s estimated NAIRU (7-5-8.5%) for the past year.

Our Take: Surge in labor costs continue to take its toll on the labor market, as slack should persist in the near term. During the last twelve months, employment levels have essentially been unchanged, despite the economy showing clearer signs of recovering growth, raising concerns over a jobless recovery scenario. The nominal minimum wage has increased by a cumulative 50% since April 2022, a reduced work week was approved, and a pension reform was approved. Building on these measures, the latest nominal minimum wage adjustment path (3.6% increase in May and 1.9% in January) exceeds the 3.8% expected for inflation this year. Our 8.5% average unemployment rate for 2025 sees risks tilted to the upside. Still weak commercial loan dynamics, growing labor market slack amid anchored inflation expectations consolidate the central bank’s scenario of lower the policy rate over the upcoming quarters. We see a yearend rate of 4.25%.