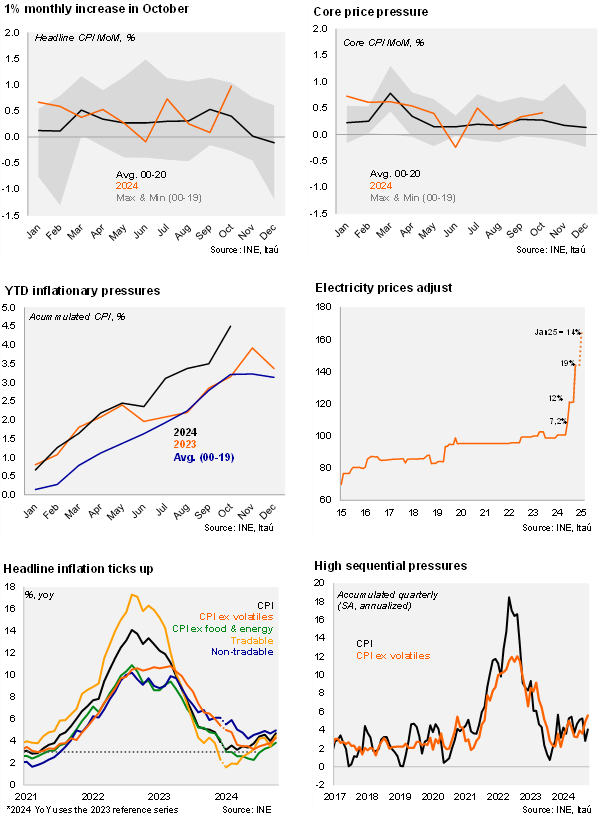

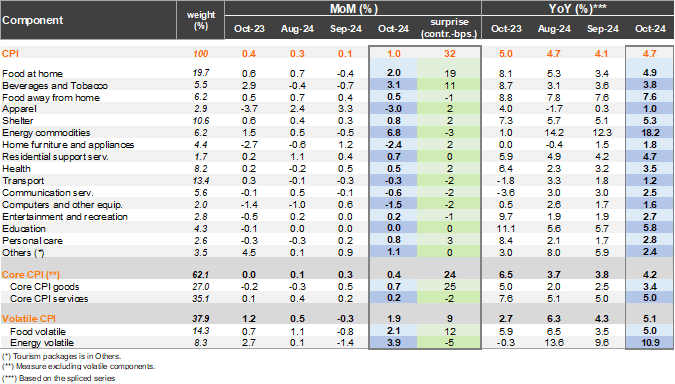

Higher-than-expected food prices along with the large electricity price adjustment lifted consumer prices by 1% in October. Consumer prices increased 1.0% from September to October, well above the central bank’s analyst survey (0.6%), the Bloomberg market consensus (0.6%), market pricing (0.59%), and our call of 0.7%. Food and non-alcoholic beverages rose materially (2.2% MoM; 50 bp contribution), along with the expected increase in electricity prices (18.9%; +48bps) and rising condominium fees that may reflect the second-round effects of higher electricity prices and the rising minimum wage. Notable drags in the month came from falling apparel and household goods following the materialization of Cyber sales, while gasoline continued to drop. With the monthly increase, annual inflation in the reference series reached 4.7% YoY (from 4.0% in September). CPI excluding volatiles rose by 0.4% MoM (0% in October last year), with core goods rising 0.7% MoM and core services ticking up 0.2%. On an annual basis, core CPI reached 4.2% (reference series) from 3.8% in the previous month. Volatiles rose by 1.9% MoM, boosted by the 3.9% energy price increase (due to electricity prices) and foods. The surprise to our call came mainly from higher food price pressures (meat, potatoes, among others). Inflation accumulated in the year sits at 4.5%.

High core pressures at the margin. Electricity prices lifted tradable prices by 1.3% from September, leading the annual tradable variation to rise by 1pp to 4.5% YoY. Food prices rose 2.2% MoM, offsetting the 0.5% drop in September, leading to an accumulation of 4.7% this year. Separately, energy prices rose by 3.7% MoM, rebounding from the 1.4% drop in September. Energy prices have accumulated a 10.9% rise so far in 2024, leading price pressures. Non-tradables increased 0.5% MoM, and 5% YoY (reference series; +0.3pp from September). At the margin, we estimate that inflation accumulated in the quarter reached 4.1% (SA, annualized; 4.7% in 2Q). Meanwhile, core inflation rose to 5.6% (SA, annualized, 3.2% in 2Q24; 3.3% average during 2011-19), pushed by rising good price pressures.

Our Take: Second-round effects are starting to show up in some CPI lines that should begin to be transmitted to other components of the basket. Added to this are the effects of an exchange rate that has remained weaker than projected for longer, with effects on goods and, consequently, on the total CPI. We preliminarily expect a November CPI increase of 0.2-0.3%, while inflation for the year will likely close a tick above our 4.5% call. Our scenario considers another 25 bp cut in the next monetary policy meeting (December 17) to close the year at 5%, although tighter global financial conditions and jumps in still anchored inflation expectations could lead to a more gradual path towards neutral.