2025/09/10 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

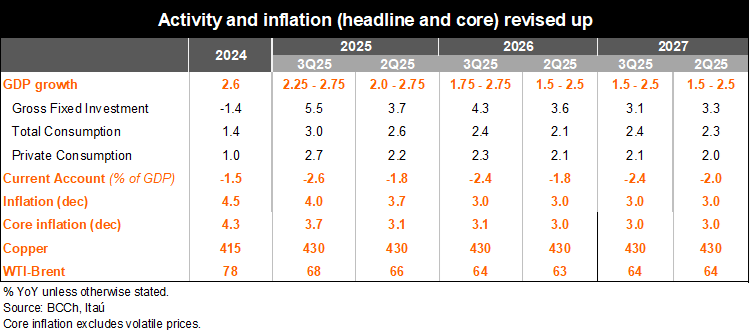

The September Monetary Policy Report (IPoM) raised the core inflation path, justifying a more cautious rate trajectory ahead. Greater core price pressures are driven by stronger domestic demand, persistent wage pressures, and a more depreciated exchange rate. Economic activity has evolved broadly as anticipated, confirming the temporary nature of early-year drivers (fiscal front-loading; tourism flows). Nevertheless, domestic demand has outperformed amid recovering sentiment, leading to a less negative output gap throughout the forecast horizon. Regarding the external front, the baseline scenario considers a Fed cutting cycle of 100bps, with two 25bp cuts this year (previously one cut this year). The IPoM’s baseline scenario considers an appreciation of the real exchange rate from current levels over the two-year horizon. To our surprise, the IPoM did not update the structural parameters, which is likely to take place in December, with our bias tilting toward an upwards revision to the real neutral rate and non-mining growth trend.

On the global front, conditions remain uncertain due to economic, institutional, and geopolitical risks. Global tariffs are expected to have a negative impact, though effects have been limited so far. Financial conditions remain relatively favorable, but the risk of reversal persists. The average copper price forecast was retained at USD 4.30/lb, while oil prices mildly ticked up (USD 64/barrel in 2026).

Domestically, the investment surge was highlighted. The rebound has been led by machinery and equipment, aided by large projects, improved business confidence, and favorable financing. The gross fixed investment forecast was raised by 1.8pp to 5.5% for this year and 0.7pp to 4.3% for 2026. The private consumption growth outlook was also upgraded, underpinned by higher real labor income despite weak job creation. The improved financial situation of households (lower rates), despite low credit dynamism, was also flagged. The 2025 private consumption forecast now sits at 2.7% (+0.5pp) and 2.3% for next year (+0.3pp). The improved domestic demand recovery leads to a higher current account deficit of 2.6% of GDP for this year (1.8% previously) and 2.4% in 2026 (+0.6pp).

A slower inflation convergence path. The central bank sees headline inflation converging to 3% by 3Q26 (1H26 previously). Core inflation is expected to remain above previous forecasts through early 2026, reflecting upside surprises in recent prints, stronger private spending expected, still elevated wage pressures, and a more depreciated real exchange rate. The Board expects a gradual disinflation as the output gap closes, and exchange rate appreciates over the projection horizon.

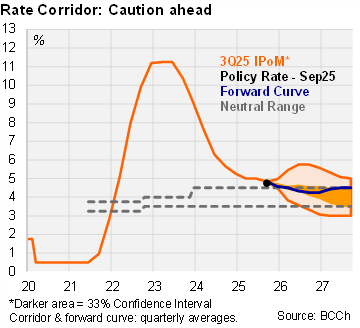

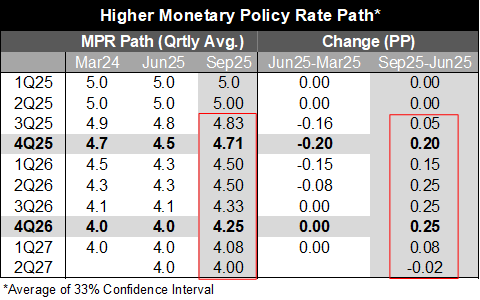

The updated rate path is on average 25bps higher during 2026 (YE rate of 4.25%). The average of the corridor 33% confidence interval is coherent with another rate pause in October, followed by a 25bp rate cut in December to 4.5%. The path shows rates on hold during 1H26, before another cut in 3Q26 to 4.25%. Meanwhile, the borders of the corridor reflect sensitivity scenarios that would lead to a YE26 rate closer to 5.75% amid increased domestic spending and growth in nominal wages, both of which would put pressure on inflation. On the other hand, worsening global conditions, that dent inflation pressures, the rate path could reach a YE26 rate of 3.25%.

Our Take: The IPoM considers a more cautious path to neutral, with risks tilted towards a higher neutral. The Board is signaling that there is no urgency to lower rates much further, preferring to accumulate additional inflation information before gradually approaching moving deeper into the real neutral rate range. Using the BCCh’s one-year inflation forecast, the ex-ante real rate is at 1.6%, near the neutral rate range of 0.5-1.5%. We do not expect a rate movement in October (taking place on October 28, with only one extra inflation print will be released). The December meeting remains live as the Board would have received three additional inflation prints. The expectation of a CLP recovery ahead, amid a dovish Fed, will support the CPI convergence path going forward.