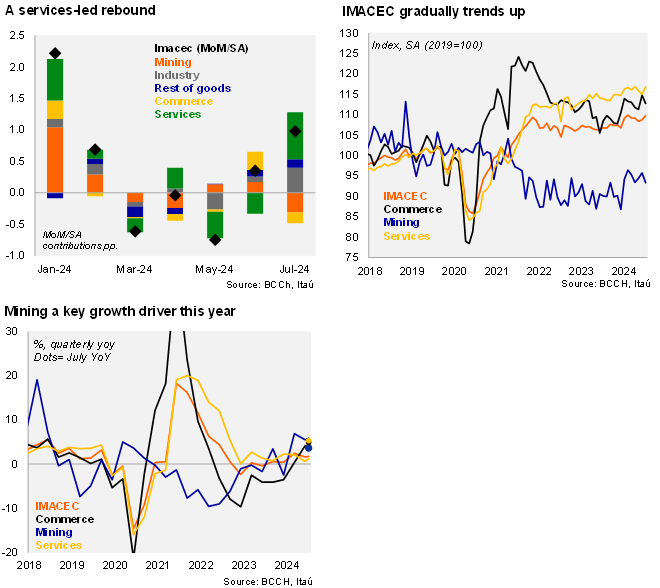

According to the Central Bank, the Monthly Index of Economic Activity (IMACEC) increased 1% from June to July, resulting in an annual increase of 4.2% YoY. The annual increase came in well above both the Bloomberg market consensus and our call of 2.7% and was up from the 0.2% in June. The month of July had one additional working day. Education was a key drag in June, contracting because of the early winter school vacation and the suspension of classes in certain regions due to heavy rainfall. These factors were transitory and expectedly reverted in July (albeit with a larger-than-expected impact on growth), with services increasing 5.3% YoY (-1.8% in June). Commercial activity increased by 4.9% in annual terms (5.8% in June), boosted by wholesale trade that was driven by sales of machinery and equipment, and household goods. The production of goods increased by 3.4% YoY (2% in June), lifted by manufacturing and mining. In seasonally adjusted terms, the IMACEC grew 1.0% MoM/SA in July, building on the +0.4% in June (that succeeded a quarterly decline; 1,3pp accumulated). The annual increase of the seasonally and calendar adjusted series came in at 2.8% (2.2% in June), highlighting the volatility of the original series. If the economy maintains the end-July level through the end of the year, GDP would expand by roughly 2.3% YoY (0.6% in 2023).

Despite the July rebound, activity still has ground to recover. IMACEC rose by 1.8% YoY in the quarter ending in July, well below the 2.5% in 1Q24. Non-mining rose by 1.2% (1.5% in 1Q). At the margin, activity contracted 1.7% qoq/saar, dragged by mining (-2.2%), while non-mining dropped 1.6% qoq/saar. Manufacturing dropped 2.4% qoq/saar, services fell 2.1%, while commerce rose a mild 1.0% qoq/saar. With the negative climate effects from 2Q24 set to fall off the measurement radar, activity at the margin will likely show a significant improvement in 3Q24.

Indicators signal that the activity improvement ahead should be contained. The banking system’s stock of outstanding real loans fell by 0.56% YoY in July, falling back to negative territory after being flat in annual terms in June. The fiscal scenario (accumulated nominal deficit of 1.8% of GDP as of July), suggests spending cuts ahead to meet fiscal targets. Imports of capital goods and consumer goods during the first few weeks of August posted annual declines of around 4%. Non-mining business confidence as measured by the IMCE remained low at 41.9 in August (50 = neutral). The labor market has shown a gradual deterioration, while the global impulse is easing as concerns grow over the strength of the Chinese economy.

Our take: We have a 2.5% GDP growth call for the year. While the anticipated activity rebound in July surpassed expectations, activity levels remain below that of February, reinforcing the loss of overall momentum since the start of the year. We expect the BCCh to lower the range of its 2.25%-3.0% range for this year when it updates its baseline scenario on Wednesday. Looking ahead, the IMACEC for August will be released on October 1.