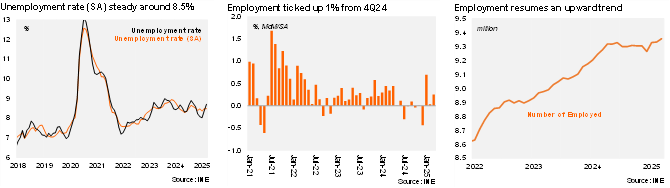

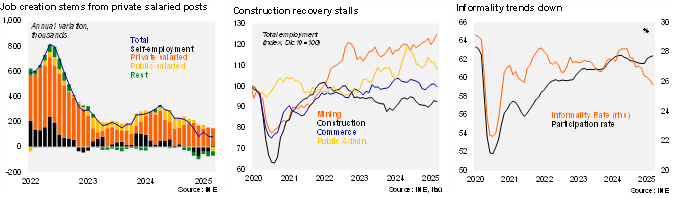

According to the INE’s labor market survey, the unemployment rate for the quarter ending in March rose to 8.7%, slightly above consensus (Itaú and Bloomberg median: 8.6%). The unemployment rate was flat with respect to 1Q24. The participation rate was 62.4%, in line with the March 2024 rate, while employment increased by 0.9% YoY, driven by financial services (20% YoY). The informality rate reached 25.8%, down 2.3pp over one year, edging further below the 2018-2019 average (28.3%). At the margin, employment rose 1% (SA) from 4Q24. The seasonally adjusted unemployment rate reached 8.5% in 1Q25 (broadly stable from previous periods; 8.7% cycle peak in the last August quarter). The unemployment rate (SA) has hovered around 8.5%, the upper bound of the estimated NAIRU, for the last nine months.

The BCCh’s labor demand proxy for the month of March rose to 70.4 from 60.6 in February, but remains well below the historical average (2017-2019: 91.6). On an annual basis, labor demand rose by 8.2% YoY. Data from the Labor Directorate has shown that total layoffs based on administrative records rose by 3.2% YoY in February, taking the moving quarter to an annual rise of 8%, suggesting that firms may be delaying the renewal of fixed-term contracts.

Our take: Business surveys have shown a gradual improvement in hiring demand as the domestic demand recovery was showing signs of consolidating. Nevertheless, the jump in labor costs and elevated policy uncertainty amid the global trade conflict, hiring demand may remain subdued. The Government is expected to present a bill with the annual adjustment to the minimum wage over the next few days. We expect the unemployment rate to average 8.5% in 2025, in line with last year. The INE will publish labor market data for the quarter ending in April on May 29.