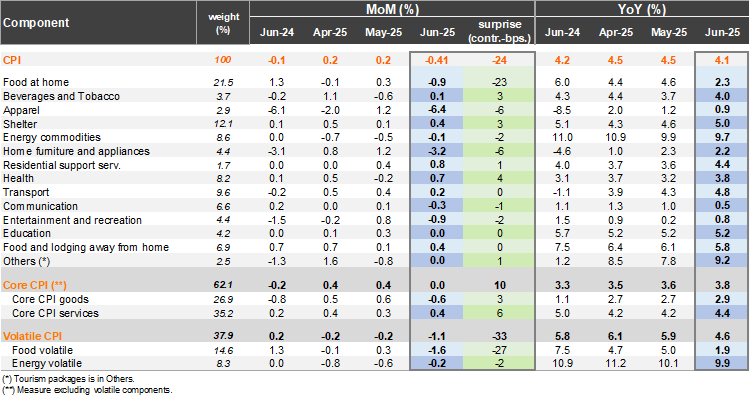

According to the INE, consumer prices fell by 0.41% from May to June, a larger drop compared to the Bloomberg market consensus of -0.2% (Itaú: -0.18%; -0.16% implicit in the 2Q IPoM; -0.1% in June 2024). Downside pressures stemmed from the food division (-0.19pp contribution), along with apparel (-0.17pp) and the household equipment and furnishings division (-0.12pp). The declines are likely related to Cyber Day sales and are expected to revert in July. These three divisions explained the bulk of the surprise to our call (with fresh meat and fruit the principal culprits). Core inflation was flat from May and, in contrast to headline, surprised us to the upside (-0.17%; -0.18% implicit in the 2Q IPoM), particularly health-related services.

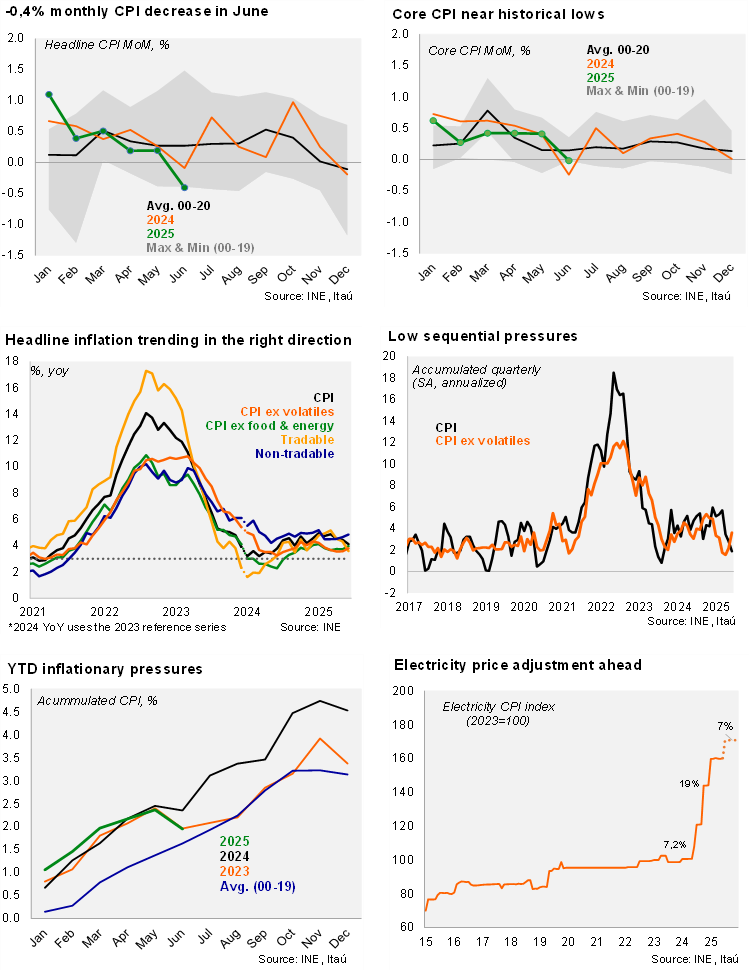

While sequential core pressures edged up, it remains consistent with annualized inflation near the 3% target. In annual terms, headline inflation dropped to 4.1% ( 4.5% in May), the lowest since September 2024. Annual inflation has been above the 3% target since early 2021. Core inflation ticked up to 3.8% (3.6% previously), with core goods inflation up to 2.9% (2.7% in May) and core services reaching 4.4% (+0.2pp from May). Volatile inflation dipped sharply to 4.6% (5.9% in May). Excluding food and energy prices, inflation sits at 4%. Sequentially, the annualized headline inflation accumulated during the second quarter reached 1.9% (the lowest since August 2023), while core pressures ticked up to a still contained 3.6% (2.2% previously).

Our Take: Weak commercial credit, growing labor market slack, and benign sequential inflation pressures (SA), in the context of anchored inflation expectations, pave the path for the BCCh to cut the policy rate by 25 bps later this month (July 29) to 4.75%, and potentially continue in September. We anticipate a year-end policy rate of 4.25%, with risks tilted towards one fewer cut materializing this year. We expect a yearend inflation rate of 3.8%, with a preliminary July increase of 0.6-0.7% boosted by payback factors and an electricity price hike of around 7% (decree with price increase was published today). The INE is scheduled to announce July’s inflation on August 8.